top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Rectification, Revised Return, or Updated Return: How TaxBuddy Chooses the Right Route After a Notice

Errors in an income tax return often surface only after an Income Tax Department notice, and choosing the correct corrective route determines whether the issue closes smoothly or escalates into penalties and prolonged scrutiny. The core pathways—rectification, revised return, and updated return—serve very different purposes and operate under strict legal timelines. Each mechanism applies to a specific type of mistake, and selecting the wrong one can complicate compliance inst

Rashmita Choudhary

Jan 29 min read

Building a Notice-Ready ITR: How TaxBuddy Helps Avoid Tax Notices

A large number of income tax notices are triggered not by fraud, but by mismatches between filed returns and data already available with the Income Tax Department. Differences in bank interest, unreported transactions, incorrect ITR selection, or missing schedules often invite scrutiny under Sections 143(1) or 142(1). A notice-ready ITR focuses on aligning every reported figure with Form 26AS, AIS, and TIS before submission. TaxBuddy’s filing process is built around this prin

Rashmita Choudhary

Jan 29 min read

Capital Losses in AIS but Not ITR: How TaxBuddy Resolves Income Tax Notices

Capital losses appearing in AIS but missing from the filed ITR often trigger mismatch notices because the tax department treats unreported entries as potential discrepancies in capital gains disclosure. When AIS reflects sale transactions from equities, mutual funds, or other capital assets, but the ITR does not incorporate the same details, the system flags the inconsistency. This situation is common when taxpayers misreport loss-making trades or assume losses need not be de

Rajesh Kumar Kar

Dec 28, 20259 min read

GST for E-Commerce Sellers: How TaxBuddy Manages GSTR-1, 3B, and TCS Compliance

E-commerce sellers face some of the most complex GST obligations in India, primarily due to platform-based transactions, automated TCS deductions, and strict reporting rules under GSTR-1 and GSTR-3B. Every sale, return, commission, and fee flows through digital records that must match the GST portal’s ledgers exactly, making reconciliation essential for avoiding mismatches and notices. Since e-commerce operators collect TCS under Section 52 and deposit it through GSTR-8, sell

Dipali Waghmode

Dec 26, 20258 min read

Online GST Return Filing in India: How TaxBuddy Ensures Error-Free Compliance

Online GST return filing in India requires accurate reporting of sales, purchases, and tax liabilities through returns such as GSTR-1, GSTR-3B, and GSTR-9. The process demands precision because the GST portal directly cross-verifies taxpayer data with income tax systems, bank statements, and vendor filings. Errors like mismatched turnover, incorrect HSN/SAC codes, or inconsistency between GST and ITR data often lead to notices or delayed processing. TaxBuddy supports busines

PRITI SIRDESHMUKH

Dec 24, 20258 min read

AIS/TIS Mismatch Income Tax Notice: How TaxBuddy Compares AIS, TIS, and Your ITR

AIS/TIS mismatch income tax notices arise when reported data in the Annual Information Statement and Taxpayer Information Summary does not align with the income declared in an ITR. These discrepancies often stem from incorrect TDS entries, missing interest income, duplicated transactions, or reporting errors from banks, employers, and financial institutions. Unresolved mismatches may lead to notices under sections like 143(1)(a) or 139(9). Accurate reconciliation is essential

Dipali Waghmode

Dec 24, 20258 min read

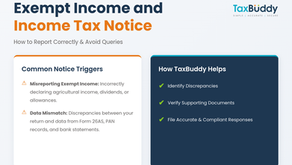

Exempt Income and Income Tax Notice: How TaxBuddy Helps You Report Correctly

Exempt income must still be reported in the Income Tax Return, even though it is not taxable. Missing, misreporting, or incorrectly classifying exempt income often triggers income tax notices because the department matches every entry with PAN-linked data, bank records, and Form 26AS . Agricultural income, dividends, and certain allowances fall under exempt categories, and any mismatch between what’s declared and what’s captured in the system leads to queries. Platforms like

Nimisha Panda

Dec 24, 20259 min read

Risk Management Income Tax Notice: How TaxBuddy Interprets and Responds Safely

Risk management for income tax notices depends on accurate interpretation, timely action, and a safe response strategy that reduces exposure to penalties and further scrutiny. Income tax notices often arise from mismatches in TDS, incorrect reporting, wrong PAN details, or discrepancies in bank information. Understanding the issue raised and replying with precise documentation helps avoid escalation. TaxBuddy simplifies this process by reviewing the notice, identifying risks

Rashmita Choudhary

Dec 24, 20258 min read

Wrong Deductions and Income Tax Notice: How TaxBuddy Reviews Section-Wise Errors

Wrong deductions in an Income Tax Return often trigger notices under sections like 139(9), 143(1), 154, and 156, especially when income, TDS, or exemption claims do not match department records. The core issue usually stems from incorrect figures, missing proofs, or bank-related reporting gaps. Automated systems quickly flag these mismatches, leading to adjustments or demands. TaxBuddy reduces these errors by reviewing the deductions section-wise, comparing data with the In

Rajesh Kumar Kar

Dec 24, 20259 min read

Salary Mismatch Income Tax Notice: How TaxBuddy Assists Salaried Taxpayers

Salary mismatch notices are among the most common issues faced by salaried taxpayers. These occur when the salary reported in Form 16, Form 26AS , AIS, or TDS statements does not match the income declared in the Income Tax Return. Even minor discrepancies can trigger notices because the Income Tax Department compares employer filings, bank entries, and payroll records with the taxpayer’s return. Platforms like TaxBuddy help resolve these mismatches by identifying inconsiste

Asharam Swain

Dec 23, 20259 min read

bottom of page