Income Tax Helpline: Know the Customer Care Contact Details

- Rashmita Choudhary

- Jun 14, 2025

- 8 min read

The income of an individual or an organisation is subject to TDS, or tax deducted at source, as per the Indian Taxation Code. Before money is credited to the entity's account, TDS is subtracted from its earnings. The Central Board of Direct Taxes, or CBDT, is in charge of and makes decisions about TDS rules and regulations. For each fiscal year, individuals or companies are required to complete TDS forms in accordance with their eligibility. This article provides comprehensive information about the process of downloading and filling forms 26Q and 26QE of the Income Tax Act of 1961.

Table of content

Queries that can Be Addressed by Calling the Income Tax Helpline

The following categories of questions can be answered by contacting any of the toll-free numbers for income tax:

You have any general questions about income taxes

You have any questions about using the e-filing portal to electronically file income tax returns or forms, or about other services.

You have any questions about the processing of Form 15CA, TDS statement, tax credit (Form 26AS), and other forms.

You have problems with PAN and TAN applications.

You need support for any correction, notification, refund, or other questions regarding the processing of income taxes.

Income Tax Department Customer Care Numbers

You may need to get in touch with the income tax department for various reasons. Fortunately, it offers various helpline numbers for different purposes. Here are the details of the income tax department's official contact information. To get your questions answered, make a note of these income tax customer service numbers.

Aaykar Sampark Kendra: Toll-free number 1800 180 1961 or 1961

e-filling of income tax return: Toll-free number 1800 103 0025

TDS Centralised Processing Centre (TRACES): 1800 1030344

Tax Information Network-NSDL: +912027218080

Tax Return Preparer Scheme: 1800 1023738

Refund/Rectification: 1800 1034455

If you need assistance with the income tax e filing login support, these helplines will be able to guide you through the necessary steps to access your account or resolve any login-related issues.

Income Tax Department Official Websites

Departmental website: incometax.gov.in

Filing income tax returns: incometaxindiaefiling.gov.in

Information related to TDS: tdscpc.gov.in

Compliance and reporting: cpc.gov.in

PAN card: @nsdl.co.in

For issues like income tax e filing login support, visiting the official e-filing portal will help you access the necessary assistance and resolve your login problems efficiently.

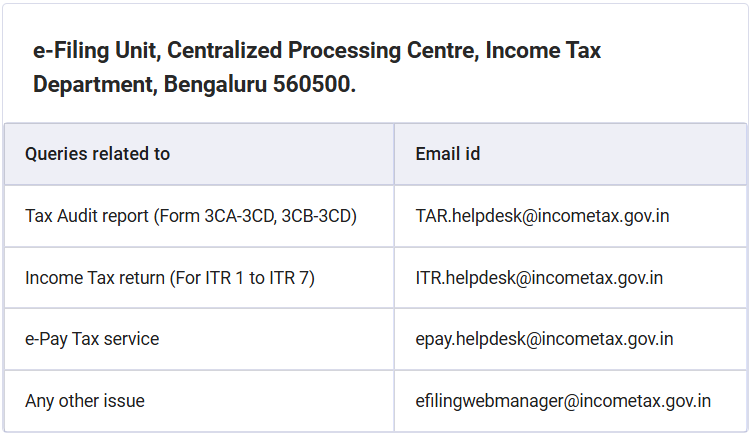

Income Tax Department Help Desk Email IDs

Income Tax return (For ITR 1 to ITR 7): ITR.helpdesk@incometax.gov.in

e-Pay Tax service: epay.helpdesk@incometax.gov.in

Tax Audit report (Form 3CA-3CD, 3CB-3CD): TAR.helpdesk@incometax.gov.in

Any other issue: efilingwebmanager@incometax.gov.in

If you're facing issues logging into the e-filing portal, you can reach out to the help desk at efilingwebmanager@incometax.gov.in for income tax e filing login support.

Income Tax SMS Codes

These are a few more official Income Tax Department SMS codes. Official communications are typically sent using these codes. These codes are specifically used by the income tax department to send warnings and reminders about tax payments. Notifications about PAN cards are also sent using a few of these codes. These include:

ITDEPT

ITDEFL

TDSCPC

UTIPAN

INSIGT

SBICMP

CMCPCI

NSDLTN

NSDLDP

CPC Helpline Toll-Free Numbers and Working Hours

Purpose | Helpdesk | Helpline Number | Working Hours |

General queries | Aayakar Sampark Kendra (ASK) | 1800 180 1961 or 1961 | Monday to Saturday: 08:00 hrs - 22:00 hrs |

e-Filing of IT Returns or Forms | e-Filing | 1800 103 0025 1800 419 0025 +91-80-46122000 +91-80-61464700 | Monday to Friday: 08:00 hrs - 20:00 hrs |

PAN & TAN queries | Tax Information Network - NSDL | +91-20-27218080 | All Days: 07:00 hrs - 23:00 hrs |

Form 16 and related queries | TDS Reconciliation Analysis and Correction Enabling System- TRACES | 1800 103 0344 +91-120-4814600

| Monday to Saturday: 10:00 hrs - 18:00 hrs |

Queries related to AIS, TIS, etc. | AIS and Reporting Portal | 1800 103 4215 | Monday to Friday: 09:30 hrs - 18:00 hrs |

Rectification and refund | Centralised Processing Center | 1800 103 4455 (Toll-free) +91-80-46605200 | Monday to Friday: 08:00 hrs - 20:00 hrs |

A Word of Caution

Digital fraud attempts via email or SMS have surged in the last few months. To lessen these problems, the income tax department has put in place a pop-up on their official website that provides every citizen with the toll-free number, email address, and contact information for income tax aid. To prevent taxpayers from receiving phishing emails, the income tax agency has also implemented a number of preventative measures, including Sender Policy Framework and Domain-based Message Authentication. The following is a list of items to keep in mind when communicating about income taxes.

By email or SMS, the income tax department never requests an OTP or PIN.

Never send sensitive information, such as passwords or IDs, by SMS or email.

Don't provide any information about bank accounts, credit cards, debit cards, or other connected matters.

All India Income Tax Helpline Numbers

The Income Tax Department provides dedicated helplines to assist taxpayers across India with a range of tax-related concerns. Whether you need help with e-filing, resolving tax notices, or checking refund statuses, the helplines are there to guide you. Below are the essential helpline numbers for your convenience:

These helplines are available during office hours to resolve any income tax-related issues you may encounter. Keep these numbers ready for efficient assistance.

Key Income Tax Official Websites

The official websites of the Income Tax Department provide a central hub for various taxpayer services, such as e-filing returns, downloading tax forms, checking refund statuses, and accessing important tax laws. Here are the primary portals you can use to manage your tax needs:

Income Tax India e-Filing Portal: https://www.incometaxindiaefiling.gov.in This portal allows you to e-file your income tax returns, access TDS certificates, and monitor your tax status.

Income Tax India Official Website: https://www.incometaxindia.gov.in The main website for all tax-related services, including information on tax laws, notices, and much more.

National Securities Depository Limited (NSDL): https://www.tin-nsdl.com For PAN applications, TDS-related services, and other tax-related functionalities.

These websites offer a wealth of resources to help you with the tax filing process smoothly and efficiently.

Conclusion

The Income Tax Department has introduced several income tax numbers to assist people in learning about various aspects of filing taxes or in finding answers to their questions. These hotline lines aid taxpayers by providing solutions to their problems. It's clear that the income tax department is excellent at answering people's questions.

FAQ

Q1. How to contact the income tax department?

Call Aayakar Sampark Kendra at the income tax department's toll-free number, 1800 180 1961, if you have any general questions.

Q2. What are the reasons for filing a complaint with the IT department?

The following are typical justifications for complaining to the IT department:

Complaints directed to a specific IT department, business, or individual

Issues with tax refunds

Tax evasion and black money

Processing returns delay

NRI taxation

Queries or issues pertaining to registered personal details

Complaints regarding Form 26AS and TDS

Q3. What should I do if I face a problem using the e-pay Tax service?

You can contact the e-Filing Centre at any of the following numbers if you have any problems with the e-Pay Tax service on the e-Filing portal. You can also send an email to epay.helpdesk@incometax.gov.in or efilingwebmanager@incometax.gov.in.

1800 103 0025

1800 419 0025

+91-80-61464700

+91-80-46122000

For issues specifically related to income tax e filing login support, these numbers will guide you in troubleshooting login-related problems.

Q4. How can you avoid phishing attacks during tax communications?

To prevent falling victim to phishing assaults, use caution. The important things to remember when it comes to tax communications.

Whether via email or SMS, the income tax department has never requested an OTP or PIN.

Refrain from disclosing any information about bank accounts, credit cards, debit cards, etc.

Avoid sending private information, such as IDs or passwords, by SMS or email.

Contact the department if you receive any emails or SMS messages purporting to be from income tax officials. To discuss the matter, you can write to incident@cert-in.org.in or send an email to webmanager@incometax.gov.in.

Q5. What is the GST customer care number?

The toll-free number for GST customer care is 1800-103-4786.

Q6. What services does the Income Tax Helpline provide?

The Income Tax Helpline offers a range of services including assistance with filing tax returns, guidance on tax deductions and exemptions, help with understanding tax notices, and support for rectifying errors in filed returns. It also provides information on refund status and general tax-related queries.

Q7. How can I contact the Income Tax Helpline for assistance?

You can contact the Income Tax Helpline by calling the toll-free number provided by the Income Tax Department. Alternatively, assistance is available through the official e-filing website, email support, or by visiting your nearest Income Tax office.

Q8. Is the Income Tax Helpline available 24/7?

The Income Tax Helpline is not available 24/7. It typically operates during regular business hours, which may vary depending on the region. Specific timings can be checked on the official Income Tax Department website.

Q9. Can the Income Tax Helpline help with filing my tax returns?

Yes, the Income Tax Helpline can assist you with the process of filing your tax returns, whether you need guidance on the forms, clarification on documents required, or support in navigating the e-filing portal.

Q10. Does the Income Tax Helpline offer guidance on rectifying mistakes in filed returns?

Yes, the Income Tax Helpline provides guidance on how to correct mistakes in filed returns. This includes information on filing revised returns, the time frame within which corrections can be made, and the procedure for rectifying errors through the e-filing portal.

Q11. Is the Income Tax Helpline available in multiple languages?

The Income Tax Helpline is available in multiple languages to cater to taxpayers from different linguistic backgrounds. You can select your preferred language when you contact the helpline.

Q12. What should I do if I can't reach the Income Tax Helpline?

If you are unable to reach the Income Tax Helpline, you can try contacting them during non-peak hours, use the email support option, or access self-help resources available on the official Income Tax website. Visiting your nearest Income Tax office is also an alternative.

Q13. Can the Income Tax Helpline assist with understanding tax notices?

Yes, the Income Tax Helpline can help you understand the contents of tax notices, explain the action required, and guide you on how to respond appropriately. They can also assist with drafting a response if needed.

Q14. How do I escalate unresolved issues from the Income Tax Helpline?

If your issue remains unresolved after contacting the Income Tax Helpline, you can escalate it by writing to the Grievance Redressal Officer or using the e-Nivaran service available on the Income Tax Department’s website.

Q15. What information should I have ready when calling the Income Tax Helpline?

When calling the Income Tax Helpline, have your PAN (Permanent Account Number), details of the specific issue or query, relevant tax documents, and any previous correspondence with the Income Tax Department ready. This will help the helpline assist you more efficiently.

Q16. Can I get help with digital signature issues from the Income Tax Helpline?

Yes, the Income Tax Helpline can assist with digital signature-related issues, such as troubleshooting errors, updating your digital signature, or linking it to your e-filing account.

Q17. Does the Income Tax Helpline provide updates on tax law changes?

While the primary function of the Income Tax Helpline is to offer support for tax-related queries, it can also provide information on recent tax law changes, updates in filing procedures, and new tax benefits or obligations introduced by the government.

Comments