How TaxBuddy DIY Helps Pensioners File Without CA Help

- Nimisha Panda

- Sep 12

- 10 min read

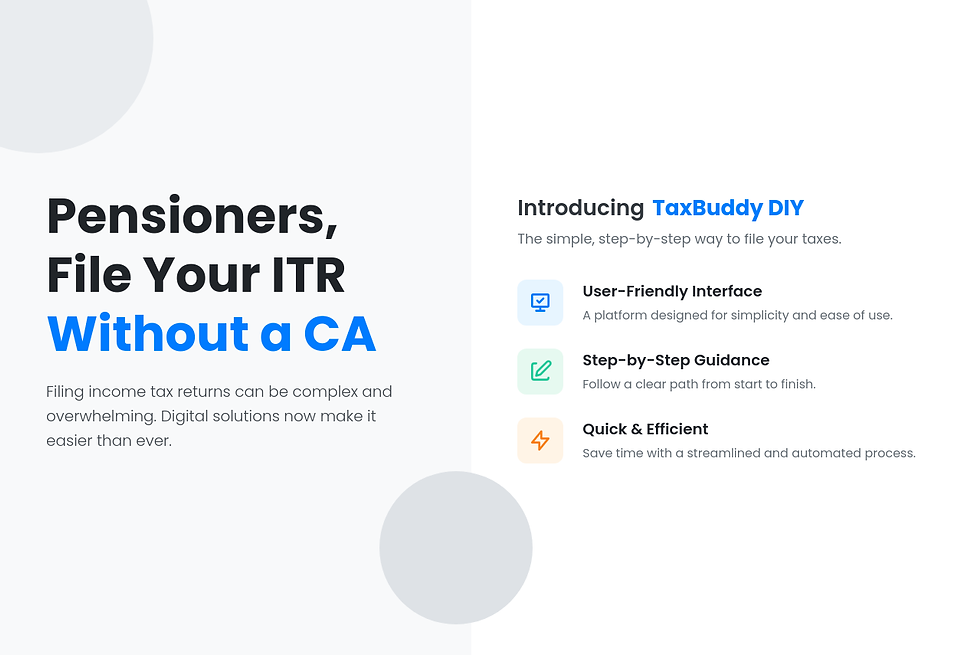

Filing Income Tax Returns (ITR) can be a complex task for many, particularly for pensioners who may not be as familiar with the intricacies of the tax system. For senior citizens, understanding the process, gathering the necessary documentation, and ensuring compliance can be overwhelming. However, with the rise of digital solutions, filing taxes has become significantly easier and more accessible. TaxBuddy DIY (Do-It-Yourself) is a platform designed to simplify the ITR filing process, especially for pensioners. It offers a user-friendly interface, step-by-step guidance, and specialized tools that make tax filing quick, straightforward, and efficient. This article will explore how TaxBuddy DIY caters specifically to pensioners, helping them navigate the ITR filing process with ease.

Table of Contents

How TaxBuddy DIY Simplifies ITR Filing for Pensioners

Filing Income Tax Returns (ITR) can be a daunting task for pensioners, especially when dealing with the complexities of tax laws, exemptions, and the various income sources that need to be declared. TaxBuddy DIY is an ideal solution designed to simplify this process for senior citizens, making it easier for them to file their returns without the need for expert intervention. The platform is user-friendly, ensuring that pensioners can navigate through the entire process smoothly and with confidence.

TaxBuddy DIY provides an intuitive and automated filing system, guiding users step-by-step through each section of the ITR process. The platform’s design takes into account the specific needs and requirements of pensioners, ensuring that they don’t have to worry about any complicated calculations or technicalities. The goal is to make the process as simple and straightforward as possible while maintaining full compliance with the latest tax laws.

Intuitive and Automated Filing Process

One of the standout features of TaxBuddy DIY is its ease of use. Pensioners are often not familiar with the intricacies of tax filing, especially if they are filing their returns independently for the first time. TaxBuddy DIY eliminates this complexity by providing an automated, structured approach to the filing process. The platform simplifies the steps, making it easy for users to understand and follow.

The process begins with basic information entry, such as personal details, pension income, and bank account information. TaxBuddy DIY then guides users through the various stages, including selecting the appropriate tax regime, entering income details, and applying deductions or exemptions. It offers clear instructions for each section, helping pensioners complete their filing quickly and efficiently.

Maximizing Tax Benefits with Smart Calculations

TaxBuddy DIY is specifically designed to help pensioners maximize their available tax benefits. Senior citizens are eligible for various exemptions and deductions under the Income Tax Act, such as higher exemption limits for pension income and interest from savings accounts. These benefits can be difficult to track manually, but TaxBuddy DIY ensures that they are automatically accounted for during the filing process.

The platform offers suggestions for deductions that pensioners may be eligible for, including deductions under Section 80C for investments in retirement plans or life insurance premiums, and Section 80D for health insurance premiums. TaxBuddy DIY helps pensioners take full advantage of these provisions, ensuring they pay only the required tax and keep their filing efficient.

Automated Document Checklist for Seamless Organization

One of the most common challenges for pensioners when filing ITR is managing and organizing the required documentation. TaxBuddy DIY addresses this by providing an automated document checklist that helps pensioners gather and organize the necessary documents before beginning the filing process.

The checklist includes all the essential documents such as Form 16 (pension income statement), bank interest statements, proof of health insurance premiums, and any other tax-saving investments or deductions. By following the checklist, pensioners can ensure that they have all the necessary documents in one place, reducing the likelihood of missing out on critical information that could impact their filing.

This organized approach not only helps streamline the filing process but also ensures that no essential income source or deduction is overlooked. From pension income to interest on savings accounts, TaxBuddy DIY ensures that every source of income is accounted for, providing an accurate representation of the taxpayer’s financial situation.

Simplifying Tax Filing for Pensioners with Specific Needs

Pensioners often have unique tax needs, which is why TaxBuddy DIY is tailored to address their specific situation. For instance, the platform automatically accounts for the pension income, interest earned from savings accounts, and other retirement-related incomes. Additionally, senior citizens have access to higher exemption limits, which TaxBuddy DIY ensures are applied correctly, thereby reducing their overall tax liability.

The platform’s design ensures that pensioners can file without having to worry about complex tax laws or missing out on any tax-saving opportunities. It also provides guidance for any tax-related questions they may have, with built-in help sections and customer support available if needed. This creates a sense of security and confidence for pensioners, allowing them to file their returns independently without the need for costly tax professionals.

Stress-Free Filing Experience

Filing taxes can often feel stressful, especially for pensioners who may not be well-versed in modern technology or the complexities of tax filing. TaxBuddy DIY eliminates much of this stress by simplifying the process and offering ongoing assistance at every step. Whether it’s through automated calculations, document checks, or easy-to-follow instructions, the platform ensures that pensioners can file their returns with ease.

Moreover, TaxBuddy DIY reduces the pressure of manual calculations, ensuring accuracy in income reporting, deductions, and exemptions. This minimizes the chances of errors that could lead to penalties or delayed refunds. The platform's secure environment also ensures that pensioners' personal and financial data is kept safe throughout the filing process.

Step-by-Step Guidance for Pensioners

TaxBuddy DIY provides detailed, step-by-step instructions that walk pensioners through each stage of the ITR filing process. The platform simplifies every step, from entering personal details to declaring income, claiming deductions, and finally submitting the return. Each step is clearly explained, with helpful prompts and explanations of common terms that can be confusing for those unfamiliar with the tax filing process.

For instance, when pensioners need to report pension income, TaxBuddy DIY offers predefined sections where they can enter their income sources, including government or private pension, and automatically applies any relevant exemptions for senior citizens. By breaking down the process into manageable steps, TaxBuddy ensures that pensioners can file their returns confidently without feeling overwhelmed.

Simplified Document Handling for Pensioners

For pensioners, collecting the necessary documentation for ITR filing can be one of the most challenging aspects of the process. TaxBuddy DIY takes this concern into account by offering simplified document handling. The platform automatically generates a checklist of required documents, including Form 16, pension statements, interest certificates, and proof of deductions. This organized approach reduces the chances of missing any key documents and ensures that the entire filing process proceeds smoothly.

Moreover, TaxBuddy DIY allows pensioners to upload and store their documents securely on the platform, eliminating the need for physical paperwork. The platform’s automated document verification ensures that all required fields are correctly filled and that no essential information is overlooked.

Specialized Support for Senior Citizens and Pensioners

TaxBuddy DIY provides specialized support for senior citizens and pensioners, catering to their specific tax filing needs. Senior citizens often have unique tax benefits, such as higher exemption limits and deductions on medical expenses and insurance premiums, which are automatically factored into the system. TaxBuddy DIY ensures that pensioners can easily access these benefits without having to manually calculate or search for the appropriate forms.

The platform also offers quick access to FAQs and a help section that is specifically designed to address concerns relevant to pensioners. Whether it’s questions about deductions on medical bills or exemptions for pension income, the support section offers clear, concise answers.

TaxBuddy DIY’s Cost-Effective Option for Pensioners

TaxBuddy DIY is an affordable option for pensioners who may be on a fixed income. The platform eliminates the need for expensive tax professional fees by providing an easy-to-use self-service tool at a fraction of the cost. Pensioners can file their ITR for a minimal fee, enjoying all the features of the platform without breaking the bank.

For pensioners who may not want to invest in full-service tax filing options, TaxBuddy DIY provides the perfect balance of affordability and convenience, ensuring that tax filing doesn’t become a financial burden.

Real-Time Tracking and Post-Filing Support

Once the ITR is filed, TaxBuddy DIY offers real-time tracking to keep pensioners updated on the status of their filing and any subsequent actions required. The platform sends timely notifications if there are any issues or if additional documents are needed, helping pensioners stay informed throughout the process.

Post-filing support is also available to assist with any queries or issues that may arise after the return has been submitted. Whether it’s a question about refund status or an issue with income discrepancies, TaxBuddy DIY’s customer support is just a click away, ensuring that pensioners always have the help they need.

Conclusion

Filing taxes doesn’t have to be a daunting task for pensioners. With TaxBuddy DIY, pensioners can experience a simplified, cost-effective, and user-friendly tax filing process. The platform offers specialised support for senior citizens, step-by-step guidance, and an organised approach to document management. By making tax filing more accessible and straightforward, TaxBuddy DIY helps pensioners save time, avoid errors, and ensure compliance with tax laws, all while maximising their available tax benefits. For those looking to file their ITR easily and with peace of mind, TaxBuddy DIY is the perfect solution.

For anyone looking for assistance in tax filing, it is highly recommended to download theTaxBuddy mobile app for a simplified, secure, and hassle-free experience.

FAQs

Q1: Is TaxBuddy DIY suitable for pensioners with no prior tax filing experience? Yes, TaxBuddy DIY is tailored to be user-friendly, making it an excellent option for pensioners with no prior tax filing experience. The platform provides step-by-step instructions and guides users through the entire process. It simplifies complex tax terms, offering prompts and explanations to ensure that even first-time filers can complete their returns without confusion. With clear directions and a straightforward interface, TaxBuddy DIY makes filing accessible to everyone, regardless of their prior knowledge of tax filing.

Q2: What documents are needed for pensioners to file their ITR using TaxBuddy DIY? Pensioners will need a few key documents to file their ITR through TaxBuddy DIY. These include:

Form 16 (if applicable): A certificate issued by the employer detailing salary and tax deductions.

Pension Statements: Detailing the pension income received during the financial year.

Bank Interest Certificates: If pensioners have earned interest from savings accounts or fixed deposits.

Proof of Deductions: Such as receipts for medical insurance premiums, investment proof under Section 80C (like PPF, ELSS), and other tax-saving instruments. TaxBuddy DIY provides a checklist to help pensioners organize and upload all necessary documents, ensuring that nothing is overlooked during the filing process.

Q3: Can TaxBuddy DIY help with claiming tax exemptions available to senior citizens? Yes, TaxBuddy DIY automatically applies tax exemptions available to senior citizens. These include higher income tax exemption limits, additional deductions for medical expenses under Section 80D, and other senior citizen-specific benefits. TaxBuddy DIY takes the user’s age and tax profile into account to ensure that all applicable exemptions and deductions are claimed, maximizing the pensioner’s tax benefits. This feature makes filing easier, as pensioners don't need to manually calculate or check for exemptions.

Q4: Is TaxBuddy DIY a cost-effective solution for pensioners? Yes, TaxBuddy DIY is a highly cost-effective solution for pensioners. It offers an affordable alternative to hiring a tax professional, providing all the tools needed to file an accurate return at a fraction of the cost. The platform offers full support and guidance without the need for expensive consultancy fees. This makes it a great option for pensioners on a fixed income, ensuring they can file their ITR without stretching their budget.

Q5: How secure is the document storage on TaxBuddy DIY? Security is a top priority on TaxBuddy DIY. The platform uses state-of-the-art encryption methods to safeguard users' sensitive financial data. All documents uploaded to the system are stored securely, ensuring privacy and compliance with data protection regulations. Pensioners can upload their tax documents, such as Form 16 and pension statements, with the confidence that their information is protected from unauthorized access. The platform’s secure document storage ensures that pensioners’ personal and financial data remain confidential.

Q6: Can pensioners get help if they have issues with filing their ITR? Yes, TaxBuddy DIY offers dedicated customer support to assist pensioners with any issues they may face during the filing process. If any questions arise about the process or if there are challenges, the customer support team is available to provide guidance. Additionally, post-filing support is available to help with any queries regarding refunds, discrepancies, or amendments. TaxBuddy DIY ensures that pensioners have the assistance they need throughout the entire tax filing journey.

Q7: Can I file my ITR on TaxBuddy DIY without professional help? Yes, TaxBuddy DIY is designed for self-filing, allowing pensioners to file their ITR independently. The platform’s user-friendly interface and step-by-step instructions make it simple to file without the need for professional assistance. However, if pensioners encounter any difficulties or prefer professional guidance, expert assistance is available at an additional cost. TaxBuddy DIY strikes a balance between self-sufficiency and professional support, giving users the option to choose what suits them best.

Q8: Does TaxBuddy DIY support multiple sources of income for pensioners? Yes, TaxBuddy DIY is fully equipped to handle multiple sources of income, which is common among pensioners. Whether the income comes from pensions, savings account interest, fixed deposits, or other retirement savings, TaxBuddy DIY ensures all income sources are accurately accounted for. The platform automatically categorises and inputs income details to ensure a complete and accurate tax return. This makes it easy for pensioners with diverse income sources to file their ITR without the need to manually input complex data.

Q9: Is there a deadline for filing ITR using TaxBuddy DIY? Yes, like all ITR filings, pensioners must adhere to the relevant deadlines set by the Income Tax Department. TaxBuddy DIY helps pensioners stay on track by providing reminders and a clear timeline for filing. The platform ensures users are well aware of the filing dates, helping them avoid late filing penalties. Pensioners can track their filing progress and ensure they submit their returns well before the deadline.

Q10: Does TaxBuddy DIY help with post-filing amendments? Yes, TaxBuddy DIY allows pensioners to make corrections or amendments to their filed ITR. If any errors are identified after the return has been filed, pensioners can file a revised return with the platform’s easy-to-follow guidance. TaxBuddy DIY ensures that even post-filing amendments are handled smoothly, allowing pensioners to correct discrepancies, such as income mismatches or missing deductions, and file the necessary revisions before the end of the assessment year.

Q11: Can pensioners use TaxBuddy DIY for filing taxes in the new tax regime? Yes, TaxBuddy DIY supports both the old and new tax regimes for ITR filing. Pensioners can choose the regime that offers the most benefits, depending on their financial situation. The platform automatically highlights the most beneficial tax regime, helping pensioners make informed decisions. Whether opting for the standard exemptions and deductions under the old regime or the lower tax rates of the new regime, TaxBuddy DIY ensures that pensioners maximize their tax savings.

Q12: Can pensioners file ITR for previous years using TaxBuddy DIY? Yes, TaxBuddy DIY supports filing of belated returns for previous years, ensuring that pensioners can catch up on any missed filings. The platform allows users to file ITRs for earlier assessment years if they missed the deadline for filing or need to revise a previous return. TaxBuddy DIY provides clear instructions on how to file for past years, ensuring that pensioners stay compliant with tax laws even if they have not filed their returns on time.

Comments