top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

How to Calculate and Pay Self-Assessment Tax Correctly in India

Self-assessment tax becomes payable when the total tax liability exceeds the amount already covered through TDS and advance tax, making it an essential final step before filing the income tax return. Correct calculation ensures accurate reporting, prevents interest under Sections 234A , 234B , and 234C , and avoids last-minute filing hurdles. Paying this tax correctly improves compliance records, ensures seamless ITR processing, and prevents refund delays caused by mismatch

PRITI SIRDESHMUKH

Dec 18, 20259 min read

How to Update Communication Address in Your ITR Profile

Updating the communication address in an Income Tax profile is essential for ensuring every notice, refund update, and official correspondence reaches the correct location. The Income Tax Department sends critical updates through email, SMS, and postal communication, making it necessary for taxpayers to maintain accurate profile details on the e-filing portal. The update takes only a few minutes and prevents missed deadlines or compliance issues. The process follows a simple

Asharam Swain

Dec 17, 20259 min read

TDS Deduction Errors and Income Tax Notices: How TaxBuddy Helps Deductors and Deductees

TDS deduction errors often surface when tax is withheld at incorrect rates, not deducted on eligible payments, or deposited with mismatched challan details. These gaps create inconsistencies in Form 26AS and AIS, leading to income tax notices for both deductors and deductees. Frequent triggers include invalid PAN entries, 20 per cent deduction under Section 206AA, short deduction flagged under Section 201, and late filing penalties under Section 234E. With correction timeline

PRITI SIRDESHMUKH

Dec 17, 20258 min read

Are In-Kind Donations Eligible for Tax Deduction? Explained

In-kind donations, such as clothes, food, books, or other non-monetary goods, hold significant value for charitable organisations, but they do not qualify for tax deductions under Indian income tax law. Section 80G of the Income Tax Act allows deductions only for monetary contributions made through cash (up to ₹2,000), cheque, draft, or digital payment methods. Tax deductions require verifiable financial transactions, supported by valid receipts from approved charitable insti

Rajesh Kumar Kar

Dec 17, 20258 min read

Authenticating and Downloading Income Tax Notices: How TaxBuddy Simplifies DIN and Portal Verification

Authenticating and downloading income tax notices relies on two essential steps: validating the Document Identification Number and using the portal’s dedicated tools that confirm whether a notice is genuine. The updated e-filing interface makes this process more structured, allowing clear verification before taking action. DIN helps establish authenticity, while the portal ensures traceability of every notice issued. With more taxpayers receiving digital notices, understandin

Nimisha Panda

Dec 17, 20259 min read

How to Link Multiple Bank Accounts on the Income Tax Portal

Linking multiple bank accounts on the Income Tax Portal ensures smooth tax filing , accurate income reporting, and error-free refund processing. The portal allows taxpayers to add, validate, and manage several accounts at once, which is essential for anyone earning interest from different banks or using separate accounts for salary, investments, and refunds. The process is straightforward but requires precise matching of PAN, mobile, and account details. When these details al

Dipali Waghmode

Dec 17, 20259 min read

Section 89 Relief for Salary Arrears: Calculation & Filing Process

When salary arrears are paid in a lump sum, the sudden jump in income often pushes a taxpayer into a higher tax slab, resulting in an unfair tax burden. Section 89 of the Income Tax Act helps correct this imbalance by allowing tax relief on arrears and advance salary through a year-wise comparison of tax liability. The provision ensures that income meant for earlier years is not taxed at today’s higher rates. With many employers issuing arrears after pay revisions or settleme

PRITI SIRDESHMUKH

Dec 17, 20258 min read

Section 115BAC New Tax Regime: Deductions, Rebate & Tax-Free Income Explained

Section 115BAC forms the core of India’s new tax regime, designed to simplify taxation by offering lower slab rates in exchange for fewer deductions. Recent updates under the Union Budget FY 2025-26 have significantly changed how taxpayers calculate benefits, especially around the higher standard deduction of ₹75,000 and the increased Section 87A rebate of up to ₹60,000. These changes push the effective tax-free income threshold to ₹12.75 lakh for salaried individuals and pe

Asharam Swain

Dec 17, 20258 min read

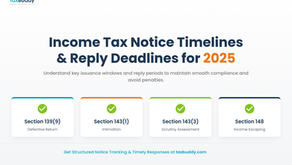

Income Tax Notice Timelines and Reply Deadlines for 2025

Income tax notices operate on specific statutory timelines, and understanding these timelines helps maintain smooth compliance throughout the 2025 cycle. Every notice issued by the Income Tax Department follows a defined window for issuance and a fixed reply period for taxpayers. These timelines depend on the type of assessment, the financial year involved, and the nature of discrepancies identified in the filed return. With the 2025 assessment cycle seeing structured updates

Rajesh Kumar Kar

Dec 17, 20259 min read

Filing ITR for Pension Income and Savings Account Interest in India

Filing an income tax return for pension income combined with savings account interest requires clarity on how these two income streams are taxed under the Income Tax Act for FY 2024-25. Pension is treated as salary income, while savings interest falls under income from other sources, and both must be reported accurately. Seniors can also access additional deductions such as Section 80TTB, which reduces taxable interest income. Selecting the correct ITR form, understanding ex

Nimisha Panda

Dec 17, 20259 min read

bottom of page