TaxBuddy vs ClearTax: Comparing Best ITR Filing Platform in 2025

- Simran Sahni

- Jan 2

- 15 min read

Updated: 12 hours ago

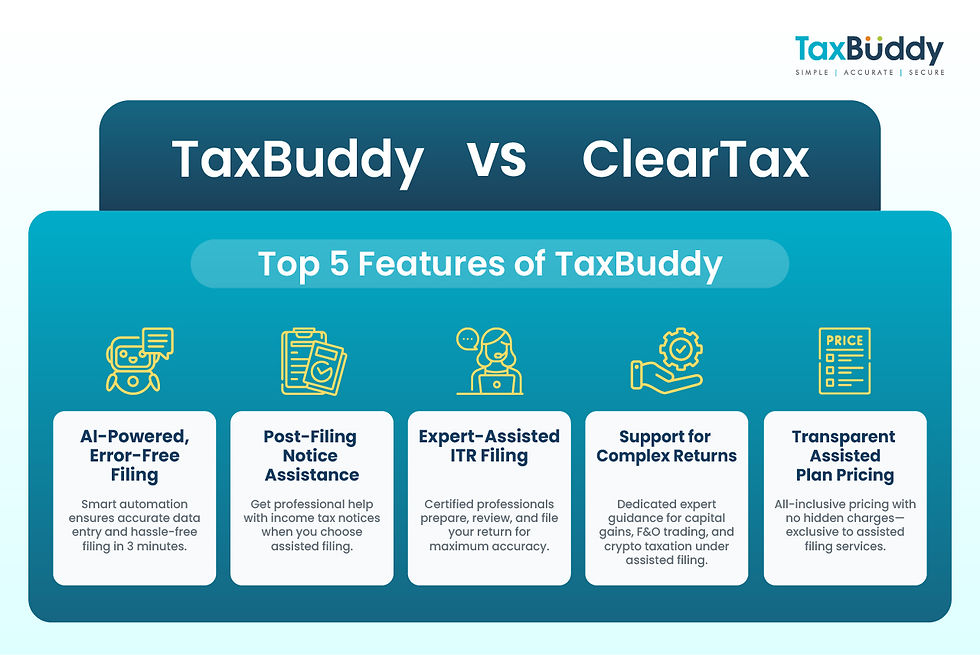

TaxBuddy is a well-known AI-powered Income Tax Filing platform that offers both DIY (Do-IT-Yourself) filing and expert-assisted ITR filing. It help you upload the documents, pick the right ITR form, and file your ITR faster than any other online platform.

You can file ITR through TaxBuddy mobile app or even via WhatsApp, making it one of the most accessible tax-filing tools in India. The AI system simplifies every step: from data extraction to form selection, ensuring seamless experience for salaried individuals, professionals, and NRIs.

TaxBuddy works well for people who want to file ITR through DIY, but also need stronger expert backing, especially when the return is complex with multiple Form 16s, capital gains, F&O trading, crypto income, or NRI filing. So, the real question is not 'which online platform is better for everyone'. It is 'which platform fits in your tax situation better'. Let's now compare TaxBuddy vs ClearTax in pricing, AI automation, expert support, and post-filing assistance, so that you can choose the best ITR filing platform for 2025.

Table of Contents

DIY vs Expert-assisted Filing Comparison: TaxBuddy vs ClearTax

Best ITR Filing Platform for Salaried Individuals in 2025: TaxBuddy vs ClearTax?

Post-Filing Support Comparison: Why TaxBuddy Scores Higher in Customer Trust

TaxBuddy vs ClearTax: Pricing Plans Comparison (Updated for 2025)

Handling Complex ITRs? Which platform is better for Crypto or F&O traders?

Income Tax Notice Handling Support

Which Platform Offers More Value in 2025? TaxBuddy or ClearTax

ITR Filing Due Date Extension 2025

The Income Tax Return (ITR) filing due date for FY 2024-2025 (AY 2025-2026) has been extended once again. Originally scheduled for 31 July 2025, the deadline was first postponed to 15 September 2025 and then extended by one more day because of technical glitches and heavy traffic on the Income Tax e-Filing portal.

Feature-by-Feature Comparison of TaxBuddy vs ClearTax

Here’s a feature-by-feature comparison to help you decide:

Feature | TaxBuddy | ClearTax |

Google Reviews | 16,600+ reviews | 1,955 reviews |

Google Ratings | ⭐ 4.9 / 5 | ⭐ 4.7 / 5 |

App Installs (Play Store) | 10 Lakh+ | 5 Lakh+ |

Response & Support Speed | ⏱️ ~30 minutes | ⏱️ ~1 hour |

Free Tax Notice Support | ✅ Included with expert assisted filing | ❌ Not included |

ITR Filing & Tax Planning | ✅ AI-powered Self-filing & Expert assisted filing | ✅ Self-guided or paid expert help |

Notice Management & Appeal Service | ✅ Available | ❌ Limited |

GST & TDS Filing | ✅ Available | ✅ Available |

Accounting & Bookkeeping | ✅ Available | ❌ Not available |

Tax Calculators | ✅ Integrated with ITR filing | ✅ Available |

PF Withdrawal Assistance | ✅ Available | ❌ Not available |

HUF Filing Support | ✅ Available | ❌ Not available |

Virtual CFO | ✅ Available | ❌ Limited |

DIY vs Expert-assisted Filing Comparison: TaxBuddy vs ClearTax

Both TaxBuddy and ClearTax offer online ITR filing options for 2025, but the experience differs depending on whether you choose DIY (do-it-yourself) or expert-assisted filing.

Here is how two platforms compare across automation, accuracy, and post-filing support:

DIY Product Features Comparison

Features | TaxBuddy | ClearTax |

Auto Tax Regime Selection | ✔️ Yes | ✔️ Yes |

Auto ITR Form Selection | ✔️ Yes | ✔️ Yes |

Comprehensive Tax Analysis | ✔️ Yes | Limited |

Multiple Form 16 Upload & Parsing | ✔️ Yes | ✔️ Yes |

Parse annexure for Salary Break-up | ✔️ Yes | ✔️ Yes |

Capital Gains Data Integrations | ✔️ Yes | ✔️ Yes |

Mutual Funds Data Integration | ✔️ Yes | ✔️ Yes |

Crypto/VDA Asset Reporting | ✔️ Yes | ✔️ Yes |

Property Income & Capital Gains Reporting | ✔️ Yes | ✔️ Yes |

Section 54 Capital Gains Exemption | ✔️ Yes | ✔️ Yes |

Gaming and Lottery Income Reporting | ✔️ Yes | ✔️ Yes |

Prefilled Freelance & Business Income | ✔️ Yes | ✔️ Yes |

Loss Carry-Forward Support | ✔️ Yes | ✔️ Yes |

24×7 Chat Support | ✔️ Yes | Limited |

Free Notice Management | Available in expert-assisted filing | Not clearly specified |

Expert-assisted Features Comparison

Features | TaxBuddy | ClearTax |

Customer Reach | PAN India + Abroad | Indian users only |

Tax Expert Network Spread | PAN India | Bengaluru |

Experience in Years | 9+ Years | 14+ Years |

24-Hour ITR Filing | ✔️ Yes | Not clearly specified |

Dedicated Tax Expert | Not Available | Only on high-end premium plans |

Real-Time Support | Chat or Call with Tax Expert | Limited |

Updated Return (ITR-U) Assistance | ✔️ Yes | Not clearly specified |

Tax Advisory | ✔️ Yes | ✔️ Yes |

Revised Return Filing Support | ✔️ Yes | ✔️ Yes |

Tax Insights & Analysis | ✔️ Yes | ✔️ Yes |

Data Privacy & Security | ✔️ Yes | ✔️ Yes |

Flexible Document Collection | ✔️ Yes | ✔️ Yes |

Customized ITR Solutions | ✔️ Yes | ✔️ Yes |

Support Email | Not clearly specified |

Best ITR Filing Platform for Salaried Individuals in 2025: TaxBuddy vs ClearTax?

For salaried individuals, the ideal ITR platform should make Form 16 upload effortless, auto-fill key details accurately, and offer quick help if needed during filing.

TaxBuddy’s AI reads Form 16 and automatically fills salary income, TDS, employer details, and common deductions like HRA, LTA, and Section 80C investments. This reduces manual entry and lowers the risk of errors. It also handles multiple Form 16s smoothly and allows filing even without Form 16 by letting users enter income details with supporting proofs.

ClearTax also supports Form 16 upload, but it generally requires more manual verification and additional inputs from the user, especially in slightly detailed salary cases.

Post-Filing Support Comparison: Why TaxBuddy Scores Higher in Customer Trust

Post-filing assistance often determines whether an ITR platform is truly reliable. While filing accuracy is important, the real test starts after filing is completed. When issues such as delays, TDS mismatches, or notices under Section 143(1) arise. Here is how both platform handle post-filing support in 2025.

TaxBuddy’s Approach to Support

TaxBuddy is primarily built on an expert-assisted filing model. If a user subscribes to an expert-assisted filing plan, he will be connected to a qualified tax expert who will file income tax return from start to finish. Following is the process:

Dedicated point-of-contact (unlike ticketing system over other filing platforms).

Direct call, email, and chat support over WhatsApp also.

Post-filing assistance: Notice is handled free of cost.

Therefore, even after filing the return, TaxBuddy continues to provide support with Form 26AS mismatches, demand notices under Section 143(1), and delay in refunds. Thus, the TaxBuddy’s platform assures that the support is proactive rather than reactive.

ClearTax’s Approach to Support

ClearTax can suit those users who are comfortable with filing their own ITR with limited or no support.

TaxBuddy vs ClearTax: Pricing Plans Comparison (Updated for 2025)

Selecting the right tax filing platform is not just about features and support, it is also about who is providing transparent and fair pricing. Below is a detailed comparison of the latest 2025 self-filing and expert-assisted income tax filing plans of TaxBuddy and ClearTax.

Self-Filing Plans: TaxBuddy vs ClearTax

Income Type / Profile | TaxBuddy (DIY Plan) | ClearTax (DIY Plan) |

Salary + 1 House Property | ₹699/year | - |

Salary + Multiple House Properties | ₹799/year | - |

Business / Professional Income | ₹1,599/year | - |

Capital Gains (Indian) | ₹1,999/year | - |

Capital Gains (Foreign + Indian) | ₹1,999/year | - |

Salary Income Plan | - | ₹424 - ₹2,373 |

Capital Gains or Rental Income Plan | - | ₹10,17 - ₹3,136 |

NRI or Foreign Income Plan | - | ₹2,118 - ₹3,390 |

F&O / Speculative Income | ₹2,999/year | NA |

Crypto Income | ₹2,999/year | NA |

NRI / Foreign Income | NA | NA |

Form 16 Upload + Auto-fill | Yes | Yes |

Post-filing Notice Assistance | ❌ Not included | ❌ Not included |

Upgrade to Expert Help | Yes (at any time) | Yes |

The prices are exclusive of taxes. TaxBuddy offers more features under each type of plan.

Expert-Assisted Filing Plans: ClearTax vs TaxBuddy

Income Type / Profile | TaxBuddy (Assisted Plan) | ClearTax (Assisted Plan) |

Salary + 1 House Property | ₹999/year | - |

Salary + Multiple Properties | ₹1,099/year | - |

Business / Professional Income | ₹2,499/year | - |

Capital Gains (Stocks/Property) | ₹2,999/year | - |

F&O / Intraday Trading | ₹4,499/year | - |

Crypto Income | ₹4,499/year | - |

Basic Plan (Salary below ₹50 Lakhs) | - | ₹2,849/year |

Premium Plan (Salary above ₹50 Lakhs, Capital Gains & Freelancing Income less than ₹50 Lakhs) | - | ₹5,199/year |

Foreign Income and Freelancing Income above ₹50 Lakhs | - | ₹7,499/year |

NRI with Indian Income | ₹4,499/year | ₹7,499/year |

Resident with Foreign Income | ₹7,499/year | ₹7,499/year |

Audit (Balance Sheet + P&L) | ₹1,000 extra | Not included in base plan |

RSU / ESOP / DTAA Filing | Included in NRI and Foreign Income Plans | Only in higher-end plans |

Post-Filing Notice Assistance | Included in all assisted plans | Not clearly mentioned |

Form 16 Auto-fill (AI-enabled) | Included | Included |

Handling Complex ITRs? Which platform is better for Crypto or F&O traders?

When you come across complex tax situations, whether you are dealing with capital gains, F&O trading, foreign income, or crypto investments, having the right platform to support you is important. Both TaxBuddy and ClearTax offer powerful tools for ITR filing, but each excels in different areas when it comes to dealing with complex income tax filings.

TaxBuddy: Handling Complex ITRs with Expert Assistance

TaxBuddy excels when it comes to extensive support for complex tax situations. The following are the reasons:

Expert-Assisted Filing: For complex cases like capital gains, F&O trading, cryptocurrency, or foreign income, TaxBuddy’s expert-assisted filing provides dedicated CA support throughout the process.

AI-Powered Automation: TaxBuddy uses AI technology to simplify extraction of data from forms like Form 16. The AI also helps auto-filling of forms for capital gains or stock investments. This ensures accuracy and efficiency.

End-to-End Filing with Post-Filing Support: Unlike ClearTax, TaxBuddy offers complete post-filing support. This includes assistance with income tax notices, tax mismatches under Section 143(1) and so on. Thus, TaxBuddy is a solid choice of taxpayers for complex tax situations.

Multi-Source Income Integration: Whether you have multiple Form 16s, capital gains, F&O trading, or crypto income, TaxBuddy integrates all the types of incomes into a single plan. Thus, making the filing process simple and accurate.

ClearTax: Handling Complex ITRs with Expertise

ClearTax also provides options for handling complex tax filings, but with some limitations:

Separate Plans for Different Types of Income: ClearTax offers separate plans based on income categories such as capital gains, F&O trading, crypto, and so on. This makes it difficult for users with multiple sources of income to distinguish between the best plan. Moreover, the premium pricing varies with the difficulty involved.

Self Filing Tools: If you are a pro in managing your taxes and also filing them, ClearTax offers DIY tools. Through this you can file your capital gains, self-employed income, and so on.

Post-Filing Support: Though ClearTax offers expert help, it is not as detailed or as easily available as TaxBuddy’s. If you are opting for capital gains, F&O trading, or crypto income plan, ClearTax’s assistance is often available only in premium plans.

Income Tax Notice Handling Support

Taxpayers relax after filing the ITR. However, they become worried upon receiving an income tax notice. Handling such notices is an important aspect of the ITR filing process. The level of support taxpayers receive while handling the IT notices is what differentiates everything.

TaxBuddy's Tax Notice Support

TaxBuddy offers substantive post-filing support. If taxpayers receive income tax notice after filing ITR through their platform, they provide free support. They provide free assistance to taxpayers in replying to Section 143(1) notices or any other discrepancies flagged by the Income Tax Department. This support includes:

Tax expert’s support on how to respond to notices.

Notice replies from qualified CAs.

Support in filing revised returns or rectifications.

Thus, the above aspects makes TaxBuddy an ideal choice for those who want peace of mind during the entire tax filing process.

ClearTax's Tax Notice Support

On the other hand, ClearTax does not include post-filing notice support in their plans. If you receive a notice after filing, you have to manage yourself or upgrade to more premium plans of ClearTax.

The lack of integrated post-filing support is a limitation of ClearTax for users who may need additional help to handle notices or discrepancies.

Which Platform Offers More Value in 2025? TaxBuddy or ClearTax

While choosing the platform that offers more value to the users, there are factors that influence this decision. Such factors include: support, pricing, and the range of services available through the platform while filing.

TaxBuddy’s Value Proposition

Comprehensive services: With AI-powered automation, TaxBuddy offers expert assistance, post-filing support, and managing complex income types (e.g., capital gains, F&O trading, crypto).

Fixed pricing: All-inclusive pricing ensures you are not surprised with hidden charges for premium features or post-filing support. It is pertinent to note, that the prices are exclusive of taxes only.

Value for complex returns: If a taxpayer has multiple sources of income, or you are expecting issues such as tax notices or mismatches, TaxBuddy is of more value with its end-to-end support.

ClearTax’s Value Proposition

Affordable entry: ClearTax offers competitive pricing for basic filings. It is a good choice for simple IT returns (ITR-1 or salary income).

Add-on flexibility: ClearTax offers tiered pricing serving different needs. However, these get costly if you need assistance for capital gains, trading income, or post-filing support.

DIY Option: ClearTax is ideal for users comfortable with DIY filing and who don’t need support while filing ITR.

Scenario Comparison of TaxBuddy vs ClearTax

Here’s a scenario comparison to help you decide which platform is better:

If you are… | Better pick | Why |

Salary only, simple deductions | ClearTax | Clean DIY flow if you are comfortable self-checking |

Salary + multiple Form 16s | TaxBuddy | Faster document parsing + assisted support if needed |

Freelancer or professional income | TaxBuddy | Better guided checks + easier escalation to expert review |

Capital gains across multiple sources | TaxBuddy | Stronger support + fewer chances of mismatch issues |

F&O / intraday income | TaxBuddy | Better handling of trading complexity with expert-backed filing |

NRI or foreign income | TaxBuddy | More end-to-end help for tricky reporting |

You want post-filing peace of mind | TaxBuddy | Notice support is a bigger focus in expert assisted filing plans |

User FAQs on TaxBuddy's ITR Filing Services

Q1. Who owns TaxBuddy?

TaxBuddy is owned and operated by SSBA Innovations Ltd.. It is a Mumbai-based fintech company. The platform was founded in 2017 by Samir Jayaswal, Sujit Bangar, Sanjay Godbole, Srinivas Reddy, and Brijmohan Lavaniya.

Q2. Can I file ITR using the TaxBuddy mobile app?

Yes, you can file your Income Tax Return (ITR) using the TaxBuddy mobile app. The app allows you to upload documents, track your filing status, and file your return directly from your smartphone, making the process easier and more accessible. The app is available for both Android and iOS users, providing a seamless filing experience regardless of your device preference.

Q3. Is TaxBuddy free to use?

TaxBuddy lets you start with basic self-filing plan at a low entry price. If your return includes capital gains, business income, crypto, F&O, or NRI income, you usually will need a higher plan or expert-assisted filing.

Q4. How much does TaxBuddy charge?

TaxBuddy’s charges depend on the plan you choose:

DIY filing: Low-cost for basic returns. Starts at around ₹699

Expert-assisted filing: Starts at around ₹999 and increases for complex returns involving capital gains, F&O, crypto, or NRI income. All expert-assisted plans include preparation, review, e-filing, and post-filing support such as notice handling.

Q5. Is Tax2Win better than TaxBuddy?

TaxBuddy is often preferred by those who need AI-driven accuracy, expert assistance, and post-filing notice handling. The better option depends on whether your priority is affordability or comprehensive support.

Q6. Which tax app is cheaper in 2025?

TaxBuddy’s DIY option is cost-effective, while expert-assisted plans may cost little but include value-added services like expert review and notice handling, making it cost-efficient for complex cases.

Q7. What support is included in TaxBuddy’s expert-assisted filing plan?

TaxBuddy offers a range of support options, including in-app assistance, WhatsApp chat, and expert help for any tax-related questions. Whether you're dealing with a tax notice, need clarification on a deduction, or want to track your refund status, TaxBuddy's expert team is ready to assist. For personalized advice or questions regarding specific documents, you can reach out to support@taxbuddy.com or call +91 9321908755 for direct assistance.

Q8. How does TaxBuddy work?

Using TaxBuddy is simple:

Sign up on the website or download the mobile app.

Upload your Form 16 or income details.

The AI system auto-fills your return.

Choose between DIY filing or expert-assisted filing.

Experts review, file, and submit your ITR directly to the Income Tax Department.

Post-filing, you also get notice assistance (if filed via expert assisted option) for complete peace of mind.

Q9. How does TaxBuddy’s AI-assisted tax filing work?

TaxBuddy's AI-assisted tax filing streamlines the process by automatically pulling data from your PAN, Form 16, and other documents, ensuring accuracy and minimizing manual effort. The AI selects the correct ITR form, fills in your salary and TDS details, and allows you to file your return directly through WhatsApp or the TaxBuddy mobile app. This makes the filing process quick, convenient, and completely hassle-free.

Q10. Where can I follow TaxBuddy on social media for the latest tax updates?

You can follow them on all the major social media platforms where they regularly share timely updates, filing tips, and expert advice. Their goal is to help both individuals and businesses stay compliant and informed. Here’s where you’ll find them:

X (Twitter): TaxBuddy.com

Instagram: taxbuddy_official

Facebook: TaxBuddy.com

LinkedIn: TaxBuddy.com

Q11. Can I ask tax-related questions on TaxBuddy’s social media platforms?

Yes, TaxBuddy does respond to questions posted in comments or through direct messages, especially for common queries. However, if you need personalized advice or have questions about specific documents, it’s best to reach out to their support team at support@taxbuddy.com or +91 9321908755.

Q12. What is the best alternative to ClearTax?

TaxBuddy is one of the best options for filing your income tax online. It's platform is AI-powered and expert help to make tax filing simple, accurate, and stress-free. Whether you’re a salaried person, freelancer, NRI, or business owner, TaxBuddy makes the process easy to manage. While platforms like Quicko, myITreturn, and Tax2win are also an option, TaxBuddy stands out with its personalized assistance, error-free filing, and easy-to-use mobile app that makes tax filing simple and quick for everyone.

Q13. How good is TaxBuddy?

TaxBuddy gets high marks for combining AI-driven automation, expert review, and post-filing support (including notice assistance) into its plans. If you value having someone look over your return, and support after submitting, TaxBuddy is a solid choice. For users who want minimal effort and maximum protection, TaxBuddy should be chosen.

Q14. Which is the best AI for ITR filing?

TaxBuddy emphasizes its AI-driven features: automatic data import, mismatch detection, suggesting correct ITR forms, and flagging notices after filing. While ClearTax also uses automation, TaxBuddy’s narrative highlights stronger post-filing support and AI assistance for more complex cases. So if you mean “best AI for ITR” in the sense of high automation + accuracy + support, TaxBuddy leads in that conversation.

Should You Choose ClearTax or TaxBuddy in 2025?

Though the ITR can be filed through the e-filing portal of the Income Tax also, it is not very easy to understand. Choosing between TaxBuddy and ClearTax comes down to two things: how complex your ITR is and whether you need expert help after filing.

TaxBuddy – Pros: Assisted expert help, bundled notice support, better value for complex returns. Cons: DIY plan doesn’t include notices.

ClearTax – Pros: Easy DIY for simple returns.

Cons: Notice help and complex cases often require costlier add-ons.

Who Should Choose What?

Choose ClearTax if you want a low-cost DIY filing for simple salary income and prefer to handle issues yourself.

Choose TaxBuddy if you have capital gains, F&O/crypto, foreign income, multiple Form-16s, or you want expert review + post-filing notice help with assisted plans.

Conclusion

TaxBuddy stands out as a versatile income tax filing platform designed to cater to a wide range of income scenarios and complexity levels. Whether you are a salaried employee managing investments or a freelancer with multiple capital gains, TaxBuddy delivers a streamlined filing experience.

Additionally, if you find yourself unsure in managing your tax returns, TaxBuddy ensures support is at hand with access to dedicated tax experts who can guide you from start to finish. Beyond filing support, TaxBuddy enriches your tax knowledge through the TaxBuddy Academy, which offers certified courses on Income Tax, GST, and more, as well as through a wealth of informative blogs and articles on a variety of direct and indirect tax topics. Moreover, the informative videos are shared over TaxBuddy's YouTube channel as well.

FAQs

Q1. Which platform is better for salaried individuals: TaxBuddy or ClearTax?

TaxBuddy is a solid choice for salaried individuals with multiple deductions or multiple Form 16s. Its AI-powered Form 16 parsing and expert assistance make it ideal for hassle-free filing. ClearTax works well for simpler filings but requires manual verification for complex scenarios.

Q2. Is TaxBuddy really AI-powered?

Yes, TaxBuddy uses AI technology to automate the extraction of data from Form 16 and other documents. This helps in minimizing manual errors and speeds up the filing process.

Q3. How much does TaxBuddy cost for self-filing?

TaxBuddy offers affordable self-filing plans starting at ₹699 per year for salaried individuals with one house property. Pricing increases based on the complexity of the return (e.g., multiple properties, capital gains, and so on).

Q4. Does ClearTax offer post-filing support?

No, ClearTax does not provide post-filing support in its paid plans. For assistance with notices or income mismatches, users would need to upgrade to a higher plan.

Q5. How does TaxBuddy handle complex tax scenarios like F&O trading or capital gains?

TaxBuddy provides expert assistance for complex tax filings, including F&O trading, capital gains, and cryptocurrency income. It includes tax expert’s review, and post-filing notice handling, ensuring accuracy and compliance.

Q6. Does TaxBuddy offer better pricing for NRI tax filing?

Yes, TaxBuddy is very affordable for NRI tax filing. Starting at ₹4,499/year for all NRI-related income types. It also includes post-filing support for notices, which ClearTax does not.

Q7. Is it easier to file taxes with ClearTax or TaxBuddy?

ClearTax offers a user-friendly DIY filing experience, ideal for simple returns. However, if you have more complex income or need post-filing assistance, TaxBuddy is a solid choice due to its expert assistance and AI tools.

Q8. Can I switch from ClearTax to TaxBuddy if I need more support?

Yes, you can always upgrade to TaxBuddy if you need expert assistance or more comprehensive support for complex income sources like capital gains or foreign income.

Q9. How does TaxBuddy help with tax notices?

TaxBuddy offers post-filing support for users who receive a tax notice. This includes expert assistance, drafting replies, and guidance on rectifications, which is not available with ClearTax unless you purchase premium add-ons.

Q10. What is the price difference between ClearTax and TaxBuddy for capital gains filing?

TaxBuddy charges ₹2,999/year for assisted plan. Whereas, ClearTax charges anywhere between ₹3,136 to ₹5,199/year for similar assistance.

Q11. Which platform is better for cryptocurrency tax filing?

Both TaxBuddy and ClearTax offer plans for cryptocurrency tax filing, but TaxBuddy is more affordable at ₹4,499/year and includes post-filing support for discrepancies. Thus, TaxBuddy is a better choice for cryptocurrency investors.

Q12. How can TaxBuddy help me in managing my taxes?

TaxBuddy will help in complete tax management, right from making you understand what is tax, to calculating the dues for your income, to filing returns online for compliance, and maximizing your tax savings.

Q13. How does TaxBuddy assist in GST compliance?

TaxBuddy extends services relating to obtaining GST number, filing of returns, and reconciliation to avoid penalties under the GST laws.

Q14. How can TaxBuddy assist with AIS-related queries?

TaxBuddy offers services for retrieving your AIS password and explaining to you the details of your financial transactions recorded in AIS to help in correct tax reporting and planning.

Q15. How does TaxBuddy assist in Form 16?

TaxBuddy will aid in analyzing the details in Form 16 for ensuring a correct tax credit claim and smoother filing of tax returns.

Q16. How does TaxBuddy assist with TDS compliance under Section 194Q?

TaxBuddy provides calculation and accurate deduction of TDS under Section 194Q to help businesses efficiently manage their taxation liabilities and avoid any issues of non-compliance.

Comments