top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

What Is a GST Return and How TaxBuddy Simplifies Filing for Small Businesses

A GST return is a mandatory electronic statement used to report sales, purchases, output tax, and input tax credit under India’s Goods and Services Tax system. Small businesses must file these returns accurately and on time to avoid penalties and maintain smooth compliance. Each return type serves a specific purpose, from outward supplies to monthly summaries, making GST filing a detailed process for business owners. With frequent updates in GST rules and reconciliation chall

Nimisha Panda

Dec 24, 20259 min read

Wrong Deductions and Income Tax Notice: How TaxBuddy Reviews Section-Wise Errors

Wrong deductions in an Income Tax Return often trigger notices under sections like 139(9), 143(1), 154, and 156, especially when income, TDS, or exemption claims do not match department records. The core issue usually stems from incorrect figures, missing proofs, or bank-related reporting gaps. Automated systems quickly flag these mismatches, leading to adjustments or demands. TaxBuddy reduces these errors by reviewing the deductions section-wise, comparing data with the In

Rajesh Kumar Kar

Dec 24, 20259 min read

Non-Filing of Income Tax Return and High Value Transaction for FY 2024-25 Explained

Non-filing of an income tax return often triggers automated alerts when financial activity suggests taxable income but no return is submitted by the due date. The system flags such cases under the e-Campaign for non-filers, prompting taxpayers to respond through the Compliance Portal. These notices arise from AIS and Form 26AS mismatches, high-value transactions, or bank-linked income that remains unreported. Responding quickly prevents penalties, defective return treatment,

Nimisha Panda

Dec 23, 20259 min read

Salary Mismatch Income Tax Notice: How TaxBuddy Assists Salaried Taxpayers

Salary mismatch notices are among the most common issues faced by salaried taxpayers. These occur when the salary reported in Form 16, Form 26AS , AIS, or TDS statements does not match the income declared in the Income Tax Return. Even minor discrepancies can trigger notices because the Income Tax Department compares employer filings, bank entries, and payroll records with the taxpayer’s return. Platforms like TaxBuddy help resolve these mismatches by identifying inconsiste

Asharam Swain

Dec 23, 20259 min read

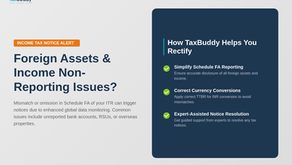

Foreign Assets and Income Tax Notice: How TaxBuddy Helps You Rectify Non-Reporting

Foreign assets must be reported accurately by every Indian resident earning or holding property, bank accounts, equity, or investments outside India. Any mismatch or omission in Schedule FA immediately increases the chance of receiving an income tax notice, especially with enhanced global data exchange systems and CBDT's foreign asset monitoring. Notices commonly arise when bank accounts, RSUs, overseas properties, or foreign income remain unreported or incorrectly converted

Rashmita Choudhary

Dec 23, 20258 min read

How to Reply to an Income Tax Notice Online Using TaxBuddy’s Notice Management Service

Income tax notices often arise from mismatches in AIS, discrepancies in Form 26AS, missing income details, or verification issues linked to PAN. Quick and accurate responses are crucial because the department allocates strict timelines—usually between 7 and 30 days—to avoid penalties or further scrutiny. A structured approach helps ensure the reply is complete, legally sound, and backed with proper documentation. TaxBuddy’s Notice Management Service supports this process by d

Asharam Swain

Dec 23, 20259 min read

Section 156 Demand Notice: How TaxBuddy Verifies and Helps You Pay or Dispute the Demand

A Section 156 Demand Notice informs a taxpayer that the Income Tax Department has detected unpaid tax, interest, penalty, or fee based on an order passed under the Income Tax Act. It specifies the exact amount owed and typically requires payment within 30 days. Quick verification is crucial, as errors in TDS credits, return data, or processing can create incorrect demands. TaxBuddy assists by matching the notice with Form 26AS , AIS, and filed returns, helping identify mismat

PRITI SIRDESHMUKH

Dec 23, 202510 min read

Time Limits for Income Tax Notices: How TaxBuddy Tracks Sections 143, 148, and 156 for You

Time limits for income tax notices under Sections 143 , 148 , and 156 determine how long the Income Tax Department can process returns, start scrutiny, reopen assessments, or raise tax demands. These deadlines shape whether a notice is valid or time-barred. Section 143 governs processing and scrutiny assessments, Section 148 deals with reassessments for escaped income, and Section 156 issues payment demands based on earlier orders. Each carries strict statutory timelines to

Nimisha Panda

Dec 23, 20259 min read

Section 143(2) Scrutiny Notice: Documents, Timelines, and How TaxBuddy Prepares Your Reply

Section 143(2) scrutiny notice is issued when the Income Tax Department selects a return for deeper verification to check discrepancies, mismatched income details, or questionable deductions. The notice requires taxpayers to submit supporting documents such as Form 16 , Form 26AS, bank statements, investment proofs, and business records to justify entries made in the ITR. Responding within timelines is essential, as delays may lead to penalties or best-judgment assessments.

Nimisha Panda

Dec 23, 20258 min read

House Property and Home Loan Mismatch: How TaxBuddy Handles Rental Income Tax Notices

House property and home loan mismatches frequently arise when rental income disclosed in ITR filings does not align with AIS or Form 26AS data, prompting automated notices under Section 143(1). These mismatches often involve unreported rent, incorrect interest claims, or TDS deductions that do not match Schedule HP entries. Automated cross-verification by the Income Tax Department highlights such differences instantly, creating a need for accurate reconciliation. With increas

Nimisha Panda

Dec 23, 20259 min read

bottom of page