top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Section 194J: TDS on Professional Fees Explained

Section 194J of the Income Tax Act, 1961, mandates the deduction of tax at source (TDS) on payments made for professional and technical services, royalties, and director remuneration. The provision ensures timely tax collection from service-based income such as legal, medical, accountancy, and consultancy fees. Applicable to both individuals and businesses, this section plays a vital role in maintaining transparency and compliance in professional transactions. It is essential

PRITI SIRDESHMUKH

Nov 10, 20259 min read

How to Report Rental Income and Claim Deductions in ITR: Detailed Guide for Indian Taxpayers

Rental income in India is taxable under the head “Income from House Property” as defined by the Income Tax Act, 1961. To ensure compliance and minimize tax liability, it’s crucial to report it accurately in your Income Tax Return (ITR). Misreporting or ignoring this income can invite penalties and scrutiny. With recent updates under Budget 2025, taxpayers can claim deductions for municipal taxes, standard deductions, and home loan interest to optimize taxes efficiently. Platf

PRITI SIRDESHMUKH

Nov 10, 20259 min read

How to Set Off Loss from House Property Against Other Income

Loss from house property is a common scenario for taxpayers with home loans or multiple properties, especially when the interest payable exceeds rental income. The Income Tax Act, 1961 allows taxpayers to set off such losses against other heads of income, reducing the overall tax burden. However, the extent of this adjustment depends on the tax regime chosen and the nature of the income involved. With updates in the Income Tax Bill 2025, the rules for set-off and carry-forwar

Rashmita Choudhary

Nov 10, 202511 min read

Section 87A Rebate 2025: Eligibility, Limit & Calculation

Section 87A of the Income Tax Act offers a direct rebate on tax liability for resident individuals whose taxable income falls below a specific threshold. For FY 2025-26 (AY 2026-27), the government has expanded this benefit, raising the new tax regime limit to ₹12 lakh and enhancing the maximum rebate to ₹60,000. This means many salaried and middle-income earners can now effectively pay zero income tax if their net taxable income is within the eligible range. The Section 87A

PRITI SIRDESHMUKH

Nov 10, 20259 min read

How to Report Minor Child’s Income in Your ITR

Under Indian tax laws, a minor child’s income must be reported following specific provisions of the Income Tax Act, 1961. Section 64(1A) requires that any income earned or accrued in a minor’s name—such as interest, dividends, or investment returns—be “clubbed” with the income of one of the parents, typically the one with a higher income. This ensures accurate tax reporting and prevents misuse of exemptions. However, the Act also provides exceptions for income earned by a min

PRITI SIRDESHMUKH

Nov 7, 20259 min read

How to Claim Section 80GG Deduction for Rent Paid Without HRA

Section 80GG of the Income Tax Act, 1961 allows taxpayers who do not receive House Rent Allowance (HRA) to claim a deduction for rent paid. This provision ensures that even those living in rented accommodations without HRA can avail tax relief, provided they meet the eligibility conditions. To claim the deduction, individuals must not own a residential property at their place of work, must pay rent for accommodation, and must file Form 10BA declaring rent details. Proper com

PRITI SIRDESHMUKH

Nov 7, 20259 min read

ITR Filing Guide for Freelancers and Consultants in 2025

Freelancers and consultants are subject to income tax just like salaried individuals, but their income is treated as business or professional earnings under the Income Tax Act. With multiple income streams, TDS entries, and expense claims, filing taxes can be complex. The government’s emphasis on digital compliance and updated tax rules under Budget 2025 has made online filing platforms indispensable. AI-powered platforms like TaxBuddy simplify ITR filing for freelancers by

Nimisha Panda

Nov 6, 20259 min read

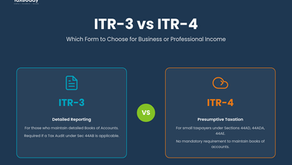

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 6, 20257 min read

Section 44AD vs 44ADA: Key Differences for Small Businesses & Professionals

Sections 44AD and 44ADA under the Income Tax Act, 1961, simplify tax filing for small businesses and professionals by allowing them to declare income on a presumptive basis rather than maintaining detailed books of accounts. These provisions encourage voluntary compliance and ease the financial reporting burden, especially for those with moderate annual receipts. Table of Contents Section 44AD: Simplified Tax Scheme for Small Businesses Section 44ADA: Presumptive Taxation

Rashmita Choudhary

Nov 6, 20259 min read

Section 270A Penalty for Misreporting or Underreporting Income

Section 270A of the Income Tax Act, 1961, lays down penalties for taxpayers who fail to accurately report their income. Introduced through the Finance Act, 2016, this provision differentiates between underreporting—caused by errors or omissions—and misreporting, which involves deliberate concealment or falsification. The law imposes a penalty of 50% of the tax on underreported income and up to 200% for misreporting. With tighter digital monitoring through AIS and Form 26AS,

PRITI SIRDESHMUKH

Nov 5, 20258 min read

bottom of page