top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Section 115BAC New Tax Regime: Deductions, Rebate & Tax-Free Income Explained

Section 115BAC forms the core of India’s new tax regime, designed to simplify taxation by offering lower slab rates in exchange for fewer deductions. Recent updates under the Union Budget FY 2025-26 have significantly changed how taxpayers calculate benefits, especially around the higher standard deduction of ₹75,000 and the increased Section 87A rebate of up to ₹60,000. These changes push the effective tax-free income threshold to ₹12.75 lakh for salaried individuals and pe

Asharam Swain

Dec 17, 20258 min read

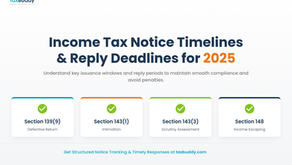

Income Tax Notice Timelines and Reply Deadlines for 2025

Income tax notices operate on specific statutory timelines, and understanding these timelines helps maintain smooth compliance throughout the 2025 cycle. Every notice issued by the Income Tax Department follows a defined window for issuance and a fixed reply period for taxpayers. These timelines depend on the type of assessment, the financial year involved, and the nature of discrepancies identified in the filed return. With the 2025 assessment cycle seeing structured updates

Rajesh Kumar Kar

Dec 17, 20259 min read

Filing ITR for Pension Income and Savings Account Interest in India

Filing an income tax return for pension income combined with savings account interest requires clarity on how these two income streams are taxed under the Income Tax Act for FY 2024-25. Pension is treated as salary income, while savings interest falls under income from other sources, and both must be reported accurately. Seniors can also access additional deductions such as Section 80TTB, which reduces taxable interest income. Selecting the correct ITR form, understanding ex

Nimisha Panda

Dec 17, 20259 min read

Can You Claim Rent Deduction Without Landlord’s PAN?

Rent deduction under House Rent Allowance (HRA) often hinges on one critical detail: the landlord’s PAN. Tax rules link HRA eligibility to proper documentation, and PAN becomes relevant when annual rent crosses a specific threshold. Most salaried individuals face confusion about when the PAN requirement applies, how to claim HRA without it, and what to do if the landlord does not hold a PAN or refuses to provide one. Clear guidelines exist within the Income Tax Act to help d

Dipali Waghmode

Dec 17, 20258 min read

How to Claim Foreign Tax Credit for Income Earned Abroad

Foreign Tax Credit allows resident taxpayers in India to avoid double taxation on income earned abroad by offsetting tax already paid in another country. The process requires accurate reporting of foreign income, filing Form 67 , and submitting supporting evidence before filing the return . Income earned outside India must be declared in Schedule FSI and Schedule TR to compute the eligible credit under Indian tax rules. Each country’s tax payment is evaluated separately, and

Rashmita Choudhary

Dec 17, 20259 min read

ITR Processed but Refund Not Issued: What’s Next

When an Income Tax Return shows the status “Processed” but the refund still hasn’t arrived, it usually means the tax department has completed verification and computed the refund, but the credit has not reached the bank account. This delay often arises from incorrect bank details, a mismatch in tax records, or pending verification at the Centralised Processing Centre. Refunds can also be held up due to a failed transaction at the bank’s end, even when everything appears corre

Nimisha Panda

Dec 16, 20258 min read

How to Track Rectification Request Status on Income Tax Portal

Tracking a rectification request on the Income Tax Portal has become significantly easier after the 2025 system enhancements that now allow both CPC-processed and AO-processed rectifications to be monitored online. The portal displays real-time updates regarding errors corrected under Section 154 of the Income Tax Act, 1961, ensuring clarity on whether a request is submitted, in progress, completed, or rejected. With the upgraded dashboard and streamlined navigation, taxpaye

Asharam Swain

Dec 16, 20258 min read

Refund Processed But Amount Is Incorrect: Steps to Rectify

Refund mismatches occur when the amount credited by the Income Tax Department does not align with the refund shown in the processed ITR. This usually happens due to errors in TDS claims, mismatches in Form 26AS or AIS, adjustments against outstanding dues, or mistakes in computation made during processing under Section 143(1) . The issue can be corrected through a structured rectification process on the Income Tax Portal, ensuring the correct refund is reissued. Platforms lik

Rajesh Kumar Kar

Dec 16, 20259 min read

Can You File an Updated Return After an Assessment Order?

Filing an updated or revised return after an assessment order often raises confusion because the timelines and restrictions under the Income Tax Act are strict. Once an assessment order is completed, the law does not permit filing a revised or updated return for that year. Taxpayers are instead required to rely on rectification options if any error comes to light post-assessment. Understanding these boundaries is essential to avoid invalid filings and unnecessary disputes. Pl

PRITI SIRDESHMUKH

Dec 16, 20258 min read

TDS Refund Process for NRIs Explained

The TDS refund process for NRIs revolves around reconciling tax deducted at source on Indian income with the actual tax liability computed under the Income Tax Act, 1961. Many NRIs experience higher TDS because banks, tenants, or buyers apply fixed rates regardless of taxable thresholds or eligible exemptions. Accurate reporting of income, TDS credits, and bank details plays a central role in ensuring timely refunds. Platforms like TaxBuddy streamline these steps by valida

Rashmita Choudhary

Dec 16, 20259 min read

bottom of page