top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Form 16 vs 26AS Mismatch Income Tax Notice: How TaxBuddy Resolves Employee Cases

A mismatch between Form 16 and Form 26AS is one of the most common reasons salaried individuals receive income tax notices, particularly under Section 143(1)(a). This happens when the TDS shown in Form 16 does not match the tax credit reflected in Form 26AS, usually due to errors or delays from the employer’s side. Identifying the discrepancy early prevents incorrect tax demands. Platforms like TaxBuddy simplify this process by reconciling both documents accurately and guid

Nimisha Panda

Jan 28 min read

Capital Gains Income Tax Notice: How TaxBuddy Reviews AIS and Broker CG Statements

Capital gains income tax notices usually emerge when the figures reported in the Income Tax Return differ from those appearing in the AIS or broker capital gains statements. These mismatches often involve incorrect STCG or LTCG values, missing transactions, or inconsistent reporting across intermediaries. The tax system flags such gaps automatically, resulting in Section 143(1) notices. TaxBuddy reviews AIS data, reconciles broker statements, and identifies the source of mism

PRITI SIRDESHMUKH

Jan 29 min read

Rental Income Mismatch Income Tax Notice: How TaxBuddy Aligns ITR, AIS, and Loan Data

Rental income mismatch notices typically arise when the declared rental income in the Income Tax Return differs from entries in AIS, Form 26AS, or reported loan records. The tax system automatically compares TDS on rent, bank credits, tenant-reported payments, and property-linked loan data to identify gaps. Even minor inconsistencies—such as missing rent receipts, incorrect TDS reporting, or unverified property loan details—can trigger a notice under Section 143(1) . Early de

Dipali Waghmode

Jan 1, 202610 min read

Large Refund Income Tax Notice: How TaxBuddy Justifies Your Refund Claim

Large refund income tax notices are issued when the claimed refund appears unusually high compared to reported income, TDS, or advance tax. The Income Tax Department flags these cases for additional verification to confirm that the refund is backed by accurate reporting and valid tax credits. Automated systems review mismatches in TDS, income details, and bank account validations before releasing funds. TaxBuddy streamlines this process by ensuring accurate filings, pre-vali

Rashmita Choudhary

Dec 31, 20258 min read

Non-Payment of Self-Assessment Tax: How TaxBuddy Manages Notices, Interest, and Rectification

Non-payment of self-assessment tax under Section 140A places the taxpayer in default and immediately exposes the individual to interest, penalties, and notices from the Income Tax Department. The unpaid amount attracts interest under Sections 234A, 234B, and 234C until cleared, and the tax authority may issue notices demanding clarification or corrective action. These situations often arise from shortfalls in advance tax, TDS mismatches, or miscalculations while filing the r

Nimisha Panda

Dec 31, 20258 min read

Section 245 Refund Adjustment Notice: How TaxBuddy Helps You Agree or Dispute the Set-Off

Section 245 refund adjustment notices are issued when the Income Tax Department proposes to set off a current-year refund against outstanding tax demands from earlier years. The notice outlines the refund amount, the pending demand, and the proposed adjustment, requiring a response within the specified timeline. Understanding how these set-offs work, how to verify the accuracy of the demand, and how to submit an objection is essential for ensuring refunds are not withheld in

Rashmita Choudhary

Dec 31, 20258 min read

Foreign Tax Credit and Form 67 Defect Notice: How TaxBuddy Helps You Correct Claims

Foreign Tax Credit (FTC) allows relief when tax is paid abroad on income taxable in India, but errors in Form 67 often trigger defect notices that delay refunds or deny credit. These notices commonly arise from mismatches in income details, incorrect currency conversion, late filing, or incomplete documentation. Accurate disclosure under Rule 128 is essential, as the Income Tax Department cross-checks Form 67 with Schedule FSI and foreign tax proofs. With multiple steps invo

Dipali Waghmode

Dec 31, 20258 min read

Section 148A Reassessment Notice: How TaxBuddy Plans Your Defence and Compliance

Section 148A reshapes reassessment by introducing a mandatory inquiry and reply process before any notice under Section 148 can be issued. The framework ensures that reassessment occurs only when supported by credible information indicating income escapement. The Assessing Officer must evaluate facts, issue a show-cause notice, consider the taxpayer’s response, and obtain higher authority approval before proceeding. This procedure enhances transparency and protects taxpayers

Asharam Swain

Dec 31, 20258 min read

AIS/TIS Mismatch Income Tax Notice: How TaxBuddy Compares AIS, TIS, and Your ITR

AIS/TIS mismatch income tax notices arise when reported data in the Annual Information Statement and Taxpayer Information Summary does not align with the income declared in an ITR. These discrepancies often stem from incorrect TDS entries, missing interest income, duplicated transactions, or reporting errors from banks, employers, and financial institutions. Unresolved mismatches may lead to notices under sections like 143(1)(a) or 139(9). Accurate reconciliation is essential

Dipali Waghmode

Dec 24, 20258 min read

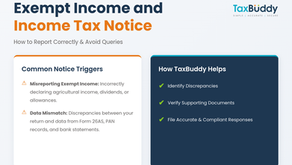

Exempt Income and Income Tax Notice: How TaxBuddy Helps You Report Correctly

Exempt income must still be reported in the Income Tax Return, even though it is not taxable. Missing, misreporting, or incorrectly classifying exempt income often triggers income tax notices because the department matches every entry with PAN-linked data, bank records, and Form 26AS . Agricultural income, dividends, and certain allowances fall under exempt categories, and any mismatch between what’s declared and what’s captured in the system leads to queries. Platforms like

Nimisha Panda

Dec 24, 20259 min read

bottom of page