top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

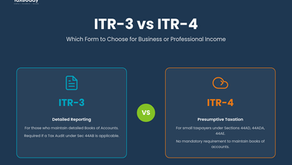

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 67 min read

Section 270A Penalty for Misreporting or Underreporting Income

Section 270A of the Income Tax Act, 1961, lays down penalties for taxpayers who fail to accurately report their income. Introduced through the Finance Act, 2016, this provision differentiates between underreporting—caused by errors or omissions—and misreporting, which involves deliberate concealment or falsification. The law imposes a penalty of 50% of the tax on underreported income and up to 200% for misreporting. With tighter digital monitoring through AIS and Form 26AS,

PRITI SIRDESHMUKH

Nov 58 min read

Section 142(1) Notice: Meaning, Reasons & How to Respond

A notice under Section 142(1) of the Income Tax Act, 1961, is sent by the Assessing Officer when additional information or documents are required before completing your income tax assessment. It may be issued whether a return has been filed or not, and is meant to verify income details, deductions, or transactions. Receiving this notice does not always imply an error or wrongdoing; it’s often a standard verification step to ensure accuracy and compliance with tax laws. Table

PRITI SIRDESHMUKH

Nov 59 min read

Section 148A Notice Explained: Reassessment and Response Process

Section 148A of the Income Tax Act, 1961, introduced through the Finance Act, 2021, redefined how reassessment proceedings are initiated by ensuring fairness, transparency, and accountability. Before issuing a reassessment notice under Section 148 , the Assessing Officer must conduct an inquiry, verify evidence, and offer the taxpayer an opportunity to respond. This change strengthens taxpayer protection, ensuring no reassessment is initiated arbitrarily and that income disc

PRITI SIRDESHMUKH

Nov 58 min read

How to Correct Unreported Income Reflected in AIS: Detailed Guide with Latest Updates

The Annual Information Statement (AIS) serves as a consolidated record of your income and financial transactions reported by employers, banks, and financial institutions. However, discrepancies like unreported income or incorrect TDS entries can disrupt your income tax return filing process. Correcting these issues before filing ensures accuracy, prevents penalties, and helps maintain compliance with the Income Tax Act, 1961. Filing accurate returns begins with ensuring tha

PRITI SIRDESHMUKH

Nov 510 min read

Step-by-Step Process to Submit AIS Feedback Online

The Annual Information Statement (AIS) is a detailed record of your financial transactions, including income, investments, and TDS details, reported to the Income Tax Department. Submitting accurate feedback on AIS ensures that your financial data is correctly reflected in your income tax records, minimising errors during return filing . The process can be completed easily online through the e-filing portal, where users can review, correct, and verify details in just a few s

PRITI SIRDESHMUKH

Nov 59 min read

How to Report Mutual Fund Redemptions and Capital Gains in ITR

Reporting mutual fund redemptions and capital gains correctly in an Income Tax Return (ITR) ensures compliance with the Indian Income Tax Act and prevents mismatch notices from the department. Each redemption—whether from equity, debt, or hybrid mutual funds—must be classified as short-term or long-term based on the holding period, and taxed accordingly. Gains are declared under Schedule CG, while dividends fall under income from other sources. With revised rules under Budget

Rajesh Kumar Kar

Nov 59 min read

Reporting Property Sale TDS in ITR: Buyer and Seller Guidelines

TDS on property sale under Section 194-IA ensures that tax is collected at the source during the sale of immovable property valued above ₹50 lakh. The buyer is responsible for deducting 1% TDS on the higher of the sale price or stamp duty value and depositing it with the government through Form 26QB. The seller, on the other hand, must ensure this TDS is reflected in Form 26AS to claim credit while filing the Income Tax Return . Understanding these obligations prevents mism

PRITI SIRDESHMUKH

Nov 410 min read

How to Report Capital Gains in ITR-2 (Schedule CG) Correctly

Reporting capital gains accurately in ITR-2 is critical for taxpayers who have sold assets like property, shares, or mutual funds. Even minor errors in Schedule CG can lead to defective return notices or delays in refund processing. ITR-2 is specifically designed for individuals and HUFs who earn income from capital gains but not from business or profession. The process involves identifying short-term and long-term gains, applying relevant exemptions, and ensuring precise re

PRITI SIRDESHMUKH

Nov 49 min read

Common Reasons Why Returns Are Declared Defective Under Section 139(9)

When an Income Tax Return (ITR) is filed with incomplete information, incorrect details, or without fulfilling mandatory requirements, it can be flagged as defective under Section 139(9) of the Income Tax Act, 1961. The notice is issued by the Assessing Officer (AO) to allow the taxpayer to rectify these errors within a specified period. Common reasons include wrong ITR form selection, missing schedules, mismatched income and TDS data, or non-submission of audit reports. Und

Rashmita Choudhary

Nov 49 min read

bottom of page