top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Income Tax Notice Land Purchase: What Buyers Must Be Aware of

Introduction Buying a piece of land can feel like a huge achievement, but it can quickly turn into a tax headache if the tax department starts paying attention. Just because you get a tax notice after buying land does not mean you have done something wrong. Any land purchase over Rs. 30 lakh has to be reported to the Income Tax Department by the Registrar’s office, thanks to Section 285BA ( Statement of Financial Transactions ). Once this information is included in your Annua

PRITI SIRDESHMUKH

Dec 18, 20256 min read

Refund Set-Off Under Section 245: Detailed Process Explained

Refund adjustments under Section 245 often catch taxpayers off-guard, especially when expecting a refund for the current year but receiving an intimation instead. Section 245 empowers the Income Tax Department to set off an upcoming refund against unpaid tax dues from previous years. This adjustment is not automatic; it involves an official notice, a response window, and a mandatory review of objections before any action. Understanding what triggers these adjustments, how th

Rashmita Choudhary

Dec 18, 20259 min read

TDS Deduction Errors and Income Tax Notices: How TaxBuddy Helps Deductors and Deductees

TDS deduction errors often surface when tax is withheld at incorrect rates, not deducted on eligible payments, or deposited with mismatched challan details. These gaps create inconsistencies in Form 26AS and AIS, leading to income tax notices for both deductors and deductees. Frequent triggers include invalid PAN entries, 20 per cent deduction under Section 206AA, short deduction flagged under Section 201, and late filing penalties under Section 234E. With correction timeline

PRITI SIRDESHMUKH

Dec 17, 20258 min read

Authenticating and Downloading Income Tax Notices: How TaxBuddy Simplifies DIN and Portal Verification

Authenticating and downloading income tax notices relies on two essential steps: validating the Document Identification Number and using the portal’s dedicated tools that confirm whether a notice is genuine. The updated e-filing interface makes this process more structured, allowing clear verification before taking action. DIN helps establish authenticity, while the portal ensures traceability of every notice issued. With more taxpayers receiving digital notices, understandin

Nimisha Panda

Dec 17, 20259 min read

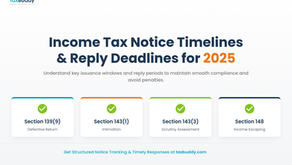

Income Tax Notice Timelines and Reply Deadlines for 2025

Income tax notices operate on specific statutory timelines, and understanding these timelines helps maintain smooth compliance throughout the 2025 cycle. Every notice issued by the Income Tax Department follows a defined window for issuance and a fixed reply period for taxpayers. These timelines depend on the type of assessment, the financial year involved, and the nature of discrepancies identified in the filed return. With the 2025 assessment cycle seeing structured updates

Rajesh Kumar Kar

Dec 17, 20259 min read

Income Tax Reassessment Notice: What Taxpayers Should Know

Introduction Section 148 of the Income Tax Act is especially important in the complex realm of income tax. This clause gives the Income Tax Department the power to review and reevaluate a taxpayer's previously submitted returns in the event that there is a suspicion that any income has not been assessed. In essence, it's a way for the tax authorities to examine and correct any inconsistencies from a previous assessment that were missed. The Assessing Officer may choose your

Asharam Swain

Dec 17, 20259 min read

How TaxBuddy Helps You Verify Whether an Income Tax Notice Is Genuine

Income tax notices often arrive without warning, creating uncertainty about whether the communication is genuine or part of a phishing attempt. Verification becomes essential because fake notices frequently mimic the exact layout, tone, and terminology used by the Income Tax Department. A genuine notice always follows a defined structure, carries a valid Document Identification Number, and reflects data already available in the taxpayer’s records. TaxBuddy’s systems help brea

Asharam Swain

Dec 14, 20258 min read

AIS vs Bank Statement Mismatch: How TaxBuddy Responds to Income Tax Notices

AIS vs bank statement mismatches occur when the entries reported to the Income Tax Department differ from the actual transactions appearing in a taxpayer’s bank records. These mismatches are increasingly common because AIS aggregates data from banks, brokers, and other reporting entities, capturing interest, deposits, securities transactions, and high-value transfers. When this data does not align with the income declared in the ITR, automated systems may issue notices for cl

Rajesh Kumar Kar

Dec 12, 20258 min read

Clubbing of Family Income and Tax Notices: How TaxBuddy Handles Minor and Spouse-Related Queries

Clubbing of income applies when earnings of a spouse or minor child must be added to the taxpayer’s total income under Section 64 . This adjustment prevents tax avoidance through diversion of income and often becomes the basis for tax notices when clubbed income is not disclosed accurately. Minor’s interest income, spouse-related gifts, and transfers without adequate consideration fall under these rules, and mismatches frequently surface in AIS or Form 26AS. Many taxpayers se

Dipali Waghmode

Dec 11, 20259 min read

How to File Revised ITR After Section 143(1) Intimation

A Section 143(1) intimation often highlights mismatches in income, deductions, or tax credits, prompting many taxpayers to recheck their original filing. When the numbers in the intimation differ from what was reported, a revised return under Section 139(5) becomes the corrective tool to ensure accuracy. Filing it on time helps prevent unnecessary tax demands, interest, or scrutiny. Platforms like TaxBuddy naturally simplify this journey by identifying discrepancies and guidi

PRITI SIRDESHMUKH

Dec 9, 20259 min read

bottom of page