Capital Gains Exemption: A Detailed Overview

- Rajesh Kumar Kar

- Dec 14, 2025

- 9 min read

Updated: Dec 21, 2025

Introduction

The profit made from the selling of capital assets, such as stocks, bonds, and real estate, among other investments, is referred to as capital gains. These capital gains are subject to taxation based on a number of variables, such as the asset's holding time and the tax bracket of the individual. Nonetheless, a person may be able to lower their capital gains tax obligation by taking advantage of some exemptions and deductions. Investors and traders who want to maximise their returns and optimise their investment plan may find it essential to comprehend the capital gains exemption. Capital gains are divided into short-term and long-term categories according to how long the asset is held.

Table of Contents

Short-Term Capital Gains

Short-term capital gains are the profits from selling an asset after fewer than 36 months of ownership. The holding period for calculating short-term capital gains on real estate, such as buildings or land, is 24 months. On the other hand, profits obtained by selling assets—like stock exchange-listed shares—after owning them for less than a year are classified as short-term capital gains. Short-term capital gains are taxed at the individual's income tax slab rate after being added to their taxable income. The following table shows the tax rates applicable to various short-term assets.

Long-Term Capital Gains

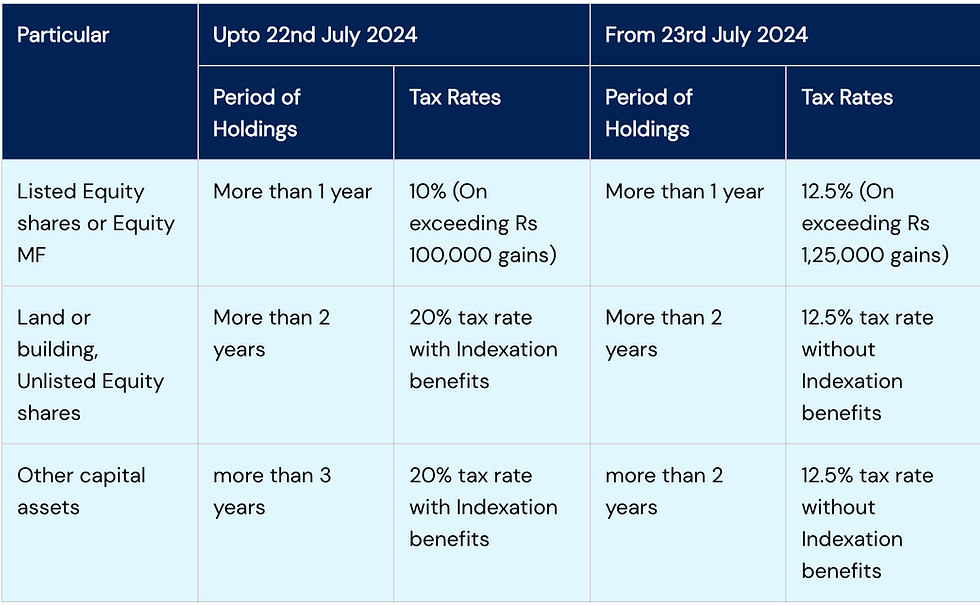

The profit from the sale of assets after 36 months of ownership is known as long-term capital gains. Usually, it is the profits from a lengthy holding period. However, different assets have different holding periods. The holding time for determining long-term capital gains is 12 months for assets like stocks and equity-oriented mutual funds, but more than 36 months for debt mutual funds. The time frame is longer than 36 months for mobile properties and 24 months for immovable properties. The following table shows the tax rates applicable to various long-term capital assets.

Capital Gains Exemption

Certain investments or transactions that are exempt from taxation on realised gains are referred to as capital gains exemptions. To safeguard their income from the sale of capital assets and ultimately lower their total tax obligation, individuals can take advantage of a number of capital gains tax exemptions. There are restrictions on these capital gains exemptions. The following are a few capital gains tax exemptions:

Section 54

This section covers the exemption from profits on the sale of property used for residence. The following are the applicable details:

Eligible Assessee: Individual/HUF

Type of asset transferred: Residential house property (long-term capital asset)

New asset purchased: Residential house property

Time limit for new investment: Purchase should be made within 1 year before transfer or within 2 years after the transfer. In the case of construction, the new one should be built within 3 years after the transfer.

Exemption Amount: LTCG or cost of new asset, whichever is less.

CAGS: Yes - deposit by the due date of return filing

To determine capital gains on a new asset, the amount previously exempted under this section will be subtracted from its COA if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time.

Section 54B

Capital gain on the transfer of land used for agricultural purposes is covered under this section. The following details are applicable:

Eligible Assessee: Individual/HUF

Type of asset transferred: Land used for agricultural purposes by the individual / his parent / HUF for 2 years before transfer (long-term or short-term capital asset)

New Asset Purchased: Agricultural land

Time limit for new investment: The new investment is made within 2 years from the date of transfer

Exemption Amount: LTCG or cost of new asset, whichever is less

CAGS: Yes - deposit by the due date of return filing

The amount previously exempted under this section will be deducted from the COA of a new asset in order to determine capital gains if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time.

Section 54D

This section applies to land and buildings used in an industrial undertaking that are acquired compulsorily. Here are the key details:

Eligible Assessee: Any assessee

Type of asset transferred: A structure or piece of land that was used for an industrial project within the two years prior to the transfer. (long-term capital asset)

New Asset Purchased: Land or building bought for shifting or re-establishing the industrial undertaking

Time limit for new investment: The new investment is to be made within 3 years from the date of transfer

Exemption Amount: LTCG or cost of new asset, whichever is less

CAGS: Yes - deposit by the due date of return filing

The amount previously exempted under this section will be deducted from the COA of a new asset in order to determine capital gains if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time.

Section 54EC

This section addresses the exemption on investment in certain bonds. Here are the key details for Section 54EC:

Eligible Assessee: Any assessee

Type of asset transferred: Land or building or both (long-term capital asset)

New Asset Purchased: These include NHAI bonds or RECL bonds, which are redeemable after 5 years and issued on or after 1.4.2018

Time limit for new investment: The new investment should be made within 6 months from the date of the transfer

Exemption Amount: Cost of new asset x Capital Gain / Net consideration (maximum up to capital gain)

CAGS: No

In order to determine capital gains on a new asset, the amount previously exempted under this provision will be subtracted from its COA if it is sold within five years (three years prior to F.Y. 2018–19). Within five years, a loan secured by the newly designated asset will be considered capital gains. During the current and upcoming fiscal years, investments in designated bonds shall not surpass Rs. 50 lakh.

Section 54EE

Investment in units of a specified fund is covered under this section. The details applicable are as follows:

Eligible Assessee: Any assessee

Type of asset transferred: Specified fund (long-term capital asset)

New Asset Purchased: Units notified by the Central Government

Time limit for new investment: The new units should be bought within 6 months from the date of the transfer

Exemption Amount: Cost of new asset x Capital Gain / Net consideration (maximum up to capital gain

CAGS: No

In order to determine capital gains on a new asset, the amount previously exempted under this provision will be subtracted from its COA if it is sold within five years (three years prior to F.Y. 2018–19). Within five years, a loan secured by the newly designated asset will be considered capital gains. During the current and upcoming fiscal years, investments in designated bonds shall not surpass Rs. 50 lakh.

Section 54F

Investment in a residential house comes under this section. The details are listed as follows:

Eligible Assessee: Individual / HUF

Type of asset transferred: Any long-term capital asset except a residential house (long-term capital asset)

New Asset Purchased: Residential house property

Time limit for new investment: Purchase should be made 1 year before transfer or within 2 years after transfer. In the case of construction, it should be done within 3 years after transfer.

Exemption Amount: Cost of new asset x Capital Gain / Net consideration (maximum up to capital gain)

CAGS: Yes - deposit by the due date of return filing

The amount previously exempted under this section will be subtracted from the COA of a new asset in order to determine capital gains if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time. A person or HUF is only permitted to own a maximum of two residential properties (i.e., both new and existing). The amount of the prior exemption will be charged as capital gains if another home is bought.

Section 54G

This section covers the shifting of industrial undertakings from urban to rural areas. The following are the key aspects of this section:

Eligible Assessee: Any assessee

Type of asset transferred: Plant, machinery, land, buildings, or rights to land or structures used in an urban industrial enterprise are capital assets covered by this section. (long-term or short-term capital asset)

New Asset Purchased: Moving an industrial project from an urban region to a rural or SEZ area entails purchasing new equipment or machinery, purchasing property, or building a structure. It is also applicable when the project was moved to a new location, and the old asset was moved, and specific costs were incurred.

Time limit for new investment: The time limit is 1 year before and 3 years after the date of transfer.

Exemption Amount: Long-Term Capital Gain OR Cost of new asset, whichever is lesser

CAGS: Yes - deposit by the due date of return filing

The amount previously exempted under this section will be subtracted from the COA of a new asset in order to determine capital gains if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time.

Section 54GA

This section is applicable to the shifting of an industrial undertaking from an urban area to an SEZ. Here are the key details:

Eligible Assessee: Any assessee

Type of asset transferred: Plant, machinery, land, buildings, or rights to land or structures employed in an urban industrial endeavour are considered capital assets under this provision. (long-term or short-term capital asset)

New Asset Purchased: Moving an industrial project from an urban location to a rural or Special Economic Zone (SEZ) area entails purchasing new equipment or machinery, purchasing property, or building a structure. The project was moved to a new location, and the old asset was moved, and specific costs were incurred.

Time limit for new investment: The time limit is 1 year before and 3 years after the date of transfer.

Exemption Amount: Long-Term Capital Gain OR Cost of new asset, whichever is lesser

CAGS: Yes - deposit by the due date of return filing

The amount previously exempted under this section will be subtracted from the COA of a new asset in order to determine capital gains if it is sold within three years. The sum in CGAS will be taxable as capital gains if it is not used within the allotted time.

Conclusion

Capital gains exemptions under the Income Tax Act of 1961 provide substantial relief by striking a balance between tax revenue and social and economic objectives. By investing the money in housing, farming, or infrastructure, taxpayers can postpone or avoid paying taxes, but they must be extremely cautious to adhere to the regulations or risk penalties. Attorneys should advise their clients about dangers, paperwork, and deadlines, particularly in light of the 2024 reforms that will eliminate indexation for the majority of assets. The Income Tax Bill, 2025, retains these elements of the structure, which are becoming simpler over time. You may better prepare your taxes while adhering to the law if you are aware of these.

Frequently Asked Questions

What is the exemption from capital gains?

According to regulations in the Income Tax Act, 1961, a capital gains exemption allows you to avoid paying taxes on earnings from selling assets like shares or real estate by reinvesting the proceeds in particular assets like bonds or a home.

How much capital gain is tax-free?

The tax-free amount is determined by the exemption (e.g., up to Rs. 50 lakh for bonds under Section 54EC, or full profit if reinvested in a property under Section 54); nevertheless, LTCG for shares is tax-free up to Rs. 1.25 lakh annually.

How do I avoid capital gains tax on my property?

You will be subject to capital gain tax if you have sold any capital assets. As previously mentioned, you can plan your capital gain tax by claiming an exemption under sections 54, 54EC, 54F, etc. You can seek a capital gain tax exemption by using these parts.

Is capital gain exempt from tax?

Although capital gains are not always tax-free, they can be provided you reinvest the profit in qualifying assets under Sections 54 to 54GB and adhere to stringent guidelines and deadlines.

Can we claim exemptions on the sale of Short-Term Capital Asset(STCA)?

On short-term capital assets, the taxpayer may claim exemptions under sections 54B and 54G. On the other hand, Long Term Capital Asset offers all the other exemptions.

How to claim an exemption if we wish to buy the house property next year?

Depending on the asset sold, taxpayers may be eligible for exemptions under sections 54 and 54F. By depositing the funds in the CGAS, one might request an exemption. By putting the money in the CGAS, they can request an exemption. They must, however, deposit it prior to the ITR filing deadline. and submit an ITR claiming the same as an exemption.

What are the documents required as proof of investment while claiming the exemption?

The taxpayer just needs to include the value, the purchase date, and the exemption section when filing an ITR. For future reference, it is crucial to preserve the records pertaining to the acquired assets.

Comments