Form 16A: How to Generate and Download Form-16A from Traces

- Farheen Mukadam

- May 14, 2025

- 9 min read

Form 16A is an important TDS certificate, which establishes that tax has been deducted on sources of income other than salary. This document plays a very vital role in arriving at correct tax calculations and smoothes the filing process of ITR. The following article simplifies the complications of Form 16A and provides all relevant information to enable any employee or a person having any other source of income to use this document to his advantage.

Table of Contents

What is Form 16A?

Form 16A is a TDS certificate issued for income other than salary, like rent, insurance commission, interest on fixed deposits, and winnings from lotteries or games. Each one of them has its own TDS rate and threshold limits as stipulated by the tax laws. For instance, if you win Rs 50,000 from lottery winnings and the TDS rate under Section 194B is 30% for earnings in excess of Rs 10,000, you take home Rs 35,000 after TDS deduction at the rate 30% of Rs 50,000. The amount of Rs 15,000 will be shown as deducted in your Form 16A.

Importance of Form 16A

Here are a few reasons making it a significant document.

Proof of TDS Deduction: Form 16A is the formal proof that there has been a deduction of TDS from your income, proving thereby the tax withheld.

Income Tax Filing: Form 16A is necessary during income tax filing, as it contains detailed information on tax deducted from the different sources of income, which helps in the accurate computation of tax.

Claiming Tax Credits: You can claim tax credit for the TDS deducted, which may help lower the total amount of your tax liability. That is where Form 16A is invaluable.

Adherence to Tax Laws: Issuing Form 16A by deductors is a requirement under the Income Tax Act. It offers adherence to the tax laws that the required TDS has been deducted and correctly reported.

Accurate Financial Record-Keeping: Form 16A provides a summary of the amount of TDS deducted; hence, accurate financial records are maintained so that all the financial reporting is transparent and accurate.

Frequency of Issuance: Your employer or any person cutting your TDS must issue Form 16A on a periodic basis, usually quarterly or yearly. Keep a copy of this document safe because it will definitely prove handy while filing your tax returns and answering all those future questions about your tax deductions.

'Types of Payments Attracting TDS under Form 16A

The ITA's Section 206C lists non-salary earnings that are subject to TDS. It should be mentioned that each of these incomes is liable to a distinct rate. Generally speaking, TDS is in charge of the following:

Rent

Dividends

Interest accrued on bank accounts

Winnings from a horse race

Amount won from a lottery or crossword puzzle

Insurance commission

Payouts to a contractor

Payments for repurchasing mutual fund units

Payouts for National Savings Scheme

Payments to non-residing sportsmen or sports associations

Compensation, commission or brokerage

Income from foreign currency bonds

Income from the Indian company’s shares

Technical and professional service fee

Revenues generated from units under Section 196b

Earnings of foreign companies under Section 196a(2)

Notably, if the total amount is less than Rs. 10,000, TDS does not apply to the interest earned on the savings account. However, the account holder is required to pay TDS if the amount exceeds this cap.

Contents of Form 16A

Form 16A may have several formats depending on the software used by the deductor and the format required by the Income Tax Department. Nonetheless, Form 16A contains the general information listed below:

Deductor and the deductee name and address

PAN of both parties

Assessment year

Quarter for which TDS is deducted

Nature of payment

Date of payment and deduction date of TDS

TDS amount deducted and deposited

Challan number and date of TDS deposit

Unique TDS certificate number

Other relevant details as required

How to Fill Out Form 16A?

Form 16A should be correctly filled, specifying details of the TDS that has been deducted from payments other than salary. Here are the step-by-step instructions:

Prepare the Form: Download the Form 16A template from the website of the Income Tax Department or take the format given by the software used by the deductor.

Deductor's Details: Mention the name, address, PAN, and TDS certificate number of the deductor.

Deductee's Information: Name, address, PAN, and assessment year for which the certificate is issued of the deductee.

Details of Transaction: Type of payment; Date of payment; Date on which TDS was deducted. State the quarter for which the TDS has been reported. Information

TDS and Challan Information: The amount of TDS deducted Challan number with the Government. Date on which the TDS was deposited with the government.

Additional Information: Enter any other information that may be asked for on the form.

Finalize and Issue: Sign and print Form 16A and ensure it is handed over to the deductee within 15 days of filing the TDS return.

Verification of Form 16A Online

The Income Tax Department's TDS Reconciliation Analysis and Correction Enablement System (TRACES) allows taxpayers to confirm income tax 16A. By obtaining Form 26AS, individuals can obtain information about the deductions made by their employer. This can be done by inputting the employer's TAN and PAN, the certificate number, and the financial year. Generally speaking, they should contact their employer first and request that they make the necessary modifications if they see any discrepancies in the information. Among the important causes of any inconsistency in the form details are the following:

Giving erroneous PAN or TAN information

Omitting information about TDS payment in the TDS return

Quoting an incorrect amount

Providing an incorrect Challan Identification Number

Step-by-Step Process to Download Form-16A

Form 16A, a valid TDS certificate as per CBDT Circular 04/2013 dated April 17, 2013, can be downloaded from the TRACES portal. This form is generated only if a valid PAN is provided. In cases where the PAN is incorrect or not mentioned in the TDS statement, Form 16A will not be issued. Below is a step-by-step guide to downloading Form 16A:

Step 1: Login to TRACES Visit the TRACES website and log in using your User ID, Password, TAN or PAN, and the captcha code.

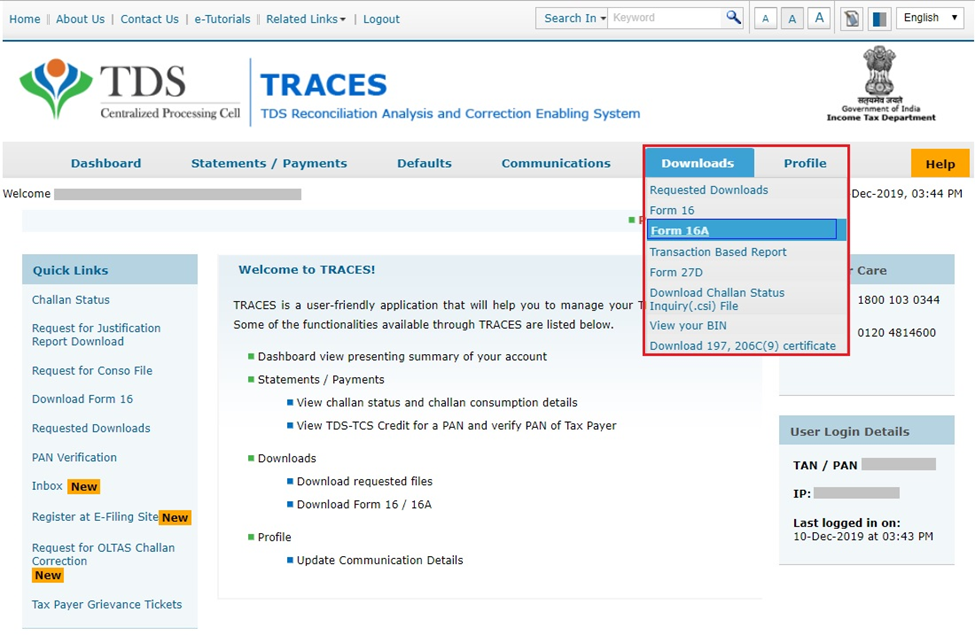

Step 2: Select Form 16A Navigate to the ‘Downloads’ tab and select ‘Form 16A’ from the dropdown menu.

Step 3: Choose Financial Year and PAN Pick the relevant Financial Year and Quarter, then choose the Form type and PAN. After making your selections, click ‘Go’. You can download Form 16A by using either the “Search PAN” or “Bulk PAN” option.

Step 4: Verify Authorized Person Details The details of the authorized person will appear automatically on the screen, as they will also appear on Form 16A. Review and confirm the information by clicking ‘Submit’.

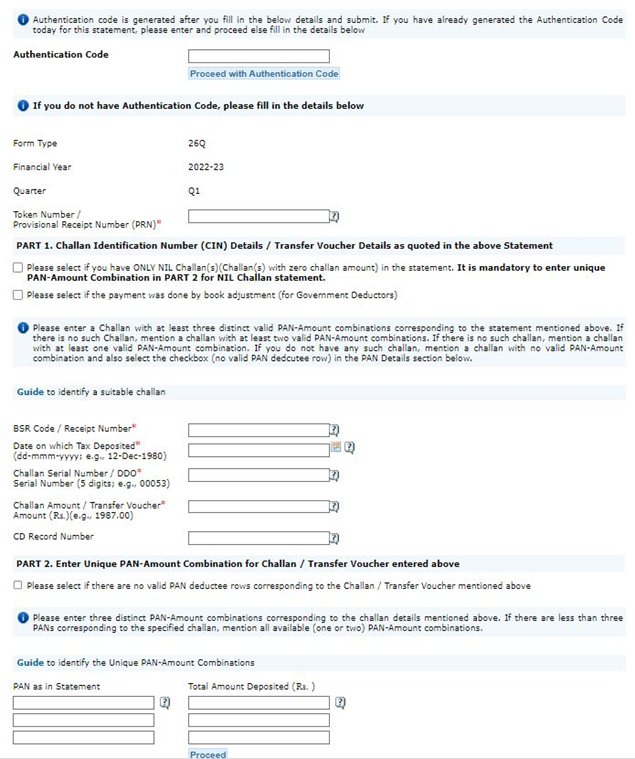

Step 5: KYC Validation KYC validation can be completed in two ways:

With Digital Signature Certificate (DSC):

The Financial Year, Quarter, and Form Type fields will be filled in automatically. Click on ‘Validate’, then enter the DSC password and click ‘OK’. Select your DSC and click ‘Sign’.

Without DSC

Enter the following details:

Token number of the TDS Return filed for the Financial Year, Quarter and Form Type

Challan details - BSR Code, challan serial number, challan amount, the date on which tax is deposited

Enter the PAN and the TDS Amount deposited against that PAN. Once done, click on 'Proceed'.

Step 6: Success Notification After KYC validation, a success message along with a request number will appear. You can access Form 16A from the 'Downloads' section using this request number. The form can be downloaded only when its status is marked as “Available.” If the status is ‘Submitted’, you may need to wait 24-48 hours.

Request Status Definitions:

● Submitted: Request is processing.

● Available: Form 16A is ready for download.

● Disabled: A duplicate request has been made.

● Failed: Contact CPC(TDS) for assistance.

● Not Available: The PAN mentioned is invalid.

Step 7: Download Form 16A Search by Request Number, Request Date, or select ‘View All’. If the status shows ‘Available’, click on ‘Download’.

Step 8: Download the TRACES Utility Download the utility. Instead of extracting the files, go to ‘Requested Downloads’ under the 'Downloads' section and click on 'Click Here'. Enter the captcha code on the next screen.

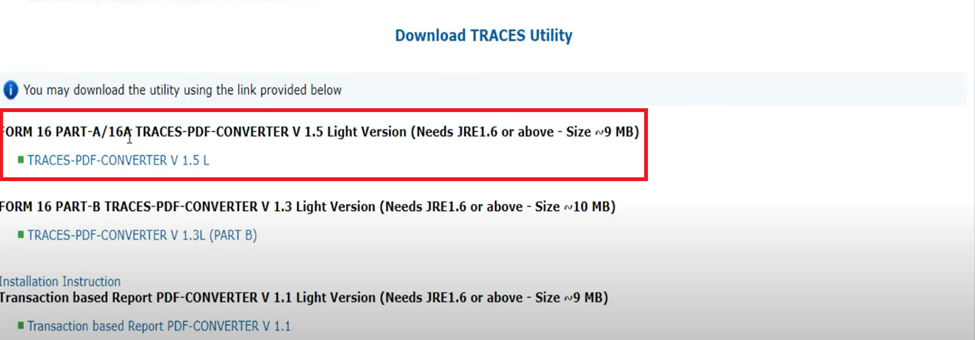

Step 9: Download TRACES PDF Converter V 1.5 Light Version To convert Form 16A to PDF, download the TRACES PDF Converter utility.

Step 10: Convert Form 16A to PDF To generate the PDF version of Form 16A:

● Open the utility.

● Select the zip folder.

● Use your TAN (in UPPERCASE) as the password for the input file.

● Choose the folder where you want to save the forms and click ‘Proceed’. The PDF files of Form 16A will be saved in the selected folder.

Note: The password to open Form 16A is your TAN in uppercase (e.g., ABCD12345E).

TDS Deduction rates for Various Cases in Form 16A

TDS is deducted at different rates according to the nature of payment. The following table illustrates these rates:

Differences Between Form 16, Form 16A, and Form 16B

The following table represents the differences between these three forms:

Parameters | Form 16 | Form 16A | Form 16B |

Issuer | Issued by the employer | Issued by financial institutions, tenants, and other concerned entities | Issued by a property buyer to its seller |

Receiver | Salaried employees | Non-salaried employees | Seller of a property |

Purpose | Issued when tax is deducted at source from salary | Issued when tax is deducted at source on income other than salary | Issued when tax is deducted from income during the sale of property or any immovable assets |

Conclusion

For taxpayers, Form 16A is a crucial document since it makes precise tax calculations easier and makes submitting income tax returns (ITR) easier. Form 16A must be routinely given by employers to their staff members, either quarterly or at the end of the year. A copy of this document must be retained for use in future tax queries and tax filing. Comprehending Form 16A is vital for precise tax computations and seamless ITR submission, regardless of whether you are an employee getting a wage or have additional sources of income. To guarantee adherence to tax laws, it is advised that you become familiar with the elements, creation procedure, and validation of Form 16A.

FAQ

Q1. What is Form 16A used for?

In the Indian context of income tax, Form 16A is a crucial document. It is a TDS (Tax Deducted at Source) certificate that is given to people and organisations by the deductor, which is usually the person or entity in charge of withholding TDS from payments made to third parties.

Q2. How to get Form 16A?

You can request Form 16A from any individual or organisation that has taken TDS, including banks, agencies, employers, etc.

Q3. What is the difference between Form 16 and Form 16A?

Form 16 is for people who get salary income, whereas Form 16A is also a TDS certificate. Form 16A, on the other hand, is for TDS on sources of income other than wages. Form 16A is issued on a quarterly basis, whereas Form 16 is given to the employee annually.

Q4. How many days after filing the quarterly TDS return can one download Form 16/ 16A?

Employers are required to provide Form 16/ 16A to workers within 15 days of the employees filing their fourth-quarter TDS returns.

Q5. Is it possible to file income tax returns using Form 16a without a payslip?

Yes, form 16A may be used to file the return. Payslips are unrelated to Form 16A.

Q6. Does an employee for whom TDS has never been deducted receive Form 16A?

Form 16A is not for the employees, and if TDS has not been withheld, Form 16A does not need to be submitted.

Q7. What is the penalty for not generating Form 16A?

According to section 272A of the Income Tax Act, the employer or deductor may be penalised for failing to provide or issue Form 16A. For every day when there is a delay without a valid explanation, there is a penalty of INR 100. It is noteworthy that the entire penalty, encompassing sections 200(3), 203, and 206, ought not to surpass the tax deducted at the source. This fine emphasises how important it is to provide TDS certifications accurately and on schedule.

Q8. When is Form 16A generated?

You will receive Form 16A from a bank if it deducts TDS from your rent receipts, insurance commission, or interest income from fixed deposit accounts.

Q9. When is Form 16 generated?

Employees typically receive Form 16 by June 15th of each year at the latest. Should you have changed jobs within the financial year, all of your previous employers will send you a Form 16.

Q10. What is a TDS certificate?

TDS certificates are sent to the deductee—the person from whose payment the tax is withheld—by the deductor, the entity that is withholding taxes. Form 16 (for TDS on Salary) and Form 16A (for TDS on non-salary payments) are the two forms of TDS certificates that are available.

Comments