top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Property Value vs Income Mismatch: How TaxBuddy Responds to High-Value Property Income Tax Notices

Property value vs income mismatch notices arise when the reported income profile does not align with the value of a purchased or sold property. The Income Tax Department now cross-verifies registrar data, AIS entries, SFT reports from banks, and loan information to detect gaps between disclosed income and high-value property transactions. As digital monitoring expands, mismatches are flagged more frequently, especially when capital gains, rental income, or funding sources are

Asharam Swain

Dec 25, 20258 min read

Refund Re-Issue Income Tax Notices: How TaxBuddy Tracks Status and Resolves Failures

Refund re-issue notices appear when the Income Tax Department fails to credit a refund due to issues like invalid bank details, non-pre-validated accounts, or mismatched information in the taxpayer’s records. Understanding why refunds fail, how to track their progress, and the steps needed for correction ensures quicker resolution. The online system allows seamless requests, yet errors in bank validation or AIS/TDS data commonly delay payouts. Platforms such as TaxBuddy simp

Rajesh Kumar Kar

Dec 25, 20257 min read

Foreign Tax Credit Claim Notices: How TaxBuddy Reviews FTC and Form 67 for Accuracy

Foreign Tax Credit claim notices arise when foreign income or tax paid abroad does not match the information reported in Form 67 or the income tax return. These notices typically highlight gaps in documentation, errors in DTAA applications, incorrect foreign tax reporting, or delays in submitting Form 67. Accurate foreign tax details, timely filing, and proper evidence are essential to ensure FTC approval. TaxBuddy plays a key role by reviewing Form 67 and related attachmen

Rajesh Kumar Kar

Dec 25, 20259 min read

Document Checklist for Income Tax Notices: How TaxBuddy Organises Proofs Before Reply

Income tax notices often request specific documents to verify income details, TDS credits, or high-value transactions. A structured checklist helps compile the correct proofs quickly and reduces the risk of penalties. The first step is understanding what the notice seeks, followed by gathering documents such as Form 16, bank statements, Form 26AS, AIS summaries, business records, and investment proofs. TaxBuddy plays a crucial role by organising notice-wise documentation and

Rashmita Choudhary

Dec 25, 20258 min read

AIS/TIS Mismatch Income Tax Notice: How TaxBuddy Compares AIS, TIS, and Your ITR

AIS/TIS mismatch income tax notices arise when reported data in the Annual Information Statement and Taxpayer Information Summary does not align with the income declared in an ITR. These discrepancies often stem from incorrect TDS entries, missing interest income, duplicated transactions, or reporting errors from banks, employers, and financial institutions. Unresolved mismatches may lead to notices under sections like 143(1)(a) or 139(9). Accurate reconciliation is essential

Dipali Waghmode

Dec 24, 20258 min read

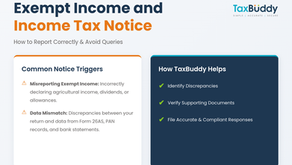

Exempt Income and Income Tax Notice: How TaxBuddy Helps You Report Correctly

Exempt income must still be reported in the Income Tax Return, even though it is not taxable. Missing, misreporting, or incorrectly classifying exempt income often triggers income tax notices because the department matches every entry with PAN-linked data, bank records, and Form 26AS . Agricultural income, dividends, and certain allowances fall under exempt categories, and any mismatch between what’s declared and what’s captured in the system leads to queries. Platforms like

Nimisha Panda

Dec 24, 20259 min read

Risk Management Income Tax Notice: How TaxBuddy Interprets and Responds Safely

Risk management for income tax notices depends on accurate interpretation, timely action, and a safe response strategy that reduces exposure to penalties and further scrutiny. Income tax notices often arise from mismatches in TDS, incorrect reporting, wrong PAN details, or discrepancies in bank information. Understanding the issue raised and replying with precise documentation helps avoid escalation. TaxBuddy simplifies this process by reviewing the notice, identifying risks

Rashmita Choudhary

Dec 24, 20258 min read

Bank Deposit Income Tax Notice: How TaxBuddy Handles Current and Savings Account Triggers

Bank deposit income tax notices often arise when unexpected or high-value transactions appear in current or savings accounts, or when interest income is not properly reported in the Income Tax Return. These triggers usually come from PAN-linked bank monitoring systems that flag discrepancies between reported and actual transactions. Common issues include unreported interest, incorrect TDS reflection, or mismatches in KYC information. TaxBuddy’s technology and expert support s

Asharam Swain

Dec 24, 20259 min read

Wrong Deductions and Income Tax Notice: How TaxBuddy Reviews Section-Wise Errors

Wrong deductions in an Income Tax Return often trigger notices under sections like 139(9), 143(1), 154, and 156, especially when income, TDS, or exemption claims do not match department records. The core issue usually stems from incorrect figures, missing proofs, or bank-related reporting gaps. Automated systems quickly flag these mismatches, leading to adjustments or demands. TaxBuddy reduces these errors by reviewing the deductions section-wise, comparing data with the In

Rajesh Kumar Kar

Dec 24, 20259 min read

Non-Filing of Income Tax Return and High Value Transaction for FY 2024-25 Explained

Non-filing of an income tax return often triggers automated alerts when financial activity suggests taxable income but no return is submitted by the due date. The system flags such cases under the e-Campaign for non-filers, prompting taxpayers to respond through the Compliance Portal. These notices arise from AIS and Form 26AS mismatches, high-value transactions, or bank-linked income that remains unreported. Responding quickly prevents penalties, defective return treatment,

Nimisha Panda

Dec 23, 20259 min read

bottom of page