Section 139(9) Defective Return Notice: How TaxBuddy Corrects and Refiles Your ITR

- Rashmita Choudhary

- Dec 23, 2025

- 10 min read

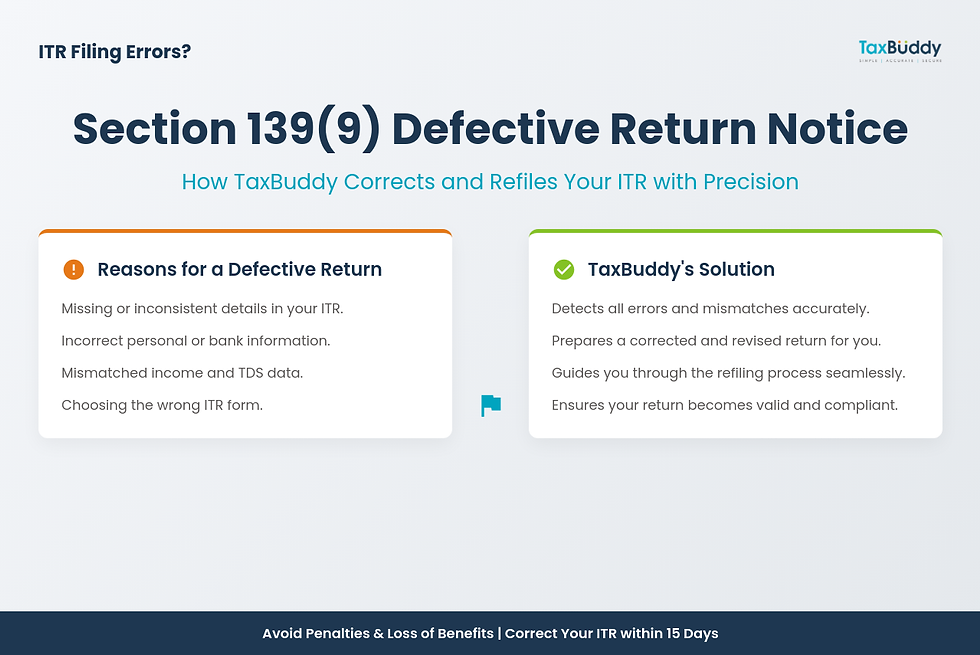

A Section 139(9) defective return notice appears when the Income Tax Department identifies missing details, incorrect information, or inconsistencies in an ITR. Errors such as mismatched income data, wrong bank details, or selecting an incorrect return form can trigger this notice. Once marked defective, the return must be corrected within the given time—usually 15 days—to avoid being treated as invalid. An invalid return carries consequences such as interest, penalties, and even loss of carry-forward benefits. Platforms like TaxBuddy simplify this process by detecting errors, preparing corrected returns, and guiding users through the refiling steps with precision.

A defective return under Section 139(9) is corrected by identifying the exact mismatch or missing detail, revising the ITR with accurate information, and submitting the corrected version within the permitted window so the return remains valid in the eyes of the tax department.

Table of Contents

Understanding Section 139(9) Defective Return Notice

A defective return notice is issued when the Income Tax Department considers the filed return incomplete or inaccurate. Instead of rejecting the ITR, the department provides the taxpayer an opportunity to correct the defect. This ensures the return remains legally valid and can be processed for refunds, assessments, and compliance checks.

Section 139(9) acts as a safeguard in the system—allowing corrections while ensuring the return accurately reflects income, deductions, and financial details.

Why an ITR Becomes Defective Under Section 139(9)

An ITR becomes defective when important data is missing, inconsistent, or incorrect. The system checks every detail: income reported across forms, TDS records, deductions, auditing requirements, and essential personal information. Any mismatch triggers the defect.

Incorrect return selection, incomplete details, or errors in audited accounts often lead to the notice. In many cases, the notice is generated automatically when discrepancies appear during preliminary processing.

Common Reasons for a Defective Return Notice

Several issues commonly result in a defective return under Section 139(9):

Missing or wrong bank account details such as account number or IFSC

Selecting the wrong ITR form for the income type

Non-submission of required audit reports

Not reporting all income sources, including interest or capital gains

Mismatched TDS data when compared with Form 26AS or AIS

Unverified ITR after submission

Missing computation statements or balance sheets for business or professional income

These issues prevent timely processing of the return and may delay refunds.

How TaxBuddy Corrects and Refiles a Defective ITR

TaxBuddy uses AI-driven checks to compare the filed return with income records, bank information, TDS entries, and declared financial details. Defects are identified within seconds, and a corrected draft return is prepared with the right form selection and accurate entries.

For complex filings involving multiple income heads or prior-year carry-forwards, TaxBuddy’s expert team reviews the data to ensure the rectified return aligns with compliance rules. Once checked, the corrected ITR is uploaded through the portal following Section 139(9) norms, ensuring validity and smooth processing.

Bank Account Errors in ITR and Section 139(9)

Bank account discrepancies are among the most frequent reasons for a defective return. Errors may include:

Incorrect account number

Wrong IFSC code

Incorrect account type (e.g., savings vs. current)

Non-linked or inactive bank accounts

These issues affect refund processing and may even prevent the system from validating the ITR.

When flagged under Section 139(9), the department requires corrected details within the specified timeline, or the return risks being labeled invalid.

Role of TaxBuddy in Fixing Bank Account Form Errors

TaxBuddy automatically cross-verifies bank details with the information available in TDS records and user submissions. Any mismatch—like typo errors or outdated accounts—is flagged instantly.

Once identified, the corrected bank details are incorporated into the revised return. TaxBuddy assists with re-uploading the corrected information and submitting the improved version through the portal, ensuring accuracy and preventing repeated notices.

Steps to Respond to a Section 139(9) Notice on the Portal

Correcting a defective return involves a structured process:

Visit the income tax e-filing portal and navigate to the “Pending Actions” section.

Open the defective return notice and review the listed defects.

Choose the option to file a corrected return under Section 139(9).

Prepare the rectified return with accurate information and correct ITR form.

Upload the corrected XML/JSON or use online mode for resubmission.

Verify the corrected return through Aadhaar OTP, net banking, or DSC.

Once submitted and verified, the system processes the rectified ITR as a valid return.

What Happens If a Defective Return Is Not Corrected?

Failure to correct the defective return within the prescribed time—generally 15 days—results in the return becoming invalid. An invalid return is treated as though it was never filed. This leads to:

Loss of carried-forward losses

Interest on tax dues

Possible penalties for late filing

Delay or denial of tax refunds

Exposure to scrutiny proceedings

The Assessing Officer may grant an extension in certain cases, but timely correction remains crucial.

How TaxBuddy Prevents Future Defective Notices

TaxBuddy incorporates built-in validation layers that check for missing data, incorrect ITR forms, mismatched TDS, and incomplete personal information before the return is ever filed. These checks reduce defective returns significantly.

By comparing AIS, Form 26AS, bank entries, and uploaded documents, TaxBuddy ensures the filed return is clean, complete, and compliant. This minimizes risk of future notices and speeds up refund processing.

Section 139(9) and Impact on Refunds, Loss Carry-Forward, and Compliance

A defective return directly affects refund timelines. Refunds are not issued until defects are corrected and the return becomes valid. For taxpayers with business or capital loss carry-forwards, an invalid return blocks the ability to carry those losses into future years.

Compliance records also take a hit, as defective returns may appear irregular during assessments or inquiries. Ensuring timely correction maintains a clean compliance history.

Practical Scenarios: When Section 139(9) Applies

Section 139(9) often applies in situations where minor oversights or reporting gaps create inconsistencies in the return. Many of these issues arise from filing the wrong ITR form, missing out on mandatory details, or overlooking data reflected in AIS, Form 26AS, or bank statements. These practical examples show how easily an ITR can be marked defective and why prompt correction matters.

One of the most frequent scenarios is filing ITR-1 despite having income from a profession or freelancing activity. ITR-1 is meant only for salary, pension, house property, and limited other income. When professional income is reported in this form, the system identifies the mismatch and flags the return as defective because business or professional income requires ITR-3. This kind of form mismatch is one of the quickest ways to receive a notice under Section 139(9).

Another common issue arises when interest income shown in the ITR does not match the amount appearing in AIS. Many taxpayers disclose interest from fixed deposits or savings accounts partially, while AIS reflects the complete figure reported by banks. When the declared income is lower than what is seen in the tax records, the return becomes defective due to incomplete reporting. This mismatch must be corrected to ensure accurate tax computation.

A defective return notice is also commonly issued when a taxpayer uploads incomplete audited financial statements. Individuals and businesses requiring an audit under the Income Tax Act must attach proper balance sheets, profit and loss statements, and audit reports. Missing schedules or unuploaded audit reports prevent the return from being processed, leading to a defect notice. The return remains incomplete until all statutory documents are attached.

Incorrect or missing bank account details also trigger defective notices. Errors such as entering a wrong account number, selecting the wrong account type, or providing an invalid IFSC code prevent the system from validating refund details. The tax department expects accurate banking information since refunds depend on proper verification. Any discrepancy in this section often results in a defective return.

Another overlooked reason for defective returns is failure to verify the ITR after submission. An unverified return is not considered valid, and the system automatically marks it defective if verification is not completed within the stipulated time. Many taxpayers assume that filing alone is enough, but verification through Aadhaar OTP, net banking, offline DSC, or EVC is mandatory to complete the process.

TDS mismatches are also a common source of defective notices. When the TDS reported by an employer, bank, or financial institution differs from what is entered in the return, the system detects inconsistencies. For example, if an employer uploads revised TDS data after the return has already been filed, the mismatch may result in a defect notice. This situation requires revisiting the ITR, updating the tax details, and submitting the corrected version.

All these scenarios highlight how easily an ITR can become defective due to overlooked details, wrong form choices, or mismatches between taxpayer declarations and departmental records. Correcting such defects ensures the return remains valid, refunds are processed without delay, and compliance history remains clean.

Conclusion

A defective return under Section 139(9) demands prompt attention to avoid the return becoming invalid. Timely correction ensures refunds are processed, losses are carried forward, and compliance remains intact. TaxBuddy helps simplify this process through automated checks, expert review, and accurate rectification support, ensuring the corrected ITR is filed without further errors.

For anyone looking for assistance in tax filing, it is highly recommended to download the TaxBuddy mobile app for a simplified, secure, and hassle-free experience.

FAQs

1 Does TaxBuddy offer both self-filing and expert-assisted plans for ITR filing, or only expert-assisted options?

TaxBuddy provides flexibility by offering both self-filing and expert-assisted plans. Users who prefer handling their filing independently can rely on TaxBuddy’s AI-backed self-filing system, which auto-detects mistakes and fills key details using Form 16 and AIS data. Those who want professional oversight can choose expert-assisted filing, where a tax specialist reviews income sources, deductions, and compliance requirements before preparing and filing the return. This combination ensures support for simple cases as well as complex filings involving multiple income heads, capital gains, or business-related disclosures.

2 Which is the best site to file ITR?

The Income Tax Department’s official portal is the primary platform for filing ITR. However, many taxpayers prefer platforms like TaxBuddy because of their ability to reduce errors, simplify data entry, and automate reconciliation with AIS, TIS, and Form 26AS. TaxBuddy’s system blends AI-driven checks with expert review, making it especially useful for those who want precise filing, faster processing, and lower chances of receiving notices such as those under Section 139(9).

3 Where to file an income tax return?

An income tax return can be filed on the Income Tax Department’s e-filing portal. Additionally, authorised intermediaries like TaxBuddy offer a user-friendly environment where returns can be prepared with automated checks, cleaned of errors, and then filed through the compliant gateway. This makes the process faster and reduces the risk of invalid or defective returns.

4 What is a defective return notice under Section 139(9)?

A defective return notice indicates that the filed ITR contains incomplete information, incorrect entries, inconsistencies, or missing details. The department highlights the specific issues and allows the taxpayer a chance to correct and refile the return. Until the defects are fixed, the return cannot be processed, and refunds or other tax benefits remain on hold. This notice ensures that the submitted data aligns accurately with reporting requirements and financial records.

5 How much time is allowed to correct a defective return?

The Income Tax Department generally provides 15 days from the date the notice is issued. Within this period, the identified defect must be corrected, and a revised version of the return must be submitted. The Assessing Officer may extend this deadline if a valid reason is provided. Timely correction is important because the return becomes invalid if the defect is not addressed within the permitted window.

6 What causes a defective return under Section 139(9)?

Several issues can lead to a defective return, including incorrect bank details, missing income disclosures, selection of the wrong ITR form, mismatched TDS entries, or failure to upload mandatory audit reports. Sometimes the ITR appears defective because it was not verified after submission. Any inconsistency between AIS, Form 26AS, TDS certificates, and the filed return may trigger this notice.

7 How does TaxBuddy help in correcting defective return notices?

TaxBuddy identifies the exact cause of the defect by comparing the filed return with AIS, Form 26AS, PAN-linked data, and bank information. Once the issue is spotted, the system prepares a corrected version of the return using AI-based checks to ensure accuracy. For more complicated cases, tax experts step in to resolve computation or reporting discrepancies and guide users through submitting the rectified return under Section 139(9), ensuring the corrected ITR is accepted.

8 What happens if a defective return is not corrected within time?

If the defect is not fixed before the deadline, the return becomes invalid. An invalid return is treated as though it was never filed. This leads to several consequences: refunds get blocked, losses cannot be carried forward, interest may apply on unpaid taxes, and late-filing penalties may arise. Filing a fresh return may not always be possible if statutory deadlines have passed, making timely correction essential.

9 Can bank account errors trigger a defective return notice?

Yes. Incorrect account numbers, wrong IFSC codes, inactive bank accounts, or mismatched account types often cause issues in ITR processing. Since refunds depend on proper banking information, any error may result in the return being marked defective. The department expects corrected bank details to be furnished through a rectified return to process refunds smoothly.

10 How does TaxBuddy assist in correcting bank account form issues?

TaxBuddy runs automated checks on the bank details entered in the return and compares them with TDS and PAN-linked records. When discrepancies appear, the platform alerts the user about the incorrect information. Bank details are updated accurately in the corrected return, ensuring smooth validation when the revised ITR is uploaded under Section 139(9).

11 Can TaxBuddy help re-upload corrected bank account details?

Yes. Once the corrected bank details are confirmed, TaxBuddy updates them in the return and guides the user through re-uploading the revised information through the portal. This ensures the tax department receives the right account details, preventing delays in refunds or further notices.

12 Can a defective return affect refunds or carry-forward of losses?

Yes. Refund processing is put on hold until the defective return is corrected. If the return becomes invalid due to non-correction, losses reported in that year cannot be carried forward, which affects future tax planning and financial projections. Fixing defects quickly ensures refunds are released and tax benefits remain intact.

Comments