top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

GST for Service Providers: How TaxBuddy Manages Returns for Agencies, CAs, and Consultants

GST compliance for service providers in India has become more structured but significantly more data-driven in 2025. Agencies, chartered accountants, and consultants now face clearer tax rates and thresholds, alongside tighter scrutiny through analytics, cross-linking with income tax data, and stricter return matching. Errors in invoicing, ITC claims, or return reconciliation can quickly lead to notices and blocked credits. In this environment, managing GST is no longer a per

Rashmita Choudhary

Jan 158 min read

Income Tax Notices for Freelancers and Businesses: How TaxBuddy Segments and Resolves Issues

Income tax notices often arise due to mismatches, missing information, or reporting errors, making compliance challenging for freelancers and business owners. Notices may relate to unreported income, incorrect tax filings, or scrutiny assessments that require prompt and accurate clarification. TaxBuddy offers a structured system that analyses notices, segments them by type, and guides users through resolution using expert oversight and automated checks. This ensures clarity

Nimisha Panda

Dec 31, 20258 min read

ITR Filing Guide for Freelancers and Consultants in 2025

Freelancers and consultants are subject to income tax just like salaried individuals, but their income is treated as business or professional earnings under the Income Tax Act. With multiple income streams, TDS entries, and expense claims, filing taxes can be complex. The government’s emphasis on digital compliance and updated tax rules under Budget 2025 has made online filing platforms indispensable. AI-powered platforms like TaxBuddy simplify ITR filing for freelancers by

Nimisha Panda

Nov 6, 20259 min read

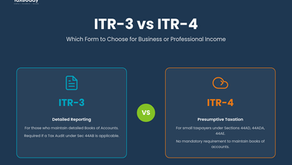

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 6, 20257 min read

ITR Filing for Freelancers and Consultants Explained

Freelancers and consultants in India must navigate unique challenges while filing Income Tax Returns (ITR) for FY 2024-25. Unlike salaried employees, their income is not subject to automatic TDS, making accurate reporting, expense tracking, and timely filing essential. Choosing the correct ITR form, maintaining supporting documents, providing bank account details, and understanding deductions under both the presumptive and regular taxation schemes are key to compliance and av

PRITI SIRDESHMUKH

Oct 1, 20259 min read

How to Save Tax on Freelance or Consulting Income

Freelancers and consultants in India face unique tax challenges due to multiple income streams, varying expenses, and compliance...

Asharam Swain

Sep 19, 202510 min read

Salaried + Freelance Professionals: How to Declare Dual Income Sources

Managing income from multiple sources can be challenging, especially when combining salaried and freelance earnings. Dual income filing...

Nimisha Panda

Sep 15, 20259 min read

Freelancer or Side Hustler? TaxBuddy Simplifies Your ITR Filing in 2025

Freelancers and side hustlers form a growing segment of India’s workforce, contributing significantly to the gig economy. With increasing...

Asharam Swain

Sep 2, 20258 min read

Got Freelance Income? Let’s Strategize Your Taxes in One Call

Freelancing is becoming an increasingly popular career choice in India, with many professionals opting for flexible work schedules and...

PRITI SIRDESHMUKH

Aug 25, 20259 min read

Can Freelancers Use ITR-1? No, and Here’s Why

Filing Income Tax Returns (ITR) is a crucial process for all taxpayers, and it becomes especially important for freelancers. However,...

PRITI SIRDESHMUKH

Jul 17, 20258 min read

bottom of page