top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Section 24(b): Home Loan Interest Deduction Explained

Section 24(b) of the Income Tax Act, 1961 allows taxpayers to claim deductions on the interest paid for home loans taken to purchase, construct, repair, or renovate residential properties. It provides substantial relief for homeowners by reducing taxable income through interest deductions, subject to specific limits and eligibility conditions. For self-occupied houses, the maximum deduction is ₹2,00,000 per year, while for rented properties, there is no upper limit. This sec

Rajesh Kumar Kar

Nov 7, 20259 min read

Dividend Income Taxation Rules in 2025 and How to Report in ITR

Dividend income taxation in India for FY 2024–25 (AY 2025–26) continues under the Income Tax Act, 1961, with key refinements introduced in Budget 2025. The TDS threshold for dividends has been raised to ₹10,000, and new compliance guidelines ensure smoother and more transparent reporting. Since the abolition of Dividend Distribution Tax, the responsibility for paying tax on dividends now lies with investors. Understanding how to compute and report dividend income correctly i

Rashmita Choudhary

Nov 5, 202511 min read

Step-by-Step Guide to Filing ITR-2 Online

Filing ITR-2 online for AY 2025-26 requires careful preparation, accurate reporting of income sources, and proper bank account validation. Individuals and HUFs with capital gains, multiple properties, foreign assets, or directorships must follow the correct process to ensure smooth filing and timely refunds. This guide provides a detailed, step-by-step overview, covering all schedules, bank account sections, e-verification methods, and common issues, while highlighting how se

PRITI SIRDESHMUKH

Oct 1, 20258 min read

Can You Receive a Notice After Timely ITR Filing?

Even after filing your Income Tax Return (ITR) on time and accurately, receiving a notice from the Income Tax Department is possible....

Rashmita Choudhary

Sep 29, 20258 min read

Section 148 Notice: Income Escaping Assessment in Simple Terms

A Section 148 Notice is issued by the Income Tax Department when there is reason to believe that a taxpayer’s income has not been fully...

Dipali Waghmode

Sep 29, 20259 min read

How to Avoid Income Tax Notices When Filing Returns

Income Tax notices are a common concern for Indian taxpayers, often triggered by errors, mismatches, or omissions during return filing....

Rajesh Kumar Kar

Sep 29, 20258 min read

Plan Your Investments Better with TaxBuddy’s Annual Guide

Effective investment planning is central to maximising wealth while staying compliant with India’s Income Tax Act 1961. Understanding tax...

Dipali Waghmode

Sep 20, 20259 min read

Can You Save Tax Without 80C? Yes – TaxBuddy Tells You How

It is possible to save tax in India without relying solely on Section 80C . Multiple deductions, exemptions, and strategic financial...

Asharam Swain

Sep 19, 20258 min read

Want to Save ₹46,800 This Year? Use TaxBuddy’s Calculator

Tax planning is a crucial step for individuals and professionals looking to optimize their income tax liability. Utilizing available...

Nimisha Panda

Sep 19, 20258 min read

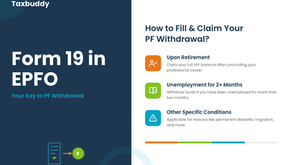

Form 19 in EPFO: How to Fill Form 19 For PF Withdrawal?

An essential application for withdrawing the balance of the Employee Provident Funds (EPF) is EPF Form 19. An employee submits it to...

Asharam Swain

Sep 18, 20256 min read

bottom of page