top of page

One stop for everything related to taxes,

Our Blogs

The latest industry news, interviews, and resources

Understanding Section 24 of the POCSO Act: A Guide to Recording a Child's Statement

The Protection of Children from Sexual Offences (POCSO) Act, 2012, is a critical law designed to protect children. A key part of this law...

Rajesh Kumar Kar

Aug 29, 20259 min read

Can You Claim Deductions Under Section 80D and 80DDB Together?

Yes. A person can absolutely claim 80D and 80DDB together in the same financial year. The Income Tax Act allows you to claim these...

PRITI SIRDESHMUKH

Aug 29, 20256 min read

80C Deduction for HUF (FY 2024-25 | AY 2025-26): A Complete Guide

A Hindu Undivided Family (HUF) can claim a significant tax deduction up to ₹1.5 lakh under Section 80C of the Income Tax Act. This...

Rashmita Choudhary

Aug 28, 20257 min read

Can You Claim Both Section 80EEA and Section 24? Yes, You Can!

Yes, a home loan borrower can absolutely claim deductions under both Section 24(b) and Section 80EEA at the same time. This allows a...

Nimisha Panda

Aug 28, 20256 min read

Why Schedule-a-Call Is a Must Before You File ITR-3 or ITR-4

Filing your Income Tax Return (ITR) can be an overwhelming process, especially for individuals with diverse income sources, businesses,...

Rajesh Kumar Kar

Aug 25, 20258 min read

Want to Reduce Advance Tax Burden? TaxBuddy’s Call Will Help

Advance tax is a crucial part of the tax system, especially for those with regular income streams that are not subject to tax deduction...

Nimisha Panda

Aug 25, 202510 min read

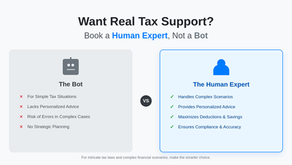

Want Real Tax Support? Book a Human Expert, Not a Bot

When it comes to filing your Income Tax Return (ITR) , many taxpayers consider online tools and bots that promise a quick and easy...

Asharam Swain

Aug 25, 202511 min read

Why Schedule-a-Call Beats Chatbots & Generic Tax Advice for Indian Taxpayers

In today’s digital world, tax filing has become increasingly automated, with chatbots and AI systems providing basic assistance to...

Dipali Waghmode

Aug 25, 202510 min read

Married, Changed Jobs, Bought a House? Call Us Before Filing

Filing your Income Tax Return (ITR) is a crucial aspect of managing your finances and staying compliant with Indian tax laws. However,...

Rashmita Choudhary

Aug 25, 20259 min read

How to Report FD Interest from Multiple Banks Under Section 194A

Interest earned from Fixed Deposits (FDs) is one of the most common sources of income for many individuals. However, the interest on FDs...

Asharam Swain

Aug 1, 20259 min read

bottom of page