top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Refund Re-Issue Income Tax Notices: How TaxBuddy Tracks Status and Resolves Failures

Refund re-issue notices appear when the Income Tax Department fails to credit a refund due to issues like invalid bank details, non-pre-validated accounts, or mismatched information in the taxpayer’s records. Understanding why refunds fail, how to track their progress, and the steps needed for correction ensures quicker resolution. The online system allows seamless requests, yet errors in bank validation or AIS/TDS data commonly delay payouts. Platforms such as TaxBuddy simp

Rajesh Kumar Kar

Dec 25, 20257 min read

Document Checklist for Income Tax Notices: How TaxBuddy Organises Proofs Before Reply

Income tax notices often request specific documents to verify income details, TDS credits, or high-value transactions. A structured checklist helps compile the correct proofs quickly and reduces the risk of penalties. The first step is understanding what the notice seeks, followed by gathering documents such as Form 16, bank statements, Form 26AS, AIS summaries, business records, and investment proofs. TaxBuddy plays a crucial role by organising notice-wise documentation and

Rashmita Choudhary

Dec 25, 20258 min read

GST Registration Made Simple: How TaxBuddy Gets Your GSTIN Approved Faster

GST registration in India follows a structured online process where businesses submit identity details, business proofs, and verification documents to receive a GSTIN. Approval generally takes around seven working days when information is accurate and authentication is completed without discrepancies. Delays usually occur due to mismatched documents or incomplete submissions. Platforms like TaxBuddy simplify this journey by organising documents, preventing filing errors, an

Dipali Waghmode

Dec 24, 20258 min read

Online GST Return Filing in India: How TaxBuddy Ensures Error-Free Compliance

Online GST return filing in India requires accurate reporting of sales, purchases, and tax liabilities through returns such as GSTR-1, GSTR-3B, and GSTR-9. The process demands precision because the GST portal directly cross-verifies taxpayer data with income tax systems, bank statements, and vendor filings. Errors like mismatched turnover, incorrect HSN/SAC codes, or inconsistency between GST and ITR data often lead to notices or delayed processing. TaxBuddy supports busines

PRITI SIRDESHMUKH

Dec 24, 20258 min read

AIS/TIS Mismatch Income Tax Notice: How TaxBuddy Compares AIS, TIS, and Your ITR

AIS/TIS mismatch income tax notices arise when reported data in the Annual Information Statement and Taxpayer Information Summary does not align with the income declared in an ITR. These discrepancies often stem from incorrect TDS entries, missing interest income, duplicated transactions, or reporting errors from banks, employers, and financial institutions. Unresolved mismatches may lead to notices under sections like 143(1)(a) or 139(9). Accurate reconciliation is essential

Dipali Waghmode

Dec 24, 20258 min read

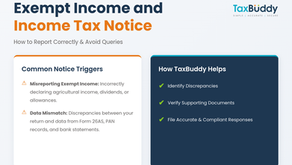

Exempt Income and Income Tax Notice: How TaxBuddy Helps You Report Correctly

Exempt income must still be reported in the Income Tax Return, even though it is not taxable. Missing, misreporting, or incorrectly classifying exempt income often triggers income tax notices because the department matches every entry with PAN-linked data, bank records, and Form 26AS . Agricultural income, dividends, and certain allowances fall under exempt categories, and any mismatch between what’s declared and what’s captured in the system leads to queries. Platforms like

Nimisha Panda

Dec 24, 20259 min read

Risk Management Income Tax Notice: How TaxBuddy Interprets and Responds Safely

Risk management for income tax notices depends on accurate interpretation, timely action, and a safe response strategy that reduces exposure to penalties and further scrutiny. Income tax notices often arise from mismatches in TDS, incorrect reporting, wrong PAN details, or discrepancies in bank information. Understanding the issue raised and replying with precise documentation helps avoid escalation. TaxBuddy simplifies this process by reviewing the notice, identifying risks

Rashmita Choudhary

Dec 24, 20258 min read

GST Nil Return Filing: How TaxBuddy Helps You Stay Compliant Even With Zero Sales

The GST system makes no exception for months with no business activity. Registered taxpayers must file nil returns for GSTR-1 and GSTR-3B even when outward supplies, inward supplies, and ITC remain at zero. This requirement keeps the GSTIN active, prevents penalty accumulation, and ensures smooth compliance when operations resume. With increasing automation on the GST portal and stricter enforcement of deadlines, timely nil filing has become essential for every business, rega

PRITI SIRDESHMUKH

Dec 24, 20259 min read

Monthly vs Quarterly GST Filing: How TaxBuddy Helps You Choose the Right Option

Choosing between monthly and quarterly GST filing affects compliance workload, cash flow, and Input Tax Credit timelines. Monthly filing suits businesses with higher turnover or frequent transactions that demand real-time reporting, while quarterly filing under the QRMP scheme benefits smaller taxpayers seeking reduced administrative effort. The right choice depends on turnover, transaction volume, and reporting needs. GST rules outline separate due dates, ITC patterns, and e

Rashmita Choudhary

Dec 24, 20258 min read

Bank Deposit Income Tax Notice: How TaxBuddy Handles Current and Savings Account Triggers

Bank deposit income tax notices often arise when unexpected or high-value transactions appear in current or savings accounts, or when interest income is not properly reported in the Income Tax Return. These triggers usually come from PAN-linked bank monitoring systems that flag discrepancies between reported and actual transactions. Common issues include unreported interest, incorrect TDS reflection, or mismatches in KYC information. TaxBuddy’s technology and expert support s

Asharam Swain

Dec 24, 20259 min read

bottom of page