top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Smart Tax-Saving Options Beyond Section 80C

Taxpayers often stop at Section 80C when planning their savings, overlooking several other powerful deductions under the Income Tax Act, 1961. These lesser-known sections can substantially reduce tax liability while aligning financial goals with long-term benefits such as health coverage, education, and retirement planning. With the right mix of deductions and informed investment decisions, tax planning becomes a strategic advantage rather than a routine annual task. Table

Rashmita Choudhary

Nov 20, 202510 min read

Section 80C vs 80CCD: Which Deduction Saves More Tax?

Section 80C and Section 80CCD are two of the most popular tax-saving provisions under the Income Tax Act, 1961. Both offer significant opportunities to lower taxable income, but their scope and eligibility differ. Section 80C focuses on diversified investments such as ELSS, PPF, and life insurance, while Section 80CCD encourages retirement savings through the National Pension System (NPS). The right choice depends on income level, employment type, and investment goals. Unde

Dipali Waghmode

Nov 7, 202510 min read

NPS Tax Benefit (80CCD 1B) – Maximize it with Our Help

Section 80CCD(1B) of the Income Tax Act provides an additional deduction of up to ₹50,000 annually for contributions to the National...

Rashmita Choudhary

Sep 20, 20255 min read

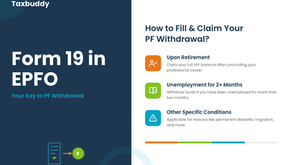

Form 19 in EPFO: How to Fill Form 19 For PF Withdrawal?

An essential application for withdrawing the balance of the Employee Provident Funds (EPF) is EPF Form 19. An employee submits it to...

Asharam Swain

Sep 18, 20256 min read

Which Regime Is Better for Pensioners with No Deductions?

For pensioners, tax planning can be more complex than for salaried individuals due to fixed income sources, allowances, and investment...

Asharam Swain

Sep 16, 20258 min read

NPS Employee Contribution u/s 80CCD(1B): Maximize Your Tax Savings by ₹50,000 (FY 2024-25)

This guide on NPS employee contribution u/s 80CCD(1B) shows how you can save a good chunk of tax, up to ₹50,000, for the Financial Year...

Rashmita Choudhary

Jul 22, 202511 min read

Section 80CCD(1B): Maximize Your Tax Savings with an Additional Rs. 50,000 NPS Deduction

Section 80CCD(1B) presents a valuable opportunity for taxpayers to reduce their taxable income further by making contributions to the...

Nimisha Panda

Jul 19, 202514 min read

What is EPS Nomination

Members of the Employees' Provident Fund Organization (EPFO) have the option to save money in pension funds through two different account...

Farheen Mukadam

May 2, 20259 min read

How to Choose the Best Pension Fund Manager For NPS

The Central Government of India launched the National Pension Scheme (NPS) for the public, private, and unorganized sectors. Anyone can...

Rajesh Kumar Kar

May 2, 20259 min read

How to get the maximum benefit from 80CCD(1B)?

Section 80CCD(1B) provides a unique opportunity to claim an additional tax deduction of up to ₹50,000 on contributions made to the...

Farheen Mukadam

Apr 29, 20257 min read

bottom of page