top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Refund Received Twice by Error: How to Report and Return It

A duplicate income tax refund occurs when the Income Tax Department unintentionally credits the refund amount more than once because of technical delays, system errors, or bank-side processing issues. Since the extra amount is not treated as legitimate income under the Income Tax Act, it must be reported and returned immediately. Timely reporting protects the taxpayer from scrutiny, unnecessary notices, and avoidable legal consequences. Most duplicate refunds are resolved thr

Asharam Swain

Dec 19, 20258 min read

Filing ITR for Partnership Firms with Business Losses

Filing income tax returns is mandatory for every partnership firm, even when the business records a loss during the financial year. Indian tax laws treat partnership firms as separate taxable entities, requiring them to file ITR-5 each year, irrespective of profit, loss, or turnover. The return helps report business performance, claim deductions, comply with audit rules, and preserve the right to carry forward losses. Timely filing becomes especially important when losses occ

Dipali Waghmode

Dec 18, 20258 min read

How to File ITR with Dividend and Capital Gains Income

Filing an Income Tax Return that includes dividend income and capital gains requires selecting the correct ITR form and reporting each income category accurately. Dividend income from domestic companies is fully taxable, and capital gains from shares, mutual funds, and property must be declared under their respective schedules. Proper classification of short-term and long-term gains is essential to ensure correct tax calculation and avoid notice-driven corrections. With upda

Nimisha Panda

Dec 18, 20258 min read

Tax Calculation and Exemptions for Senior Citizens in 2025

Tax calculation for senior citizens in 2025 depends on age-based exemption limits, special deductions, and relaxed compliance rules designed to reduce tax liability and paperwork. Individuals aged 60 to 79 qualify as senior citizens, while those aged 80 or above fall under the super senior category. Their tax benefits include higher basic exemption limits, deductions on interest income, relaxed advance tax requirements, and health insurance benefits under Section 80D . Pensio

Asharam Swain

Dec 18, 20259 min read

Understanding Refund Adjustment Notices Under Section 245A

Refund adjustment notices under Section 245A are issued when the Income Tax Department intends to set off a taxpayer’s refund against outstanding tax dues from earlier years. These notices ensure that pending liabilities are cleared before a refund is released, making the adjustment process both efficient and legally compliant. Understanding why such a notice is issued, how adjustments are calculated, the role of accurate bank details, and the right way to respond can prevent

Nimisha Panda

Dec 18, 20258 min read

How to Update Communication Address in Your ITR Profile

Updating the communication address in an Income Tax profile is essential for ensuring every notice, refund update, and official correspondence reaches the correct location. The Income Tax Department sends critical updates through email, SMS, and postal communication, making it necessary for taxpayers to maintain accurate profile details on the e-filing portal. The update takes only a few minutes and prevents missed deadlines or compliance issues. The process follows a simple

Asharam Swain

Dec 17, 20259 min read

Are In-Kind Donations Eligible for Tax Deduction? Explained

In-kind donations, such as clothes, food, books, or other non-monetary goods, hold significant value for charitable organisations, but they do not qualify for tax deductions under Indian income tax law. Section 80G of the Income Tax Act allows deductions only for monetary contributions made through cash (up to ₹2,000), cheque, draft, or digital payment methods. Tax deductions require verifiable financial transactions, supported by valid receipts from approved charitable insti

Rajesh Kumar Kar

Dec 17, 20258 min read

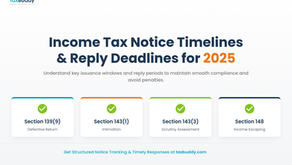

Income Tax Notice Timelines and Reply Deadlines for 2025

Income tax notices operate on specific statutory timelines, and understanding these timelines helps maintain smooth compliance throughout the 2025 cycle. Every notice issued by the Income Tax Department follows a defined window for issuance and a fixed reply period for taxpayers. These timelines depend on the type of assessment, the financial year involved, and the nature of discrepancies identified in the filed return. With the 2025 assessment cycle seeing structured updates

Rajesh Kumar Kar

Dec 17, 20259 min read

Filing ITR for Pension Income and Savings Account Interest in India

Filing an income tax return for pension income combined with savings account interest requires clarity on how these two income streams are taxed under the Income Tax Act for FY 2024-25. Pension is treated as salary income, while savings interest falls under income from other sources, and both must be reported accurately. Seniors can also access additional deductions such as Section 80TTB, which reduces taxable interest income. Selecting the correct ITR form, understanding ex

Nimisha Panda

Dec 17, 20259 min read

Can You Claim Rent Deduction Without Landlord’s PAN?

Rent deduction under House Rent Allowance (HRA) often hinges on one critical detail: the landlord’s PAN. Tax rules link HRA eligibility to proper documentation, and PAN becomes relevant when annual rent crosses a specific threshold. Most salaried individuals face confusion about when the PAN requirement applies, how to claim HRA without it, and what to do if the landlord does not hold a PAN or refuses to provide one. Clear guidelines exist within the Income Tax Act to help d

Dipali Waghmode

Dec 17, 20258 min read

bottom of page