top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Tax Filing Apps in India 2025: Top Players Compared

Filing income tax returns in India has evolved into a largely digital experience, with multiple tax filing apps offering tailored solutions for diverse taxpayer needs in 2025. These apps simplify filing through automation, expert support, pre-filled forms, and mobile integration. TaxBuddy, a leading AI-powered platform, provides both self-filing and expert-assisted options, making it suitable for salaried individuals, freelancers, and business owners alike. Comparing featur

PRITI SIRDESHMUKH

Dec 3, 20258 min read

AI Bots vs Human Tax Experts – Which Should You Trust With Your ITR?

Filing Income Tax Returns in India demands precision, compliance, and up-to-date knowledge of the Income Tax Act, 1961. Taxpayers face a choice: rely on AI-powered bots for speed and automation or consult human tax experts for nuanced guidance and complex case handling. While AI bots efficiently handle simple returns and reduce manual errors, human professionals provide strategic advice, error detection, and post-filing support, especially for multiple income sources, capita

Nimisha Panda

Dec 3, 20258 min read

Top Tax-Saving Investments Under Section 80C in 2025

Tax-saving investments under Section 80C continue to be the foundation of smart financial planning for Indian taxpayers in 2025. With the deduction limit capped at ₹1.5 lakh, Section 80C covers a diverse mix of traditional savings and modern market-linked instruments. Each option not only helps reduce taxable income but also contributes to disciplined wealth creation. Understanding the key investment avenues under this section can help individuals choose instruments that mat

Rajesh Kumar Kar

Nov 20, 20259 min read

Complete List of Deductions Under Chapter VI-A

Chapter VI-A of the Income Tax Act, 1961 provides a structured way for taxpayers to reduce their taxable income through specific deductions. These deductions cover investments, insurance premiums, medical expenses, donations, and interest income, offering comprehensive relief under the old tax regime. The updated list for FY 2024-25 includes sections ranging from 80C to 80U , with limits designed to encourage financial discipline and savings. TaxBuddy simplifies this proces

Nimisha Panda

Nov 20, 202510 min read

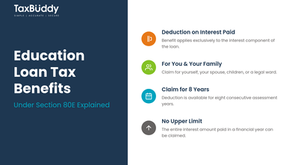

Education Loan Tax Benefits Under Section 80E Explained

Education loans not only make higher studies possible but also bring valuable tax relief through Section 80E of the Income Tax Act, 1961. This section allows individuals to claim a deduction on the interest paid on education loans for themselves, their spouse, children, or wards. The benefit applies exclusively to the interest component and can be claimed for up to eight consecutive years. There is no upper limit on the deduction, which means every rupee of interest paid red

PRITI SIRDESHMUKH

Nov 20, 20259 min read

Section 80U: Tax Benefits for Persons with Disabilities

Section 80U of the Income Tax Act, 1961, provides a fixed tax deduction to individuals certified as persons with disabilities. It is designed to ease financial strain by reducing taxable income, irrespective of medical expenses. The deduction applies to resident individuals who have at least 40% disability certified by a recognized authority. This benefit reflects the government’s intent to ensure inclusivity and financial support for differently-abled taxpayers through stra

Dipali Waghmode

Nov 12, 20259 min read

ESOP Taxation Explained: How to Report in ITR

Employee Stock Option Plans (ESOPs) are a popular way for companies to reward and retain employees by offering ownership in the business. However, these benefits come with tax implications at multiple stages. ESOP taxation in India occurs first when shares are allotted (perquisite tax) and again when they are sold (capital gains tax). Proper reporting in your Income Tax Return (ITR) is crucial to avoid errors, penalties, and scrutiny. Understanding how these taxes apply, how

Dipali Waghmode

Nov 12, 20259 min read

Section 87A Rebate 2025: Eligibility, Limit & Calculation

Section 87A of the Income Tax Act offers a direct rebate on tax liability for resident individuals whose taxable income falls below a specific threshold. For FY 2025-26 (AY 2026-27), the government has expanded this benefit, raising the new tax regime limit to ₹12 lakh and enhancing the maximum rebate to ₹60,000. This means many salaried and middle-income earners can now effectively pay zero income tax if their net taxable income is within the eligible range. The Section 87A

PRITI SIRDESHMUKH

Nov 10, 20259 min read

How to File Section 154 Rectification Request Online

Section 154 of the Income Tax Act, 1961, empowers taxpayers to correct apparent mistakes in their income tax assessments or intimation orders issued by the department. These errors are typically factual or computational and do not involve complex legal interpretations. The government’s e-filing portal now allows individuals to file rectification requests entirely online, making it simpler and faster to correct discrepancies such as mismatched TDS, wrong loss carry-forwards,

Rajesh Kumar Kar

Nov 4, 20259 min read

Which Tax Regime Is Best for First-Time Filers?

Choosing between the old and new tax regimes is often the first major decision for a new taxpayer in India. The new tax regime, now the default option from FY 2023-24 onwards, offers concessional rates and simplicity but fewer deductions, while the old regime provides multiple exemptions at higher slab rates. For FY 2025-26, the government has revised slabs, raised the basic exemption limit, and enhanced rebates under the new regime, making the choice more significant than e

Rashmita Choudhary

Oct 16, 20259 min read

bottom of page