Can You Claim Both Section 80EEA and Section 24? Yes, You Can!

- Nimisha Panda

- Aug 28, 2025

- 6 min read

Updated: Sep 1, 2025

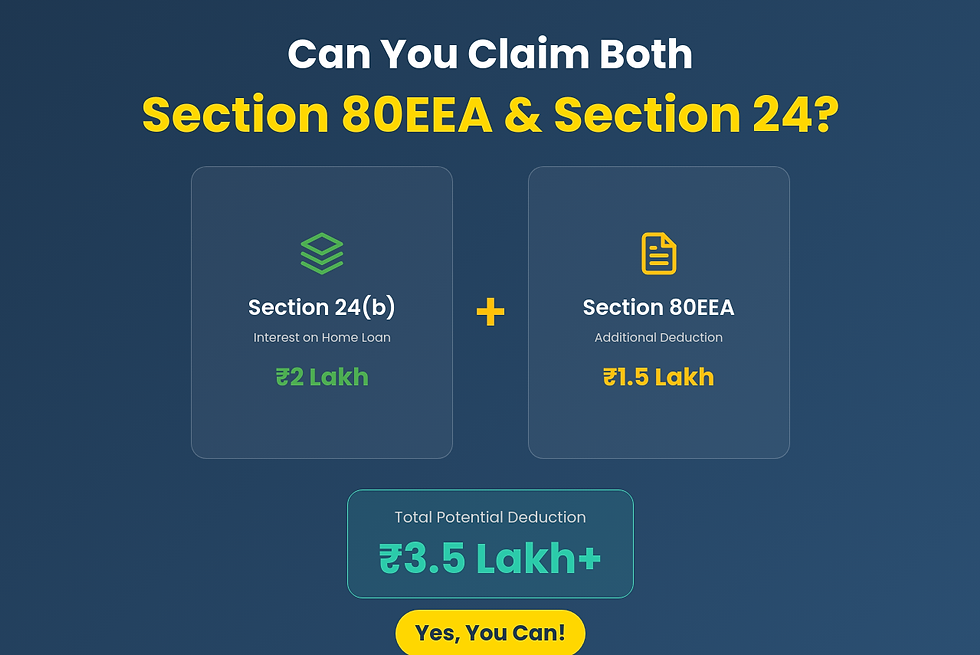

Yes, a home loan borrower can absolutely claim deductions under both Section 24(b) and Section 80EEA at the same time. This allows a homeowner to get a potential total deduction of ₹3.5 lakh or even more. This guide explains exactly how to achieve this, what conditions you must satisfy, and provides clear examples to help you.

Table of Index

How Deductions Under 80EEA and Section 24 Work Together

A person can claim a home loan interest deduction under Section 24(b), and Section 80EEA provides an extra deduction for interest on a loan for affordable housing. It's important to know that the 80EEA deduction is in addition to the limit set by Section 24. Think of it this way: Section 24 is your main deduction bucket, and Section 80EEA is a special top-up bucket just for the interest on your first affordable home. This combination allows a taxpayer to maximize their tax savings significantly.

Here's a simple breakdown of how the benefits add up:

₹2,00,000 Deduction under Sec 24(b)

+ ₹1,50,000 Deduction under Sec 80EEA

= Total ₹3,50,000 Benefit

Understanding the Two Pillars: Section 24 vs. Section 80EEA

To take full advantage of tax benefits, a homeowner must understand the two main sections for interest deduction: Section 24(b) and Section 80EEA. Section 24(b) is a broad deduction available to anyone who has taken a home loan, while Section 80EEA specifically targets first-time buyers of affordable homes. Understanding the differences is key to making a correct claim.

Here is a direct comparison based on the official Income Tax Act provisions:

Feature | Section 24(b) | Section 80EEA |

Deduction Amount | Up to ₹2 lakh for a self-occupied property. For a rented property, the entire interest paid can be claimed. | Additional deduction of up to ₹1.5 lakh. |

Property Type | Applies to self-occupied, rented, or deemed rented properties. | Applies to the first residential house property purchased. |

Loan Sanction Period | No specific sanction period, but the loan must be for purchasing, constructing, or repairing a property after April 1, 1999, to claim the full ₹2 lakh benefit. | The loan must have been sanctioned between April 1, 2019, and March 31, 2022. |

Ownership Status | Available to any individual or HUF who is a property owner. | Available only to individuals who are first-time home buyers and do not own any other house on the loan sanction date. |

Property Value Limit | No limit on the property's value. | The stamp duty value of the property must not be more than ₹45 lakh. |

Your Eligibility Checklist: Can YOU Claim Both?

An individual looking to claim both 80EEA and 24 should use a clear checklist to confirm their eligibility for the tax deduction. This makes it easy to see if you meet all the required conditions. If you can answer "yes" to all the following questions, you are in a great position to claim benefits under both sections.

☐ Is your total home loan interest for the year more than ₹2,00,000? ☐ Are you a first-time home buyer (meaning you do not own any other residential property on the date your loan was sanctioned)? ☐ Was your home loan sanctioned between April 1, 2019, and March 31, 2022? ☐ Is the stamp duty value of your property ₹45 lakh or less? ☐ Are you NOT eligible to claim a deduction under Section 80EE?

If you answered "Yes" to all these questions, you are eligible to claim deductions under both sections!

Step-by-Step Example: Calculating Your Total Deduction

Here is an example of how to calculate the 80EEA deduction along with the Section 24 benefit to show how home loan tax benefit calculations work in a real-life scenario. This practical example will help you understand how the deductions are applied.

Case Study

Let's imagine a person named Rohan meets all the conditions for claiming deductions under both Section 24(b) and Section 80EEA.

Total Home Loan Interest Paid in FY 2024-25:₹4,00,000

All eligibility conditions for Section 80EEA are met.

Calculation Steps:

Claim under Section 24(b): First, Rohan claims the maximum deduction allowed under Section 24(b) for his self-occupied house.

Deduction:₹2,00,000

Calculate Remaining Interest: Next, he subtracts the amount claimed under Section 24(b) from his total interest payment.

Remaining Interest: ₹4,00,000 - ₹2,00,000 = ₹2,00,000

Claim under Section 80EEA: Now, Rohan can claim an additional deduction from the remaining interest amount under Section 80EEA.

Deduction:₹1,50,000 (This is the maximum allowed under 80EEA, even though his remaining interest is higher).

Total Deduction Claimed: Finally, he adds the deductions from both sections to find his total benefit.

Total Benefit: ₹2,00,000 (Sec 24b) + ₹1,50,000 (Sec 80EEA) = ₹3,50,000

Don't Confuse 80EEA with 80EE: A Quick Clarification

Many people confuse the 80EE vs 80EEA sections, but they are different. Section 80EE was for home loans sanctioned in an earlier period, specifically the financial year 2016-17. It had different conditions, such as a lower deduction limit of ₹50,000 and a different property value cap. A person cannot claim benefits under both Section 80EE and Section 80EEA for the same loan. It is important to know which section applies to your loan to make the correct claim.

What About the Principal Amount? Don't Forget Section 80C

While Section 24 and Section 80EEA cover the interest part of your EMI, a home loan borrower should not forget about the principal repayment deduction. The principal portion of your EMI can be claimed as a deduction under Section 80C of the Income Tax Act. This section allows for a total deduction of up to ₹1.5 lakh across various investments and expenses, including your home loan principal. This provides another layer of tax savings on your home loan.

Conclusion: Maximize Your Tax Savings Intelligently

To achieve maximum tax savings, a homeowner should plan their home loan tax benefits carefully. It is confirmed that you can claim deductions under both Section 80EEA and Section 24 if you meet the conditions. This can result in a significant total deduction of up to ₹3.5 lakh on your home loan interest.

Key takeaways for your home loan tax planning include:

Always check the eligibility checklist for both sections.

Remember that these benefits are only for those who opt for the old tax regime.

Keep your loan interest certificate and property documents ready for tax filing.

Don't leave money on the table. You should verify your home loan statement to ensure you claim every deduction you are entitled to. For personalized tax planning, it is always a good idea to consult with an expert.

FAQs

1. Is Section 80EEA still available for new home loans?

No, the loan must have been sanctioned by March 31, 2022, to qualify for Section 80EEA. However, if your loan was approved before this deadline, you can continue to claim the deduction for the entire repayment period of the loan.

2. Can I claim HRA and home loan deductions under Section 24 and 80EEA together?

Yes, a person can claim HRA (House Rent Allowance) and home loan deductions together. This is possible if you are renting a home in one city for work and have taken a loan for a property in a different city where your family resides.

3. What if my total interest is less than ₹2 lakh? Can I still claim 80EEA?

No, you cannot claim a deduction under Section 80EEA in this case. Section 80EEA is an additional deduction that applies only to the interest amount remaining after you have already used the full ₹2 lakh limit under Section 24(b).

4. How do co-owners or joint home loan applicants claim these deductions?

Both co-owners can claim deductions under Section 24(b) and Section 80EEA in their individual tax returns. However, each co-owner must individually meet all the eligibility criteria for both sections, be a co-owner of the property, and be a co-borrower of the loan.

5. Can I claim these deductions for a let-out or rented property?

For Section 24(b), you can claim the entire interest paid on a loan for a let-out property as a deduction. For Section 80EEA, the main condition is being a first-time home buyer, and the deduction can be claimed whether the property is occupied by you or rented out.

6. What documents do I need to claim deductions under Section 24 and 80EEA?

You need the home loan interest certificate provided by your bank or financial institution. This certificate clearly shows the principal and interest amounts paid during the financial year. It's also wise to keep the loan sanction letter and property registration documents handy as proof of value and ownership.

7. Where do I show Section 80EEA and Section 24 in the ITR form?

The deduction under Section 24(b) is claimed in the "Income from House Property" schedule of the ITR form. The deduction under Section 80EEA is claimed under "Chapter VI-A" deductions.

8. Can I claim the principal repayment under 80EEA?

No, Section 80EEA is only for the interest component of the home loan. The principal repayment can be claimed under Section 80C.

9. Is there an income limit to be eligible for Section 80EEA?

No, the Income Tax Act does not set any income limit for a taxpayer to be eligible for the Section 80EEA deduction. The restriction is on the stamp duty value of the property, which must be ₹45 lakh or less.

10. Does the 80EEA deduction apply to the old or new tax regime?

The deductions under Section 80EEA and Section 24 for a self-occupied property are available only if you choose to file your taxes under the old tax regime. These deductions cannot be claimed if you opt for the new tax regime.

Comments