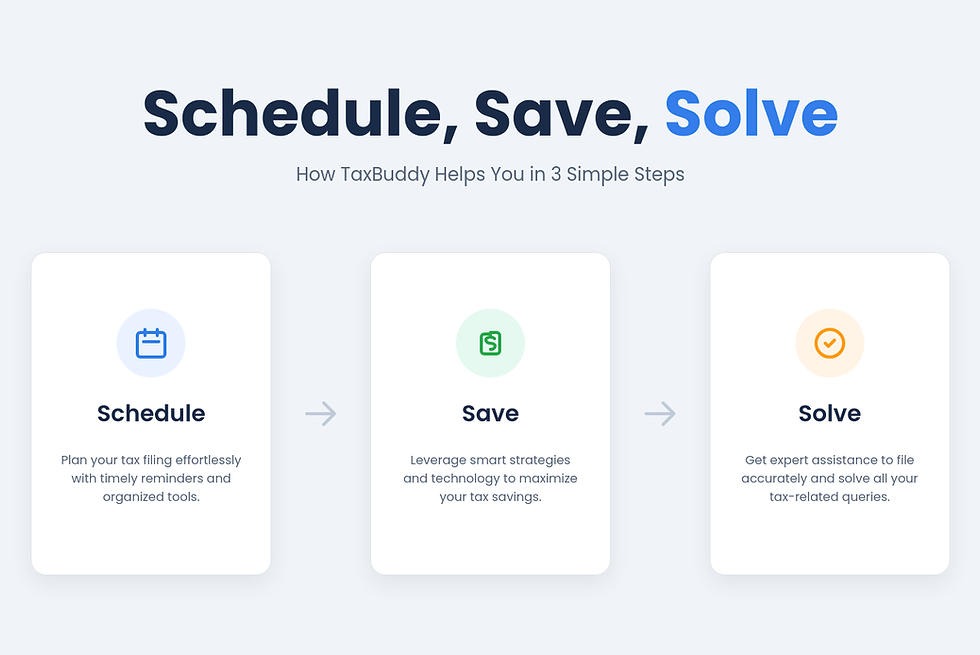

Schedule, Save, Solve: How TaxBuddy Helps You in 3 Simple Steps

- Rashmita Choudhary

- Aug 25

- 12 min read

Updated: Aug 26

The process of filing taxes can be daunting, but with the right planning, strategies, and tools, it becomes manageable. Understanding the intricacies of tax filing, staying updated with the latest regulations, and leveraging the available technology can save time, reduce errors, and potentially increase your savings. As the deadlines for filing Income Tax Returns (ITR) approach, it’s crucial to stay organized and informed about the latest legal changes and platform updates.

Table of Contents

Schedule: Plan & Organize Your Tax Filing

Tax filing requires careful planning and timely execution. Organizing your tax filing process ahead of time can ensure that you meet all deadlines and avoid the last-minute rush. Start by reviewing your financial documents, including your Form 16, income statements, and investment proofs, as well as any other tax-related records. Organize these documents systematically, making sure you account for all income sources and eligible deductions. Planning your filing well in advance will give you the time to double-check everything for accuracy, reducing the chances of errors. Additionally, setting reminders for key dates, such as TDS updates and tax due dates, will ensure that you don’t miss any important deadlines.

Save: Maximize Your Tax Benefits

Maximizing your tax savings is crucial for effective financial planning, and understanding the various deductions and exemptions available can significantly reduce your overall tax liability. The Indian tax system offers numerous provisions that allow you to minimize your taxable income while making smart financial decisions. By taking advantage of these benefits, you can not only save on taxes but also boost your long-term wealth through tax-efficient investments. Here’s a deeper look at how you can maximize your tax benefits:

Key Deductions Under Popular Sections

India’s Income Tax Act offers several sections that allow you to claim deductions for specific expenses, investments, and contributions. These deductions lower your taxable income, which directly reduces the amount of tax you need to pay.

Section 80C: Section 80C is one of the most commonly used provisions for tax-saving. It allows a deduction of up to ₹1.5 lakh for investments in specified instruments. This section includes:

Public Provident Fund (PPF): A long-term investment option offering tax-free returns.

National Savings Certificates (NSC): A government-backed savings scheme with tax benefits.

Employees’ Provident Fund (EPF): Contributions to your EPF account qualify for deduction under this section.

Life Insurance Premiums: Premiums paid on life insurance policies for yourself, your spouse, or your children.

Tax-saving Fixed Deposits: Investments in 5-year fixed deposits with banks qualify for deduction.

Children’s Education Fees: Tuition fees for up to two children are eligible for deduction.

These investments not only provide tax relief but also help build long-term wealth.

Section 80D: This section allows you to claim deductions on premiums paid for health insurance. This is particularly important as it ensures both your health and your tax savings. The deductions are:

Health Insurance for Self and Family: You can claim a deduction of up to ₹25,000 for premiums paid for health insurance for yourself, your spouse, children, and parents. If the insured is a senior citizen, the limit increases to ₹50,000.

Health Insurance for Parents: An additional deduction of up to ₹25,000 can be claimed for insuring your parents. If they are senior citizens, this increases to ₹50,000.

Health insurance not only protects you and your family but also offers tax relief, which is why it’s advisable to review your health cover regularly to ensure you're maximizing this deduction.

Section 80G: Contributions to charitable organizations or funds can provide tax savings under Section 80G. Donations to registered trusts, NGOs, and other charity funds are eligible for deductions, which can be up to 100% or 50% of the amount donated, depending on the organization. These deductions are available for donations made to causes such as:

Educational Institutions: Donations to approved institutions

Scientific Research or Rural Development: Contributions to institutions involved in scientific research or rural development.

Political Parties: Donations to registered political parties can also qualify for deductions.

Making charitable contributions not only fulfills social responsibilities but also reduces your tax liability significantly.

Tax-Saving Instruments to Consider

In addition to the deductions available under specific sections, you can also invest in tax-saving instruments that grow your wealth while offering tax relief. These instruments help you reduce your taxable income while also providing returns on your investments:

Public Provident Fund (PPF): PPF is a popular long-term, risk-free investment option offering attractive interest rates and tax-free returns. Contributions to a PPF account are eligible for deduction under Section 80C, and the interest earned, as well as the maturity amount, is exempt from tax.

National Pension Scheme (NPS): NPS is an excellent tax-saving option for those looking to plan for retirement. Contributions to NPS qualify for deductions under Section 80C, as well as an additional deduction of ₹50,000 under Section 80CCD(1B), which is above the ₹1.5 lakh limit of Section 80C. The NPS offers the dual benefit of tax relief and retirement savings.

Equity-Linked Savings Scheme (ELSS): ELSS is a type of mutual fund that invests primarily in the stock market. These funds offer high growth potential over the long term and come with a three-year lock-in period. Contributions to ELSS qualify for tax deductions under Section 80C. While ELSS is a high-risk, high-return investment, it provides an opportunity to grow your wealth while reducing your tax burden.

National Savings Certificate (NSC): The NSC is a fixed-income investment scheme that provides a fixed return and qualifies for tax deduction under Section 80C. It is particularly suitable for individuals who prefer guaranteed returns along with tax savings.

Evaluating Your Financial Situation

To maximize your tax benefits, it’s essential to regularly evaluate your financial situation and review your tax-saving investments before filing your ITR. By strategically investing in tax-saving instruments and claiming the available deductions, you can optimize your tax planning. Additionally, keeping track of your health insurance premiums, donations to charity, and educational expenses ensures that you're fully utilizing the deductions available.

Planning for the Future

Maximizing your tax benefits doesn’t just stop at filing your returns. It’s important to plan your finances throughout the year to ensure that you’re not only saving taxes but also securing your financial future. By spreading your investments across various tax-saving instruments, balancing risk and return, and making the most of available deductions, you ensure both short-term savings and long-term wealth accumulation.

Tax-saving tools like PPF, NPS, and ELSS help in this dual goal. They reduce your taxable income now, while also building your financial portfolio for the future.

Solve: File, Comply & Resolve Tax Issues

Filing your Income Tax Return (ITR) accurately is just one part of the tax filing process, but ensuring that you remain compliant with tax laws is crucial to avoid penalties, scrutiny, and other legal complications. Tax filing is a responsibility that extends beyond simply filling out the necessary forms and submitting them before the due date. It also involves ensuring your filings are correct, up-to-date with the latest provisions, and aligned with current tax regulations. Failure to adhere to these requirements can lead to a variety of issues, including notices from the tax authorities, delays in receiving refunds, or worse, penalties.

In today’s digital age, utilizing online platforms such as TaxBuddy can significantly simplify the entire tax filing process. TaxBuddy is designed to ensure that your ITR is filed accurately, incorporating the latest updates in tax provisions and regulations. By using an online platform, you also have the benefit of guidance from tax experts who ensure that all relevant data is captured, deductions are accurately calculated, and the filing complies with the latest tax laws.

In case errors are made during the initial filing, revisions can be filed easily with platforms like TaxBuddy. The online system allows for straightforward corrections to be made, ensuring that your filing is updated and rectified. However, it is important to act quickly to resolve any mistakes, as failing to do so can complicate the process, potentially resulting in penalties or legal scrutiny. Taxpayers who submit their returns without verifying critical information, such as income sources, TDS credits, or exemptions, may later find themselves facing complications that could have been avoided with a more careful filing.

If discrepancies or errors arise after your return has been submitted, you may receive tax notices or inquiries from the Income Tax Department. Receiving such a notice can be a stressful experience for many taxpayers, but it's important to address these issues promptly. Delaying a response to a tax notice or failing to act on a discrepancy can escalate the problem, leading to additional penalties or audits. In such situations, platforms like TaxBuddy offer professional assistance to help you manage tax notices and resolve post-filing issues efficiently. They can guide you on how to respond to these notices, whether by filing a revised return or submitting additional documentation to support your filing.

By working with platforms like TaxBuddy, taxpayers can ensure that their tax filings are not only accurate but also compliant with the law. The ability to easily revise filings and access expert support for resolving discrepancies helps maintain peace of mind and ensures a smooth tax filing experience. Taking the time to file accurately and adhering to compliance guidelines will not only help avoid unnecessary delays in receiving refunds but also reduce the risk of facing penalties and other complications down the line. With the right tools and expert support, you can confidently navigate the tax filing process and resolve any post-filing issues without unnecessary stress or hassle.

Latest Legal Backdrop and TaxBuddy Updates

In the complex world of taxation, it is vital to stay up-to-date with the latest legal changes, as they directly impact compliance, filing requirements, and tax-saving opportunities. For the Financial Year 2024-25 (Assessment Year 2025-26), the Central Board of Direct Taxes (CBDT) has introduced significant updates to the Income Tax Return (ITR) forms and filing processes. These updates aim to improve transparency, accuracy, and ease of compliance, while also aligning the system with the latest tax regulations.

The CBDT has revamped ITR forms to ensure that taxpayers can file their returns with greater clarity. These revisions are designed to make the filing process more user-friendly and to reduce errors that could lead to delays or penalties. The forms have been tailored to accommodate changes in tax regulations, such as new provisions related to deductions, exemptions, and income reporting, ensuring that they align with the current tax laws and reforms.

Additionally, as the tax environment becomes more digitalized, the Income Tax Department’s e-filing platform has undergone several updates. These updates focus on enhancing the user experience, simplifying navigation, and reducing system glitches, which have often been a source of frustration for taxpayers. The platform has also been optimized for smoother integration with other government systems, such as the Goods and Services Tax (GST) portal and the TDS network, ensuring a more streamlined filing process.

Technological Advancements and Integration with Platforms Like TaxBuddy

With the aim of simplifying tax filing, platforms like TaxBuddy have integrated the latest ITR form updates and e-filing platform changes, offering users a seamless experience. TaxBuddy has incorporated these changes into its system, allowing taxpayers to file their returns smoothly while ensuring they remain fully compliant with the latest legal requirements. The platform’s AI-powered tools help minimize errors by providing automatic checks for common issues, such as mismatched TDS credits, incorrect deductions, or overlooked exemptions.

Moreover, TaxBuddy provides guidance throughout the filing process, making it easier for users to understand the nuances of new provisions and how they affect their tax situation. This ensures that taxpayers can make informed decisions about their filings, taking full advantage of available tax benefits while remaining compliant with new regulations. The platform's easy-to-use interface and personalized assistance also ensure that even users who are unfamiliar with the filing process can navigate it without confusion.

Understanding the Changes and Their Impact

For taxpayers, understanding the changes in ITR forms and the legal backdrop is crucial. The revised forms may require additional documentation, such as proof of income from foreign assets, new schedules to report income from digital platforms, and enhanced disclosures regarding tax-saving investments. These updates help the Income Tax Department better track and verify income and deductions, ensuring that taxpayers cannot claim deductions or exemptions they are not entitled to.

Taxpayers need to understand the implications of these changes and how they affect their filing process. Those who are well-versed in the filing procedure may find the new forms straightforward, but those less familiar with the tax process may require additional support, which platforms like TaxBuddy can provide. By offering a clear understanding of the legal updates and the platform’s improvements, taxpayers can avoid errors and delays in processing, ensuring timely refunds and compliance.

Conclusion

Tax filing may seem complex, but with proper planning, understanding the latest changes, and using the right tools, you can navigate the process with ease. Maximizing your tax benefits, organizing your documents, and ensuring compliance are all critical steps in ensuring a smooth filing process. Platforms like TaxBuddy provide the necessary tools and expertise to simplify your tax filing, resolve issues, and maximize your savings. By staying ahead of the deadlines and keeping your filings accurate, you can avoid penalties and ensure that you meet all requirements.

For anyone looking for assistance in tax filing, it is highly recommended to download the TaxBuddy mobile app for a simplified, secure, and hassle-free experience.

FAQs

Q1. What does the "Schedule" step in TaxBuddy's process entail? The "Schedule" step involves booking an appointment with a TaxBuddy expert. You can choose a convenient time to discuss your tax filing needs. Whether it’s through a call or a live chat, this step helps initiate the process of understanding your tax profile, including income, deductions, and exemptions. Scheduling allows TaxBuddy to personalize the experience and allocate the right expert for your needs.

Q2. How can I schedule a call with a TaxBuddy expert ? Scheduling a call with a TaxBuddy expert is simple. You can do it directly through the TaxBuddy website or mobile app. The platform allows you to pick a time that suits you, ensuring flexibility. Once scheduled, you will receive a confirmation along with all the details you need for the consultation.

Q3. What happens during the "Save" step in the TaxBuddy process? In the "Save" step, TaxBuddy experts guide you through claiming all eligible tax deductions and exemptions, optimizing your return. From 80C deductions to health insurance benefits under 80D, the experts ensure that no opportunity to save on taxes is overlooked. They also use AI to pre-fill your ITR, reducing the chances of manual errors that could affect your savings.

Q4. How does TaxBuddy ensure I save the maximum possible amount on my taxes? TaxBuddy ensures that you maximize your savings by carefully reviewing your financial documents and identifying all available deductions and exemptions. The experts also stay up-to-date with the latest amendments in the tax laws, ensuring that you're taking advantage of any new provisions that apply to you. Additionally, TaxBuddy’s AI system optimizes your ITR to ensure every potential saving is captured accurately.

Q5. What are some common tax-saving deductions that TaxBuddy helps me claim? TaxBuddy helps you claim several tax-saving deductions, including:

Section 80C: For investments in PPF, EPF, LIC, and ELSS.

Section 80D: For health insurance premiums.

Section 24(b): For home loan interest.

Section 10(14): For house rent allowance (HRA).

TaxBuddy ensures that all applicable deductions are claimed, reducing your taxable income and optimizing your overall tax liability.

Q6. How does the "Solve" step simplify my tax filing? The "Solve" step refers to TaxBuddy’s expert-driven process for resolving any discrepancies or complexities in your return. This step includes reviewing your drafted ITR, ensuring accuracy, and filing it on your behalf. If any issues arise—like a mismatch in TDS credits or questions about tax notices—TaxBuddy’s experts are available to provide solutions, ensuring that your filing is error-free and compliant with the Income Tax Act.

Q7. Can TaxBuddy help solve issues related to tax notices or audit concerns? Yes, TaxBuddy helps solve issues related to tax notices and audit concerns. If you receive a notice from the Income Tax Department or face issues with your filing, TaxBuddy provides expert guidance to address these matters. The platform offers post-filing support, including assistance with tax notices, revised returns, and audit preparations, ensuring peace of mind after filing.

Q8. How does TaxBuddy ensure my tax filing is fully compliant with the law? TaxBuddy ensures compliance by staying updated on the latest tax laws and amendments. The experts are well-versed in the Income Tax Act, ensuring that your filing adheres to the required regulations. The AI system also incorporates up-to-date compliance checks to ensure that every detail is correct before filing your return.

Q9. How does TaxBuddy use technology to simplify the filing process? TaxBuddy uses AI-driven technology to simplify the filing process. The AI auto-fills your ITR form by pulling data from your uploaded documents, such as Form 16, investment proofs, and bank statements. This reduces the manual effort involved and minimizes errors. Additionally, TaxBuddy integrates with the Income Tax Department’s e-filing portal, ensuring fast and accurate submission.

Q10. What makes TaxBuddy's 3-step process different from other tax filing platforms? TaxBuddy’s 3-step process—Schedule, Save, Solve—provides a more personalized and optimized experience compared to other platforms. It combines AI technology with expert guidance at every step, ensuring accuracy, tax savings, and quick resolution of any issues. This seamless blend of automation and expertise ensures that you’re not just filing taxes, but doing so with confidence and efficiency.

Q11. How long does the "Schedule, Save, Solve" process take from start to finish? The "Schedule, Save, Solve" process is designed to be quick and efficient. Scheduling your appointment is immediate, and once your call is scheduled, the entire process—from understanding your tax profile, maximizing savings, to filing your return—typically takes about 24 to 48 hours, depending on the complexity of your return. TaxBuddy’s experts work quickly while ensuring that everything is handled accurately.

Q12. How can I track the progress of my tax filing throughout the "Schedule, Save, Solve" process? TaxBuddy keeps you updated at every step of the process. After scheduling your call, you’ll receive updates on the progress of your return—whether it’s drafting, review, or filing. You can track the status through the TaxBuddy dashboard, where you’ll see live updates, including e-filing progress and any post-filing actions required. The platform ensures that you’re informed and in control throughout the entire process.

Comments