top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

What is Belated Return in Income Tax?

The Income Tax Department of India is reminding taxpayers that September 15, 2025, is the deadline for submitting their Income Tax Return (ITR) for the fiscal year 2024–2025. In accordance with Section 139(4) of the Income Tax Act, individuals who do not file by this date may still choose to file a delayed return. A belated return may be submitted until December 31, 2025 (three months before the conclusion of the applicable assessment year 2025–2026) or before the assessment

Nimisha Panda

Nov 128 min read

Section 87A Rebate 2025: Eligibility, Limit & Calculation

Section 87A of the Income Tax Act offers a direct rebate on tax liability for resident individuals whose taxable income falls below a specific threshold. For FY 2025-26 (AY 2026-27), the government has expanded this benefit, raising the new tax regime limit to ₹12 lakh and enhancing the maximum rebate to ₹60,000. This means many salaried and middle-income earners can now effectively pay zero income tax if their net taxable income is within the eligible range. The Section 87A

PRITI SIRDESHMUKH

Nov 109 min read

LTA Exemption Rules for FY 2024-25: Eligibility & Limits

Leave Travel Allowance (LTA) exemption for FY 2024-25 is available only to salaried employees opting for the old tax regime under Section 10(5) of the Income Tax Act, 1961. The exemption applies solely to travel within India and covers expenses incurred by the employee and eligible family members. It excludes accommodation, food, and other local costs. LTA can be claimed for up to two journeys in a four-year block, with the current block being 2022–2025. The claim amount is

Rajesh Kumar Kar

Nov 1011 min read

HRA Exemption Calculation with Examples for FY 2024-25

House Rent Allowance (HRA) remains one of the most significant tax-saving components for salaried individuals. For FY 2024-25, the HRA exemption under Section 10(13A) of the Income Tax Act is available only under the old tax regime. It helps employees reduce their taxable income if they live in rented accommodation and meet specific eligibility conditions. With updated ITR reporting requirements and stricter documentation rules, understanding how to calculate and claim HRA e

Asharam Swain

Nov 109 min read

Section 24(b): Home Loan Interest Deduction Explained

Section 24(b) of the Income Tax Act, 1961 allows taxpayers to claim deductions on the interest paid for home loans taken to purchase, construct, repair, or renovate residential properties. It provides substantial relief for homeowners by reducing taxable income through interest deductions, subject to specific limits and eligibility conditions. For self-occupied houses, the maximum deduction is ₹2,00,000 per year, while for rented properties, there is no upper limit. This sec

Rajesh Kumar Kar

Nov 79 min read

Presumptive Taxation Scheme Under Section 44ADA Explained

Section 44ADA of the Income Tax Act offers a simplified taxation route for professionals with annual receipts up to ₹75 lakh. It allows eligible individuals to declare 50% of their gross receipts as taxable income, eliminating the need for detailed expense records or complex bookkeeping. This scheme is especially beneficial for professionals like doctors, lawyers, architects, and consultants who seek ease of compliance and reduced administrative work. By adopting this scheme

Nimisha Panda

Nov 69 min read

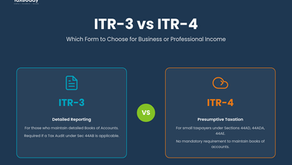

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 67 min read

Section 44AD vs 44ADA: Key Differences for Small Businesses & Professionals

Sections 44AD and 44ADA under the Income Tax Act, 1961, simplify tax filing for small businesses and professionals by allowing them to declare income on a presumptive basis rather than maintaining detailed books of accounts. These provisions encourage voluntary compliance and ease the financial reporting burden, especially for those with moderate annual receipts. Table of Contents Section 44AD: Simplified Tax Scheme for Small Businesses Section 44ADA: Presumptive Taxation

Rashmita Choudhary

Nov 69 min read

Set-Off and Carry Forward of Capital Losses: Complete Rules Explained

Capital losses can significantly impact tax planning if not managed correctly. The Income Tax Act, 1961 allows taxpayers to reduce their taxable income by setting off such losses against capital gains in the same or future years. The concept of set-off and carry forward helps individuals and businesses optimize their tax outgo by adjusting losses within defined limits and time frames. With recent Budget 2025 changes expanding flexibility, understanding these provisions has b

Asharam Swain

Nov 59 min read

Dividend Income Taxation Rules in 2025 and How to Report in ITR

Dividend income taxation in India for FY 2024–25 (AY 2025–26) continues under the Income Tax Act, 1961, with key refinements introduced in Budget 2025. The TDS threshold for dividends has been raised to ₹10,000, and new compliance guidelines ensure smoother and more transparent reporting. Since the abolition of Dividend Distribution Tax, the responsibility for paying tax on dividends now lies with investors. Understanding how to compute and report dividend income correctly i

Rashmita Choudhary

Nov 511 min read

bottom of page