top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Section 24(b): Home Loan Interest Deduction Explained

Section 24(b) of the Income Tax Act, 1961 allows taxpayers to claim deductions on the interest paid for home loans taken to purchase, construct, repair, or renovate residential properties. It provides substantial relief for homeowners by reducing taxable income through interest deductions, subject to specific limits and eligibility conditions. For self-occupied houses, the maximum deduction is ₹2,00,000 per year, while for rented properties, there is no upper limit. This sec

Rajesh Kumar Kar

Nov 7, 20259 min read

How TaxBuddy Helps You Resolve Interest Income Mismatch Notices

Interest income mismatch notices usually arise when the Annual Information Statement (AIS) shows higher or different interest amounts than what appears in the Income Tax Return. These discrepancies often come from FD renewals, cumulative interest entries, missing savings interest, or incorrect TDS figures. At times, even small mistakes in bank account opening forms—like wrong PAN or outdated KYC—can trigger mismatches. TaxBuddy simplifies this entire process by automatically

Rajesh Kumar Kar

Nov 7, 20259 min read

How to Claim Section 80GG Deduction for Rent Paid Without HRA

Section 80GG of the Income Tax Act, 1961 allows taxpayers who do not receive House Rent Allowance (HRA) to claim a deduction for rent paid. This provision ensures that even those living in rented accommodations without HRA can avail tax relief, provided they meet the eligibility conditions. To claim the deduction, individuals must not own a residential property at their place of work, must pay rent for accommodation, and must file Form 10BA declaring rent details. Proper com

PRITI SIRDESHMUKH

Nov 7, 20259 min read

Presumptive Taxation Scheme Under Section 44ADA Explained

Section 44ADA of the Income Tax Act offers a simplified taxation route for professionals with annual receipts up to ₹75 lakh. It allows eligible individuals to declare 50% of their gross receipts as taxable income, eliminating the need for detailed expense records or complex bookkeeping. This scheme is especially beneficial for professionals like doctors, lawyers, architects, and consultants who seek ease of compliance and reduced administrative work. By adopting this scheme

Nimisha Panda

Nov 6, 20259 min read

What to Do When Wrong PAN Is Reported by Banks — TaxBuddy’s Fix

Wrong PAN information reported by banks often triggers immediate tax complications, including incorrect TDS entries, Form 26AS mismatches, and higher TDS deduction at 20%. These errors disrupt refund processing and create avoidable compliance hurdles for taxpayers. The issue usually arises during account opening or interest reporting when outdated or incorrect PAN details are used. Correcting it requires quick coordination with the bank, verification of PAN details on the Inc

Asharam Swain

Nov 6, 20258 min read

ITR Filing Guide for Freelancers and Consultants in 2025

Freelancers and consultants are subject to income tax just like salaried individuals, but their income is treated as business or professional earnings under the Income Tax Act. With multiple income streams, TDS entries, and expense claims, filing taxes can be complex. The government’s emphasis on digital compliance and updated tax rules under Budget 2025 has made online filing platforms indispensable. AI-powered platforms like TaxBuddy simplify ITR filing for freelancers by

Nimisha Panda

Nov 6, 20259 min read

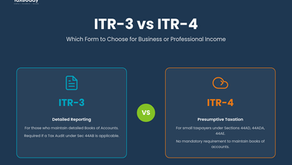

ITR-3 vs ITR-4: Which Form to Choose for Business or Professional Income

Choosing the right ITR form is vital for accurate tax filing , especially for individuals earning from business or professional activities. The 2025 updates by the Income Tax Department have clarified eligibility and simplified reporting, making it easier for taxpayers to decide between ITR-3 and ITR-4 based on their income type, turnover, and record-keeping practices. Both ITR-3 and ITR-4 apply to business or professional income, but the choice depends on whether the taxpaye

PRITI SIRDESHMUKH

Nov 6, 20257 min read

Section 44AD vs 44ADA: Key Differences for Small Businesses & Professionals

Sections 44AD and 44ADA under the Income Tax Act, 1961, simplify tax filing for small businesses and professionals by allowing them to declare income on a presumptive basis rather than maintaining detailed books of accounts. These provisions encourage voluntary compliance and ease the financial reporting burden, especially for those with moderate annual receipts. Table of Contents Section 44AD: Simplified Tax Scheme for Small Businesses Section 44ADA: Presumptive Taxation

Rashmita Choudhary

Nov 6, 20259 min read

How TaxBuddy Helps You Stay Compliant and Avoid Future ITD Notices

Accurate tax filing is the strongest safeguard against future Income Tax Department (ITD) notices. Every mismatch, missed income entry, or unreported bank account increases the chances of a compliance trigger. TaxBuddy minimises these risks through automated, AI-driven checks that validate every detail against AIS, TIS, Form 26AS, and updated Income Tax Act amendments. Its system identifies issues before filing, ensures full reporting of bank accounts, detects income discrep

Nimisha Panda

Nov 5, 20259 min read

Set-Off and Carry Forward of Capital Losses: Complete Rules Explained

Capital losses can significantly impact tax planning if not managed correctly. The Income Tax Act, 1961 allows taxpayers to reduce their taxable income by setting off such losses against capital gains in the same or future years. The concept of set-off and carry forward helps individuals and businesses optimize their tax outgo by adjusting losses within defined limits and time frames. With recent Budget 2025 changes expanding flexibility, understanding these provisions has b

Asharam Swain

Nov 5, 20259 min read

bottom of page