top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

LTA Exemption Rules for FY 2024-25: Eligibility & Limits

Leave Travel Allowance (LTA) exemption for FY 2024-25 is available only to salaried employees opting for the old tax regime under Section 10(5) of the Income Tax Act, 1961. The exemption applies solely to travel within India and covers expenses incurred by the employee and eligible family members. It excludes accommodation, food, and other local costs. LTA can be claimed for up to two journeys in a four-year block, with the current block being 2022–2025. The claim amount is

Rajesh Kumar Kar

Nov 1011 min read

HRA Exemption vs 80GG Deduction: Which One to Claim?

House Rent Allowance (HRA) exemption and Section 80GG deduction are two separate tax benefits under the Indian Income Tax Act that reduce taxable income for individuals paying rent. While HRA exemption under Section 10(13A) is available only to salaried individuals receiving HRA as part of their salary, Section 80GG provides relief to those who pay rent but do not receive HRA, including self-employed individuals. Understanding the distinction between these two helps taxpayer

Nimisha Panda

Nov 79 min read

Section 80C vs 80CCD: Which Deduction Saves More Tax?

Section 80C and Section 80CCD are two of the most popular tax-saving provisions under the Income Tax Act, 1961. Both offer significant opportunities to lower taxable income, but their scope and eligibility differ. Section 80C focuses on diversified investments such as ELSS, PPF, and life insurance, while Section 80CCD encourages retirement savings through the National Pension System (NPS). The right choice depends on income level, employment type, and investment goals. Unde

Dipali Waghmode

Nov 710 min read

Section 24(b): Home Loan Interest Deduction Explained

Section 24(b) of the Income Tax Act, 1961 allows taxpayers to claim deductions on the interest paid for home loans taken to purchase, construct, repair, or renovate residential properties. It provides substantial relief for homeowners by reducing taxable income through interest deductions, subject to specific limits and eligibility conditions. For self-occupied houses, the maximum deduction is ₹2,00,000 per year, while for rented properties, there is no upper limit. This sec

Rajesh Kumar Kar

Nov 79 min read

Section 80EEA: Tax Benefit for First-Time Home Buyers

Section 80EEA of the Income Tax Act, 1961 provides an additional deduction of up to ₹1.5 lakh on home loan interest for first-time home buyers purchasing affordable housing. Introduced through the Finance Act, 2019, it extends beyond Section 24(b) benefits, encouraging residential ownership for middle-income earners. This provision supports the government’s “Housing for All” vision by making home loans more tax-efficient and promoting affordable housing among new buyers. Tab

Rashmita Choudhary

Nov 79 min read

How to Claim Section 80GG Deduction for Rent Paid Without HRA

Section 80GG of the Income Tax Act, 1961 allows taxpayers who do not receive House Rent Allowance (HRA) to claim a deduction for rent paid. This provision ensures that even those living in rented accommodations without HRA can avail tax relief, provided they meet the eligibility conditions. To claim the deduction, individuals must not own a residential property at their place of work, must pay rent for accommodation, and must file Form 10BA declaring rent details. Proper com

PRITI SIRDESHMUKH

Nov 79 min read

Presumptive Taxation Scheme Under Section 44ADA Explained

Section 44ADA of the Income Tax Act offers a simplified taxation route for professionals with annual receipts up to ₹75 lakh. It allows eligible individuals to declare 50% of their gross receipts as taxable income, eliminating the need for detailed expense records or complex bookkeeping. This scheme is especially beneficial for professionals like doctors, lawyers, architects, and consultants who seek ease of compliance and reduced administrative work. By adopting this scheme

Nimisha Panda

Nov 69 min read

ITR Filing Guide for Freelancers and Consultants in 2025

Freelancers and consultants are subject to income tax just like salaried individuals, but their income is treated as business or professional earnings under the Income Tax Act. With multiple income streams, TDS entries, and expense claims, filing taxes can be complex. The government’s emphasis on digital compliance and updated tax rules under Budget 2025 has made online filing platforms indispensable. AI-powered platforms like TaxBuddy simplify ITR filing for freelancers by

Nimisha Panda

Nov 69 min read

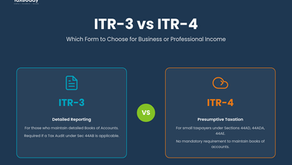

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 67 min read

Section 44AD vs 44ADA: Key Differences for Small Businesses & Professionals

Sections 44AD and 44ADA under the Income Tax Act, 1961, simplify tax filing for small businesses and professionals by allowing them to declare income on a presumptive basis rather than maintaining detailed books of accounts. These provisions encourage voluntary compliance and ease the financial reporting burden, especially for those with moderate annual receipts. Table of Contents Section 44AD: Simplified Tax Scheme for Small Businesses Section 44ADA: Presumptive Taxation

Rashmita Choudhary

Nov 69 min read

bottom of page